Trading strategies

Explore practical techniques to help you plan, analyse and improve your trades.

Our library of trading strategy articles is designed to help you strengthen your market approach. Discover how different strategies can be applied across asset classes, and how to adapt to changing market conditions.

Volatility doesn't discriminate. But it can punish the unprepared.

Stops getting hit on moves that reverse within minutes. Premiums on short-dated options climbing. And the yen no longer behaving as the reliable hedge it once was.

For traders across Asia, navigating this environment means asking harder questions about risk, timing, and the assumptions baked into strategies built for calmer markets.

1. How do I trade VIX CFDs during a geopolitical shock?

The CBOE Volatility Index (VIX) measures the market’s expectation of 30-day implied volatility on the S&P 500. It is often called the “fear gauge.” During geopolitical shocks such as the current Iran escalations, sanctions announcements, and surprise central bank actions, the VIX can spike sharply and quickly.

What makes VIX CFDs different in a shock

VIX itself is not directly tradeable. VIX CFDs are typically priced off VIX futures, which means they carry contango drag in normal conditions.

During a geopolitical shock, several things can happen at once

- Spot VIX may spike immediately while near-term futures lag, creating a disconnect.

- Spreads on VIX CFDs can widen significantly as liquidity thins.

- Margin requirements may change intraday as broker risk models adjust.

- VIX tends to mean-revert after spikes, so timing and duration are critical.

What this means for Asian-hours traders

Asian market hours mean many geopolitical events can break while local traders are active or just starting their session.

A shock that hits during Tokyo hours may already be priced into VIX futures before Sydney opens.

Some traders use VIX CFD positions as a short-term hedge against equity portfolios rather than a directional trade. Others trade the reversion (the move back toward historical averages once the initial spike fades). Both approaches carry distinct risks, and neither guarantees a specific outcome.

2. Why are my 0DTE options premiums so expensive right now?

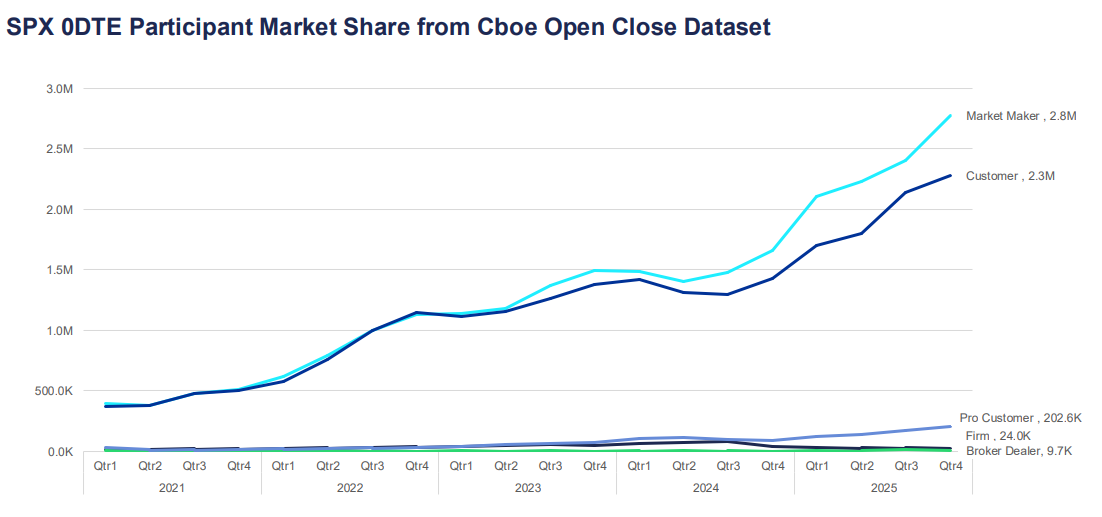

Zero days-to-expiry (0DTE) options expire on the same day they are traded. They have become one of the fastest-growing segments of the options market, now representing more than 57% of daily S&P 500 options volume according to Cboe global markets data.

For Asian-based participants accessing US options markets, elevated premiums during volatile periods can feel like mispricing, but usually reflects structural pricing factors.

Why premiums spike

Options pricing is driven by intrinsic value and time value. For 0DTE options, there is almost no time value left, which might suggest they should be cheap but the implied volatility component compensates for that.

When uncertainty increases, sellers may demand greater compensation for the risk of sharp intraday moves.

This can be reflected in

- Higher implied volatility inputs.

- Wider bid-ask spreads.

- Faster adjustments in delta and gamma hedging.

In higher-VIX environments, hedging flows can contribute to short-term feedback loops in the underlying index. This can amplify price swings, particularly around key levels.

What this means for Asian-hours traders

Many 0DTE options contracts see their most active pricing and hedging flows during US trading hours. Entering positions during the Asian session may mean facing stale pricing or wider spreads.

If you are seeing expensive premiums, it may reflect the market accurately pricing the risk of a large same-day move. Whether that premium is worth paying depends on your view of the likely intraday range and your risk tolerance, not on the absolute dollar figure alone.

3. How do I adjust my algorithmic trading bot for a high-VIX environment?

Many algorithmic trading systems are built on parameters calibrated during lower-volatility regimes. When VIX spikes, those parameters can become outdated quickly.

The regime mismatch problem

Most trading algorithms use historical data to set position sizes, stop distances, and entry thresholds. That data reflects the conditions during which the system was tested. If VIX moves from 15 to 35, the statistical assumptions underpinning those settings may no longer hold.

