Market news & insights

Stay ahead of the markets with expert insights, news, and technical analysis to guide your trading decisions.

Latin America recorded $730 billion in crypto volume in 2025. Across the region, 57.7 million people now own some form of digital currency rankingslatam, a base that is growing faster than anywhere else in the world

As institutional capital arrives and regulation matures, these are the publicly traded names investors are watching closest.

Why LATAM is a crypto powerhouse right now

Top LATAM crypto stocks to watch

1. Nu Holdings (NYSE: NU)

Digital banking · 127M users across Brazil, Mexico and Colombia

Nubank could be one of the most direct listed proxies for LATAM's fintech and crypto boom. The company integrated cryptocurrency trading directly into its Nu app and partnered with Lightspark to embed the Bitcoin Lightning Network for faster and more cost-effective Bitcoin transactions.

In Q3 2025, revenue jumped 42% year-on-year to $4.17 billion, customer deposits rose 37% to $38.8 billion, and gross profit was up 35% to $1.81 billion.

The stock has returned roughly 36% over the past year and tripled the S&P 500's returns over the last three years. The company dominates Brazil, with over 60% of the adult population using Nubank.

Nu Holdings also recently secured conditional approval to launch Nubank N.A., a US national digital bank. However, the announcement triggered a pullback, with investors cautious about capital deployment timelines and expansion costs.

UBS has lowered its price target to $17.20, citing some market caution despite positive operational shifts.

What to watch

- Credit quality trends in Brazil and Mexico.

- Pace of USDC adoption via Nubank rewards.

- US bank charter timeline and early cost disclosures.

2. MercadoLibre (NASDAQ: MELI)

E-Commerce/Fintech · 18 countries across Latin America

MercadoLibre is not a pure crypto play, but Mercado Pago (its fintech arm) has become one of the most important financial rails in LATAM. The company holds around 570 BTC on its balance sheet as a hedge against regional inflation, and has issued its own US dollar-pegged stablecoin, Meli Dólar.

Full year 2025 net revenue from Mercado Pago reached $12.6 billion, up 46% year-on-year, while total payment volume hit $278 billion, up 41%. Fintech monthly active users have grown close to 30% for ten consecutive quarters, and the credit portfolio nearly doubled to $12.5 billion year-on-year.

The catch for MercadoLibre is profitability. Overall margin compression of 5–6% is attributed to persistent investments in free shipping, credit card expansion, first-party commerce, and cross-border trade.

The stock has declined around 14.5% over the past six months, with the market repricing the stock around what management has framed as a deliberate investment phase heading into 2026.

The longer-term case remains compelling. Mercado Pago has introduced crypto-asset management and insurance products across its core markets, positioning it less as an e-commerce company and more as a full-scale digital bank with crypto infrastructure built in.

What to watch

- Mercado Pago loan loss trends and credit portfolio quality.

- Stablecoin integration and crypto volume through its payment network.

- Whether the Argentina credit card launch can reach profitability.

