- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Trading Strategies, Psychology

- Understanding Inflationary Pressures

- Home

- News & analysis

- Trading Strategies, Psychology

- Understanding Inflationary Pressures

- Consumer Confidence and Retail Sales

- Labour Market and Wages – (Unemployment rate, Jobless Claims and Average Earnings)

- Housing Market – (House Prices and Mortgage approvals)

News & analysisNews & analysis

News & analysisNews & analysis

Broadly speaking, inflation is a general increase in prices which result in a fall in the purchasing value of money. In this article, we are going to look at measures of inflation and other indicators that can help traders to detect early signs of inflation. Traders try to follow the inflationary pressures to anticipate the next interest rate move by central banks. If the central bank sees that inflationary pressures are building up and that economic growth is accelerating, they can decide to raise the interest rate to combat inflation and slow down the economy.

Producer Price Index (PPI) and Consumer Price Index (CPI) are widely used measures of inflation. PPI tracks wholesale price inflation while CPI follows retail price inflation. As the name entails, PPI and CPI follow the changes in prices from the Producer’s and Consumer’s point of view respectively. PPI can be viewed as the leading indicator because higher producer prices will eventually be passed on to consumers.Therefore, PPI and CPI figures allow traders to forecast the central bank’s next move about the interest rate.

Early Warning Signs of inflation

There are other factors that can help traders to see that inflation is building up ahead of the release of PPI and CPI figures. In doing so, forex traders are better able to trade inflation data more confidently.

These two economic data provide investors with an indication of the health of the consumers. Consumer Confidence offers an essential insight into the demand for goods and services regardless of consumers’ financial situation. Consumers are likely to spend if they feel confident about the overall economy. Similarly, Retail Sales help to measure the trends in consumer spending which could cause investors to rethink the direction of interest rates.

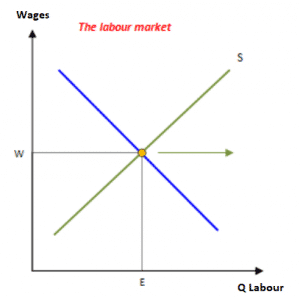

Employment rate helps to detect whether there is a shortage or oversupply of labour. The simple demand and supply diagram of the labour market will provide you with the direction of wages when there are changes in the labour market. Wage inflation therefore translates into more spending and adds to inflationary pressures.

The correlation between the housing market and inflation can be a complex one. However, for this article, we will look at house prices and interest rates. When interest rates are low, buying houses become more affordable. Depending on demand and supply, any change in house prices or mortgage approvals will provide insights on the inflationary outlook.

Inflation is critical for the Forex markets as it can exert a considerable influence on the exchange rate of a currency. Because central banks tend to adjust interest rate to fight inflation or deflation, forex traders monitor inflationary pressures very closely.

It helps them to forecast whether the next move of the central bank will put downward or upward pressure on the currency.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#ForexStrategy #ForexTrading #ForexTraining #ForexCourse #ForexEducation #ForexHelp #ForexAnalysis #FXSignal #MetaTrader #MetaTrader4 #MetaTrader5Next Article

Countries Using The US Dollar

The US Dollar is the most traded currency in the world and paired with all other major currencies. It acts as the intermediary in triangular currency transactions, held by almost every central bank around the world. Unofficially, US Dollar utilization occurs in over 30 countries worldwide and officially; it gets used as a legitimate currency in ...

September 19, 2018Read More >Previous Article

Bank of England Rate Decision – Preview

All the talk about whether Mark Carney will leave the Bank of England in 2019 or not has ended, the current Bank of England governor has extended hi...

September 12, 2018Read More >Please share your location to continue.

Check our help guide for more info.