- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Dynamic margin

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Signal Centre

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Dynamic margin

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Signal Centre

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Articles

- Trading Setups

- The Break and Retest – Trading Setups

- The tendency for prior resistance to become support, and prior support to become resistance.

- Several key-level breakout price moves will offer a challenge to the strength of a move by retesting the key level just breached, before continuing a move in the breakout direction.

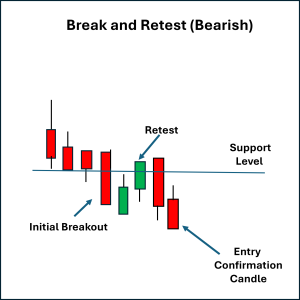

- A: Break → price pushes decisively below a support level, showing strong seller control.

- B: Retest → price rallies back to the broken support, which now holds as resistance.

- C: Confirmation → the retest is rejected, and a bearish candle close beneath the low of the initial breakout candle is seen. This pattern suggests buyers are unable to reclaim the level, confirming that the balance of power remains with the sellers.

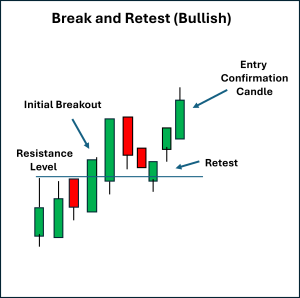

- A: Break → price surges through resistance, showing strong buyer conviction.

- B: Retest → price pulls back to the broken level, which now holds as support.

- C: Confirmation → the retest of the key level is rejected, and a bullish candle close above the high of the initial breakout candle is seen. This pattern suggests sellers are unable to reclaim the level, confirming that the balance of power remains with the buyers.

- For bearish setups, stops are commonly placed just above the retest candle high of the original support zone.

- For bullish setups, stops are typically set just below the retest candle low of the previous resistance zone.

- Using fixed risk-to-reward targets, often 2:1 or better.

- Profit targets may be set near the next key level in the direction of the new trend

- Employing trailing stops to capture extended runs after strong breakouts.

News & analysisWhat Is the Break and Retest?

The “Break and Retest” is a common price action setup based on two important principles:

Psychologically, this price action indicates market control as the breakout is confirmed, and a new trend may be in play.

Essentially, the retest level can be thought of as a battleground. It is asking questions of the conviction of a potential sentiment change, so a new directional move can begin.

Bearish Break and Retest

A bearish setup occurs when support is broken to the downside, and price then retests the former support level, which now acts as resistance.

This reflects an inability of the buyers to force price back above the broken level, while the sellers use the retest and subsequent continuation to confirm the move

You can see a real chart example of this on the 4-hourly USDJPY, where a previous support level was breached, then retested before the confirmation of a downwards continuation was seen.

Bullish Break and Retest

A bullish setup occurs when resistance is broken to the upside, and price then retests the former resistance, which now acts as support.

This sequence reflects sellers being unable to force price back below the broken level, while buyers use the retest to confirm the move.

You can see a real chart example of this on the daily gold futures CFD (XAUUSD), where a broken resistance level is retested prior to seeing uptrend confirmation with the price breaching the initial breakout candle high.

Stop Placement and Exits

Risk management for the Break and Retest often focuses on the retest zone itself:

Profit-taking exit approaches can include:

Final Thoughts

The Break and Retest combines a decisive breakout move with a clear technical retest and confirmation, allowing traders to join a trend at a defined confirmation point with structured and logical stop placement.

The psychology is rooted in how market participants react to broken levels and the desire to see conviction before committing to increases in volume and momentum.

This setup is commonly used by many traders as it avoids “chasing” the first breakout candle and offers a new and potentially stronger confirmation of the robustness of a new trend.

As always, confluence factors such as increased volume, overall trend direction, and proximity to other key market levels can add confidence in the potential for continuation of the price action move.

If you want to take the first steps on adding this to your trading toolbox, have a look at charts and see the frequency of this scenario, as well as track charts that exhibit this move to see what happens next.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

10 Professional Trading Standards: The Foundation of Trading Planning and Behaviour

Before a trader defines their strategy or chooses their markets, they must decide how they plan to conduct themselves. A trading strategy should be underpinned by a set of standards and behaviours that guide every decision and approach. Establishing professional standards can provide a framework for consistency and personal accountability...

September 29, 2025Read More >Previous Article

The Inside Bar Breakout – Trading Setups

The Inside Bar breakout is a price action setup that indicates a short-term consolidation within the broader context of an existing trend — and a po...

September 19, 2025Read More >Please share your location to continue.

Check our help guide for more info.