3. Méliuz (B3: CASH3.SA)

Fintech/Bitcoin treasury · Brazil's first listed Bitcoin treasury company

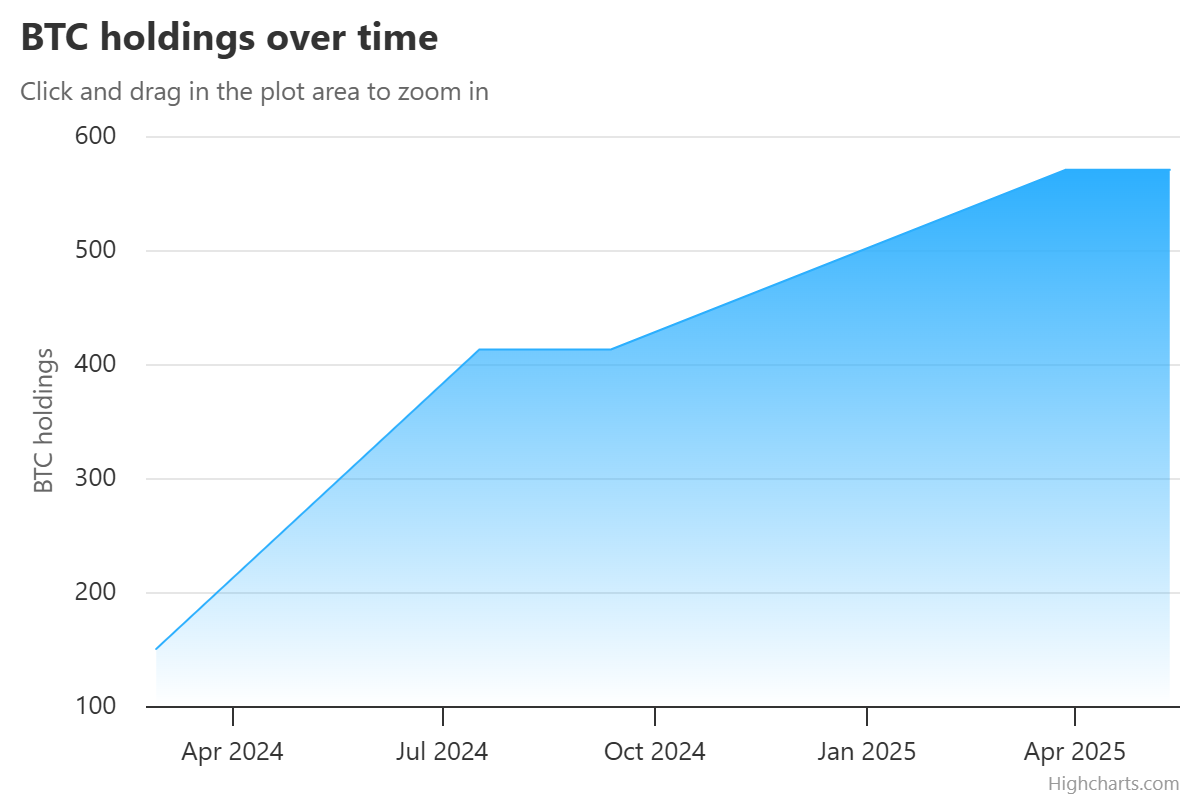

Méliuz is the most direct equity expression of the corporate Bitcoin treasury trend in LATAM. In early 2025, Méliuz became the first publicly traded company in Latin America to formally adopt a Bitcoin treasury strategy, receiving shareholder approval to allocate cash reserves toward Bitcoin accumulation.

Rather than issuing cheap dollar-denominated debt to buy BTC, Méliuz uses share issuance and operational cash flow. The company also sells cash-secured put options on Bitcoin to generate yield, a playbook borrowed from Japanese Bitcoin treasury firm Metaplanet, keeping 80% of BTC holdings in cold storage

CASH3 essentially acts as a leveraged vehicle for BTC exposure, capturing upside intensely in bull cycles, but generating greater volatility on the way down, especially where debt is involved.

The stock surged approximately 170% in May 2025 following the announcement of the Bitcoin strategy. However, it has since pulled back to its April 2025 levels, broadly tracking Bitcoin's price action and highlighting the stock's volatility.

What to watch

- Bitcoin price direction.

- BTC per share metric.

- Expansion of yield-generation strategies

- Any moves to list shares internationally.

4. OranjeBTC (B3: OBTC3.SA)

Pure-play Bitcoin treasury · LATAM's largest corporate Bitcoin holder

Where Méliuz is a fintech business that also holds Bitcoin, OranjeBTC is the opposite: a company whose entire purpose is Bitcoin accumulation.

The company listed on B3 in October 2025 through a reverse merger with education firm Intergraus, marking Brazil's first public debut of a firm whose business model centres entirely on Bitcoin accumulation.

OranjeBTC currently holds over 3,650 BTC and raised nearly $385 million in Bitcoin, with backing from notable investors including the Winklevoss brothers, Adam Back, FalconX, and Ricardo Salinas.

Its $210 million financing round was led by Itaú BBA, the investment arm of Brazil's largest bank, in a significant vote of institutional confidence.

