- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Oil, Metals, Soft Commodities

- The USA and the UK ban Russian oil imports as Gold price approaches all-time high

- Home

- News & analysis

- Oil, Metals, Soft Commodities

- The USA and the UK ban Russian oil imports as Gold price approaches all-time high

News & analysisNews & analysis

News & analysisNews & analysisThe USA and the UK ban Russian oil imports as Gold price approaches all-time high

9 March 2022 By GO MarketsThe USA and the UK announced measures to ban Russian oil imports in order to isolate Russia from the global economy. This follows on from sanctions imposed on Russia’s top oligarchs and government officials along with its central bank in a bid to push against Russia’s war on Ukraine. The market responded to the news with a volatile trading session.

In the USA the NASDAQ finished the day down 0.28% after it had made a 2.6% during the middle of the day. The Dow Jones finished the day in a similar way finishing down 0.56% and the S&P 500 down 0.72%. The European markets were flat with the FTSE down 0.067% and the DAX down 0.024%. The VIX index also reached 37 and is at its highest level since the start of the pandemic.

Commodities

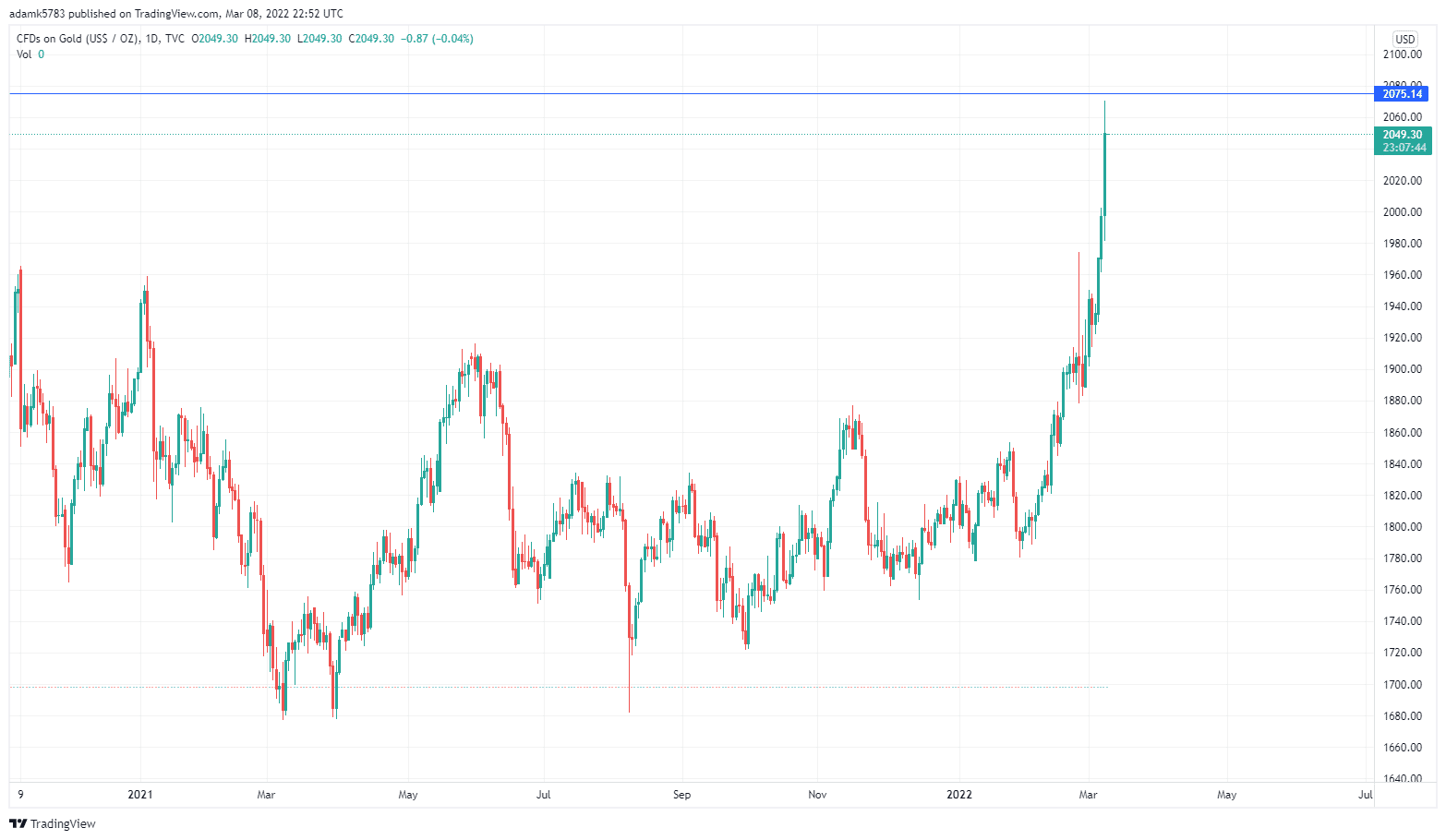

On the back of the oil imports ban from Russia, Brent Crude jumped 7.7% at $132.75 before settling to $123.21. As a reference in 2021, the USA imported 8% of if its total oil imports from Russia. Other commodities such as Nickel and Palladium continued their runs as bearish investors closed their positions causing a short squeeze. Gold was able to push through the $2000 resistance and touched its all-time high of $2075. Gold will be one to watch as the US Federal Reserve is poised to release its CPI figures on Friday. With record levels of volume being transacted through gold, it is worth keeping watch on.

4-hour gold chart below:

Bitcoin had another relatively flat day rising by .64% in the BTC/USD pair. Ethereum performed better with ETH/USD rising 3.28% although it could not finish above the previous day’s highs. The USD/AUD pair continues its grind up moving 0.63% as it moves to test resistance. The USD/EUR looks to be consolidating although it did finish the day down 0.39%. The USD/JPY climbed for the second straight day climbing 0.32% as it continues tightening its range.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#SpotGold #SpotSilver #GoldTrading #SilverTrading #SpotWTICrudeOil #WTICrudeOil #SpotBrentCrudeOil #BrentCrudeOil #OilTrading #Commodities #CommoditiesTrading #CommodityMarket #CommodityTradingNext Article

Commodities’ record high prices wreaking havoc for inflation

A sudden rapid increase in commodity prices, propelled by supply concerns stemming from the Russia and Ukraine conflict, has brought about inflationary pressure and moved future inflation expectation. The increase has also pushed indices into a bear market and caused some volatility in global equities. Nickel, European gas and wheat have all...

March 9, 2022Read More >Previous Article

Are EV cars inevitable?

Since the recent crisis in Europe, you would have noticed a few things in the stock market which have directly or indirectly affected your normal day ...

March 8, 2022Read More >Please share your location to continue.

Check our help guide for more info.