- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Shares and Indices

- Walmart stock gains after better-than-expected earnings report

- Home

- News & analysis

- Shares and Indices

- Walmart stock gains after better-than-expected earnings report

- Founded: July 2, 1962

- Headquarters: Bentonville, Arkansas, United Kingdom

- Number of employees: 2.1 million (2023)

- Industry: Retail

- Key people: Greg Penner (Chairman), Doug McMillon (President and CEO)

- 5 day: +3.33%

- 1 month: +8.36%

- 3 months: +13.31%

- Year-to-date: +11.62%

- 1 year: +20.16%

- JPMorgan Chase & Co.: $176

- Stifel Nicolaus: $175

- Deutsche Bank: $190

- Telsey Advisory Group: $185

- Oppenheimer: $185

- Morgan Stanley: $168

- BMO Capital Markets: $175

- Truist Financial: $170

- Royal Bank of Canada: $168

- Evercore ISI: $177

- Jefferies Financial Group: $195

- Stephens: $190

- Tigress Financial: $196

- Piper Sandler: $210

- Volatility never sleeps. Trade over earnings releases as they happen outside of main trading hours

- Reduce your risk and hedge your existing positions ahead of a new trading day

- Extended trading hours on popular US stocks means extended opportunities

News & analysisNews & analysis

News & analysisNews & analysisWalmart stock gains after better-than-expected earnings report

21 February 2024 By Klavs ValtersWalmart Inc. (NYSE: WMT) announced the latest financial results before the US market open on Tuesday.

World’s largest supermarket chain achieved revenue of $173.388 billion in the fourth quarter vs. $170.854 billion expected. Revenue grew by 5.7% year-over-year.

Earnings per share (EPS) reported at $1.80 (up from $1.71 the year prior) vs. $1.643 per share expected.

Full-year revenue grew by 6% from the year before $648.1 billion. EPS grew by 5.7% to $6.65 per share.

Walmart also announced that it will acquire electronics company VIZIO HOLDING CORP. in a deal worth $2.3 billion.

Company overview

CEO commentary

Doug McMillon, CEO of Walmart had this to say to investors: ”Our team delivered a great quarter, finishing off a strong year. We crossed $100 billion in eCommerce sales and drove share gains as our customer experience metrics improved, even during our highest volume days leading up to the holidays. We’re proud of the team and excited about building on our momentum as we work to bring prices down for our customers and members.”

Stock reaction

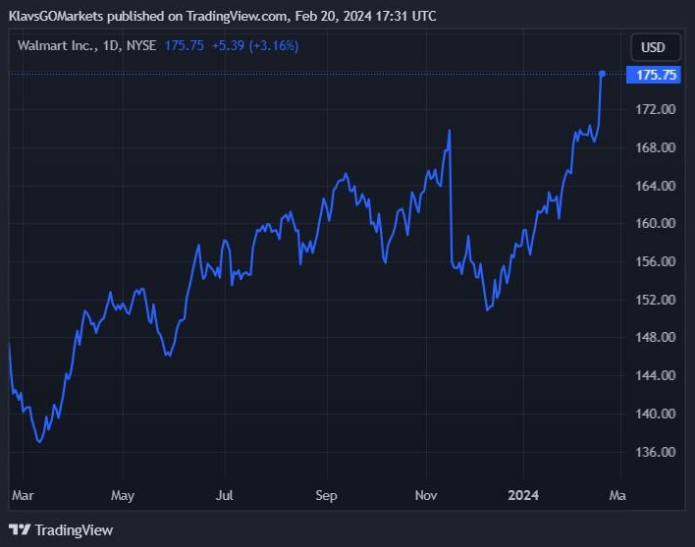

Shares rose by over 3% during Tuesday’s trading session, trading at $175.75 a share.

Stock performance

Walmart stock price targets

Walmart Inc. is the 17th largest company in the world with a market cap of $473.78 billion, according to CompaniesMarketCap.

You can trade Walmart Inc. (NYSE: WMT) and many other stocks from the NYSE, NASDAQ, HKEX and ASX with GO Markets as a Share CFD on the MetaTrader 5 platform. To find out more, go to “Trading” then select “Share CFDs”.

GO Markets offers pre-market and after-market trading on popular US Share CFDs.

Why trade during extended hours?

Sources: Walmart Inc., TradingView, MarketWatch, MarketBeat, CompaniesMarketCap

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

NVDA earnings preview – AI mania put to the test

The most anticipated US earnings announcement is coming up with NVDA due to report fiscal Quarter ending Jan 2024 earnings after the Wednesday US market close. NVDA has seen a meteoric rise, quintupling in 2023 and up more than 40% so far in 2024, being the number one stock riding AI mania, making this earnings report one that all investors will be...

February 21, 2024Read More >Previous Article

Home Depot earnings results announced

US home improvement chain Home Depot Inc. (NYSE: HD) reported Q4 financial results before the opening bell on Wall Street on Tuesday. The company r...

February 21, 2024Read More >Please share your location to continue.

Check our help guide for more info.