In 2026, OBTC3 has fallen around 32% year-to-date, making it the hardest-hit of the two Brazilian Bitcoin treasury stocks. The stock hit an all-time high of 29.00 BRL on its listing day (October 7, 2025) and an all-time low of 6.06 BRL in February 2026.

It currently trades around 7.06 BRL, a steep discount to its debut, but one that closely mirrors Bitcoin's own pullback from peak levels.

OranjeBTC is the most volatile name on this list and should be treated as a high-beta Bitcoin vehicle. Liquidity is thinner than established names.

What to watch

- Bitcoin per share trajectory.

- Any capital raises or new BTC purchases.

- Potential international listing ambitions.

- How the market-value net asset value (mNAV) discount/premium evolves relative to Bitcoin's price.

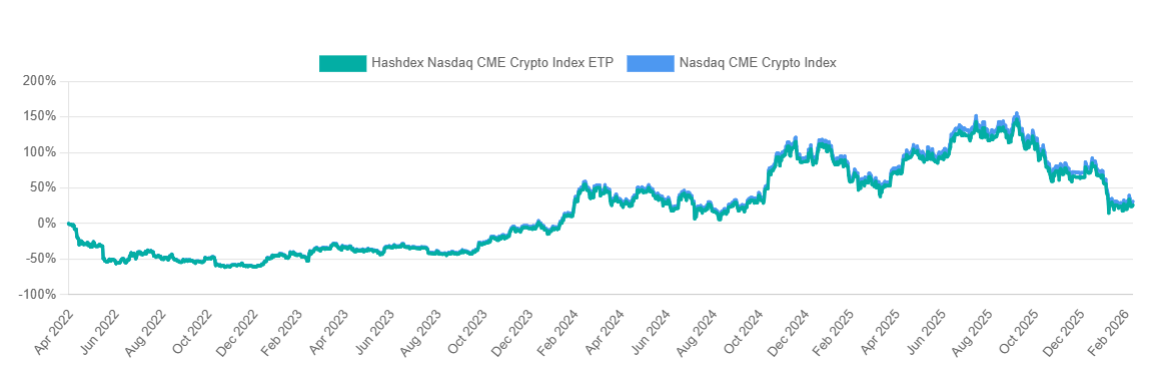

5. Hashdex — HASH11 (B3: HASH11)

Crypto Asset Management · Brazil's leading crypto ETF issuer

Hashdex offers a different kind of exposure to crypto. Rather than a single company's balance sheet or business strategy, HASH11 is a diversified basket of crypto assets wrapped in the familiarity of a regulated Brazilian ETF structure.

Brazil hosts 22 ETFs offering full or partial exposure to crypto assets, with Hashdex funds attracting 180,000 investors and daily transaction volumes averaging R$50 million.

Hashdex launched the world's first spot XRP ETF (XRPH11) on Brazil's B3 in April 2025, tracking the Nasdaq XRP Reference Price Index and allocating at least 95% of net assets to XRP.

The company also operates single-asset ETFs for Bitcoin (BITH11), Ethereum (ETHE11) and Solana (SOLH11), alongside its flagship HASH11 multi-asset index fund.

In mid-2025, Hashdex launched a hybrid Bitcoin/Gold ETF (GBTC11) that dynamically adjusts allocations between the two assets.

For investors who want diversified crypto market exposure rather than single-asset risk, HASH11 is the most accessible on-ramp through Brazil's regulated equity infrastructure.

However, as a multi-asset crypto index, HASH11 is still subject to the broad performance of digital asset markets. And unlike the equity names on this list, there is no operating business creating independent value.

What to watch

- Crypto market sentiment broadly.

- Potential expansion of Hashdex products into the US market.

- AUM growth as institutional adoption accelerates in Brazil.

- Relative performance of HASH11 vs single-asset alternatives.

What to watch next

Institutional infrastructure is still in early innings — Deutsche Börse's Crypto Finance Group entered LATAM in early 2026, and local exchanges have opened over 200 BRL-denominated trading pairs since 2024. The pace of that buildout will set the tone for all five names.

Regulatory progress in Brazil, Mexico, and Chile is the key enabler for the next wave of capital. Any setbacks would hit the higher-beta names like OBTC3 and CASH3 hardest.

