- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Shares and Indices

- PayPal Q2 earnings results are here

- 1 Month +20.47%

- 3 Month -1.19%

- Year-to-date -52.47%

- 1 Year -67.23%

- Berenberg $145

- Oppenheimer $101

- Keybanc $100

- Wells Fargo $97

- JP Morgan $112

- JMP Securities $100

- RBC Capital $92

- Piper Sandler $93

- Truist Securities $80

- Credit Suisse $95

- Morgan Stanley $129

News & analysisPayPal Holding Inc. (PYPL) announced its latest financial results after the closing bell in the US on Tuesday.

The US financial technology company reported revenue of $6.8 billion in Q2, topping Wall Street estimate of $6.778 billion.

Earnings per share also beat analyst estimates for the quarter at $0.93 per share vs. $0.87 per share estimate.

”Our second quarter results were solid with currency neutral revenue and non-GAAP earnings growth exceeding expectations. We continue to gain share as we execute across our key strategic initiatives, even as we drive operational efficiency across our business.” Dan Schulman, President and CEO of PayPal said in a press release after the latest results.

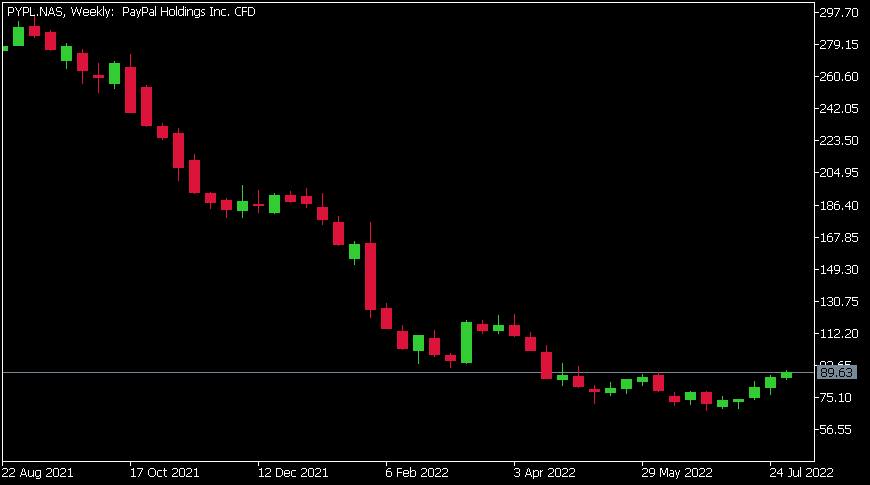

PayPal Holding Inc. (PYPL) chart

Shares of PayPal were up by 1.20% at the close of trading on Tuesday $89.63. The stock rose by around 11% after better than expected Q2 results.

Here is how the stock has performed in the past year:

PayPal price targets

PayPal is the 118th largest company in the world with a market cap of $103.79 billion.

You can trade PayPal Holding Inc. (PYPL) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: PayPal Holding Inc., TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

USDJPY ready to bounce or retrace further.

USDJPY ready to bounce or retrace further. The USDJPY has been recently provided great buying opportunities for traders. However, in recent days it has posted its largest drop since beginning the current upward at the beginning of January 2021. The question remains, is this just a standard retracement or is it a symbol of a much bigger...

August 3, 2022Read More >Previous Article

Reserve Bank of Australia hikes Cash Rate by 0.50%

The Reserve Bank of Australia, (RBA) has increased the Country’s cash rate by half a percent to combat the rising inflation in i...

August 2, 2022Read More >Please share your location to continue.

Check our help guide for more info.