Stablecoin volume is the region's most reliable real-time signal. Despite a global slowdown in early 2025, LATAM still recorded $16.2 billion in trading volume between January and May, up 42% year-on-year. Watch whether that momentum holds — a reacceleration lifts all five; a reversal pressures them equally.

Global indices were choppy overnight, mainly finishing lower on the back of failed peace talks and Russia continued advances in Ukraine. According to reports from the French government, the Russian president Vladimir Putin intends to take the country by any means and that “the worst is to come”. The reports sent the FTSE 100 down 2.57%.

The decline was further aided by the removal of Russian equities from the index. In addition, the DAX followed dropping 2.16%. In the USA the NASDAQ closed down 1.56% as the tech sector saw more selling.

The FANG stocks were all down continuing from what has been a volatile week. The Dow Jones and the SP500 performed a little better but were still up and down during the trading session. Overall, the S&P500 finished down 0.53% and the Dow Jones 0.29% respectively.

Money continues to flow into commodities as pressure is growing for Western countries to ban Russian oil and gas imports. Gold continues to provide strength in the volatile market holding $1936 USD per ounce. Oil touched $119 USD a barrel before tapering to $110.

Nickel was also a strong mover jumping 6% to $27,815 its highest level since April 2011. Wheat continued its rise another 5.46%. Palladium, another commodity in which Russia is a large producer, is also up 3.2% to $2,753.68 by 12.43 GMT.

Palladium is a crucial metal needed by Automakers for catalytic converters to curb emissions. Iron Ore showed some strength increasing by 5.5% to $153USD per tonne. In currencies, the BTC/USD pair lost momentum at $42,541 USD down 3% at 10.45 pm GMT.

Ethereum is also down 4.48% over the last 24 hours. The EUR/USD fell to fresh levels of 1.1032 its lowest level since May 2020. The markets remain volatile and very reactive to news coming out of Europe as the weekend approaches.

US indices had a bumper day of trading as the Federal Reserve increased interest rates by 25 basis points. The Reserve is also expected to raise rates to between 1.75% and 2.00% by the end of the year, with 7 increases expected till the end of 2022. The Federal Reserve made it clear that they are doing their utmost to fight inflation.

Jerome Powell also indicated that the economy shouldn't need to enter into a recession. Whilst the Federal Reserve lowered economic projections for 2022 and increased inflation most of this had already been priced in. The Nasdaq finished the very strong session up 3.77% as tech stocks rebounded after initially selling down on the Federal Reserve’s announcement.

It was supported by the Dow Jones and the S&P500 which were up 1.55% and 2.24% respectively. In Europe, the FTSE had a solid day rising 1.62% and the DAX performed very well increasing by 3.76%. The Chinese stock market both in Hong Kong and on the mainland was also roaring yesterday on the back of a commitment from China’s State Council to sure up and introduce policies to boost its economy.

The CSI 300 index gained 4.3% and the Hang Seng index jumped 9.1%, its largest jump since 2008. This may provide some confidence for the region. Commodities Commodity prices continue their retreat from their highs a few weeks ago.

Brent Crude Oil continues to hover below 100 USD finishing the day at 97.96 USD a drop of 0.74%. Gold was able to hold its support level at 1917 USD per ounce and bounced after initially dropping below 1,900 USD due to the interest rate announcement. Natural gas continues to tighten its price range and increased by 2.80% Cryptocurrency Bitcoin had a high volume buying day as buyers stepped up and the price of BTC/USD increased by 4.83% to 41,202 USD.

Bitcoin remains rangebound however the volume increase indicates attention may be returning. Similar results occurred for Ethereum with the ETH/USD increasing by 5.60% to 2,766 USD. FOREX The USD was weak against most other currencies following the Federal Reserve's announcement.

The AUD had a strong day backed by its commodities moving up 1.29% against the USD. The EUR/USD and GBP/USD both reacted positively to Federal Reserve’s announcement, with them moving up 0.71% and 0.81% respectively. Against the CHF the USD was able to hold up relatively well at the 0.9400 level.

The market will likely continue to react to the news from the Federal Reserve as the week draws to an end.

The US technology sector rose again last night and worked back the losses from the previous day of trading as the market came to grips with the Federal Reserve’s announcement surrounding interest. Tesla was a standout performer and has seen a huge rise in the last week rising more than 20% and rising 7.91% overnight. The Nasdaq moved up 1.95%.

The Dow Jones was slightly weaker as commodities had mixed results, although the index was still up by 0.74% and the S&P 500 finished the session up 1.13%. In Europe, banks and financial stocks helped power the FTSE to a solid day up 0.5% and the DAX ended up 1% with similar strength shown in the financial sector as they look to benefit from rising interest rates. Commodities Commodities saw relatively mixed results across the board.

Gold was down 0.75% to 1920.80 as it continues to consolidate after pulling back from the highs a fortnight ago. Brent Crude Oil fell back 1.59% to USD 114.48. The commodity took a breath after rising 17.89% in the preceding three days.

Natural gas has seen a breakout of its consolidation as it broke above $5.00. The spot price finished up 4.35% at $5.185. Natural Gas daily chart Cryptocurrency Bitcoin had another solid session with the BTC/USD pair at $42,650 at 10.31 pm GMT.

Bitcoin has continued its rally from the previous week which is up a combined total of 12.56%. Ethereum has performed even better with a 4.92 rise overnight and an 18.63% increase over the last two weeks. The price of ETH/USD is currently sitting just above $3000 at $3002.71 at 10.36 pm GMT.

FOREX The AUD/USD has continued its move up. The price has broken out of its channel and is approaching $0.75. The EUR/USD, after selling down early in the day, the price was able to recover and then finish the day up 0.12% at $1.1029 as it continues its rally from the lows of two weeks ago.

The USD/JPY is rocketing along as it approaches its long-term resistance at 125 JPY. Overnight the price broke through 120.00 JPY and closing at 120.092JPY, a 1.08% increase.

Andrew ‘Twiggy’ Forrest has bet on a winner in Australian Agricultural Company (AAC). The company is Australia’s largest integrated cattle and beef producer and is recognised as the oldest continuously operating company in Australia. In recent week’s key investment figure, Twiggy Forrest through his investment company Tattering, has doubled its holding from 8.97% to 17.4% at a cost of approximately $122 million making it a substantial holder.

The old investing and trading adage is that you should always follow the big money, and, in this case, the big money could not be much bigger then Twiggy. Company Overview AAC operations consist of properties, feedlots, and farms on around 6.4 million hectares of land in QLD and the Northern Territory representing almost 1% of all land mass in Australia. The company then exports the beef to key markets globally.

The company currently has a market capitalisation of $1.28 Billion and a share price of $2.11 as of 3pm EST 5 July 2022. Recent Performance The company has seen very strong earnings in recent years as they have improved their margins and reduced their costs. In the 2022 year their sales and production volumes dropped off.

At the same time Asian and Australian volume were down 21% and 24% respectively which do lead to some concern. With over half of its product being sold in Asia, the Asia pacific region specifically is a pause for concern. However, with the price of Wagyu beef sales increasing by 20%, the company has been able to offset the volume drop off and see revenue remain steady.

Opportunities The company has been expanding globally and this has seen a high demand for its products internationally. With a 56% increase year on year and a 21% volume increase in sales the USA represents a market that is hungry for AAC and its beef. The leadership of AAC has shown an impressive ability to minimise costs in times of low profitability and ensure the company does not operate with negative cashflow.

According to DataM Intelligence Analysis (2021) The price of Wagu Beef is expected to compound 7% annual for the rest of the decade. These figures bode well for AAC. Management has shown itself to be particularly impressive in reducing costs and improving margins particularly during difficult years during Covid 19.

It was able to improve its operating margin by 43% from the prior year showing just how effective it can be. Weaknesses With growing inflationary pressures and a global theatre that has seen many disruptions to the supply chain, the potential increase or blowout of costs related to the logistical movement of good may be cause for concern. Particularly with much of its market overseas, the potential for supply chain pressures is great for AAC.

In addition, any further border closures, or economic sanctions may prove to be problematic for the company. Technical Analysis The company’s share price has seen a significant rise in recent weeks in its price and pure volume of buying. The chart shows a significant coiling of the price as the buying volume was building and the sellers were drying up.

The price has also broken through the multi decade high of $2.13 on significant volume. The $2.13 level had added importance as it was also the midpoint of the 20-year range. In recent days the market has retested the $2.10 level but a short/medium term technical target of $3.38 is not out of the question.

In the Long term a price target based on the fundamentals of the company, the increase in price of Beef, management’s history of effective financial management and the growth pathways in the USA and Asia may see the share price rise towards $4.50.

After weeks of relentless selling the market provided a decent rally to end the week. The S&P 500 saw a nice jump rising 3.44% during Friday’s trading session. This may provide investors and traders some positive momentum for the beginning of the week.

Whilst the market is still holding a down trend, it was able to bounce of the bottom of the downward channel. Similar moves were seen on the NASDAQ and the Dow Jones as well as other global indices. In Australia, the ASX 200 was not quite as productive as the American indices in its Friday session.

The Aussie market may catch some of the gains from the Friday US session in the early part of the week. Inflationary pressures have eased somewhat with hard commodities such as Oil and Natural Gas have pulled back from their recent highs. This has also supported leading to money flowing back into growth markets.

Small Cap companies had an important day as the market rallied, lifting 3.31%. This marks the strongest day since July 2020 and some much-needed relief after a brutal sell off. As the end of the financial year approaches, tax selling should be expected on the market.

Furthermore, it is a time where funds and fixed weight portfolios rebalance their assets. Stocks in the spotlight Anteris Technologies, (AVR) The Bio/Medi Tech company saw great growth in its share price during the last week as it climbed more than 33%. The company announced a 6-month update of its first cohort of 5 patients using its DurAVR 3D Single piece aortic valve.

The results showed an 86% improvement in Haemodynamic/normal blood flows since the product was implanted into patients. The company’s share price rose to $28.30 its highest level since 2019 om the back of these results. With a relatively small float the share price can be quite volatile and have a high daily range.

BlueScope Steel (BSL) Blue Scope Steele has seen a large drop in its share price sitting just above its long-term support. The large Steele manufacturer has seen as the market reacts to an increase in costs for the manufacturing and construction sectors. The share price has been trending downward after peaking in August 2021.

Woolworths (WOW) Consumer staple Woolworth’s had a strong rally as its share price rose 7.26% to $35.46 after slipping to as low as $32.60 in the middle of June. The company’s share price has held up relatively well during the recent volatility as inflation and geopolitical pressure have seen much of the market slip.

The USA and the UK announced measures to ban Russian oil imports in order to isolate Russia from the global economy. This follows on from sanctions imposed on Russia’s top oligarchs and government officials along with its central bank in a bid to push against Russia’s war on Ukraine. The market responded to the news with a volatile trading session.

In the USA the NASDAQ finished the day down 0.28% after it had made a 2.6% during the middle of the day. The Dow Jones finished the day in a similar way finishing down 0.56% and the S&P 500 down 0.72%. The European markets were flat with the FTSE down 0.067% and the DAX down 0.024%.

The VIX index also reached 37 and is at its highest level since the start of the pandemic. Commodities On the back of the oil imports ban from Russia, Brent Crude jumped 7.7% at $132.75 before settling to $123.21. As a reference in 2021, the USA imported 8% of if its total oil imports from Russia.

Other commodities such as Nickel and Palladium continued their runs as bearish investors closed their positions causing a short squeeze. Gold was able to push through the $2000 resistance and touched its all-time high of $2075. Gold will be one to watch as the US Federal Reserve is poised to release its CPI figures on Friday.

With record levels of volume being transacted through gold, it is worth keeping watch on. 4-hour gold chart below: Bitcoin had another relatively flat day rising by.64% in the BTC/USD pair. Ethereum performed better with ETH/USD rising 3.28% although it could not finish above the previous day’s highs. The USD/AUD pair continues its grind up moving 0.63% as it moves to test resistance.

The USD/EUR looks to be consolidating although it did finish the day down 0.39%. The USD/JPY climbed for the second straight day climbing 0.32% as it continues tightening its range.