Common failure modes in high-VIX environments include

- Stops triggered repeatedly by noise before the intended directional move occurs.

- Position sizing based on fixed-dollar risk, which becomes relatively small compared to actual intraday ranges.

- Correlation assumptions between assets breaking down.

- Slippage on execution that erodes edge.

Approaches some algorithmic traders consider

Rather than running a single fixed set of parameters, some systems incorporate a volatility regime filter. This is a real-time check on VIX or ATR that triggers a switch to different settings when conditions shift.

Approach adjustments that some traders review in high-VIX environments

- Widen stop distances proportionally to ATR to reduce noise-driven exits.

- Reduce position size to maintain constant dollar risk relative to wider expected ranges.

- Add a VIX threshold above which the system pauses or moves to paper trading mode.

- Reduce the number of simultaneous positions, as correlations tend to rise during market stress.

No adjustment eliminates risk. Backtesting new parameters on historical high-VIX periods can provide some indication of likely performance, though past conditions are not a reliable guide to future outcomes.

4. Is the Japanese Yen (JPY) still a reliable safe-haven trade?

During periods of global risk aversion, capital has historically flowed into JPY as investors unwind carry trades and seek lower-volatility holdings. However, the reliability of this dynamic has become more conditional.

Why has the yen historically moved as a safe haven?

Japan’s historically low interest rates made JPY the funding currency of choice for carry trades and when risk-off sentiment hits, those trades unwind quickly, creating demand for yen.

Additionally, Japan’s large net foreign asset position means Japanese investors tend to repatriate capital during crises, further supporting JPY.

What has changed

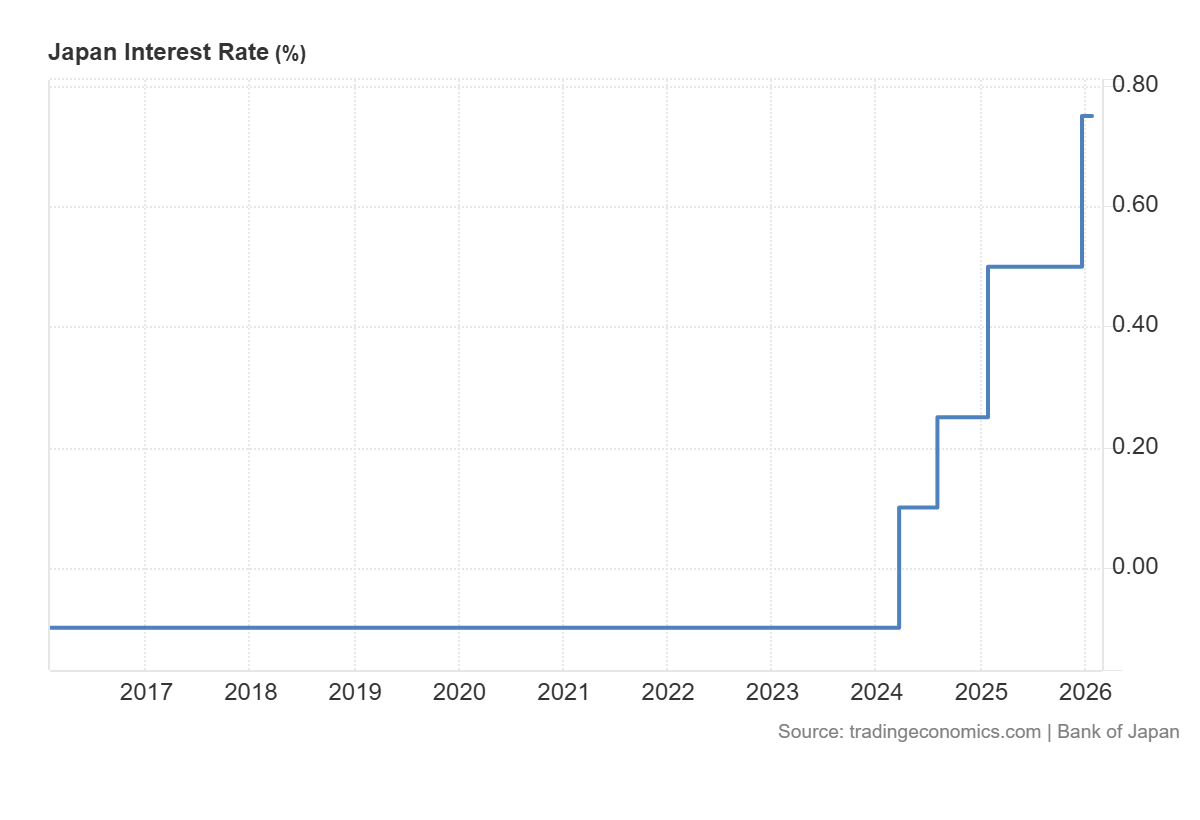

The Bank of Japan’s shift away from ultra-loose monetary policy in recent years has complicated the traditional safe-haven dynamic.

As Japanese interest rates rise:

- The scale of carry trade positioning may change.

- USD/JPY can become more sensitive to interest rate spreads.

- BoJ communication and domestic inflation data may influence JPY independently of global risk appetite.

The yen can still behave as a safe haven, particularly during sharp equity sell-offs. But it may respond more slowly or inconsistently compared to earlier cycles when the policy divergence between Japan and the rest of the world was more extreme.

What to watch

For traders monitoring JPY as a safe-haven signal, BoJ meeting dates, Japanese CPI releases, and real-time US-Japan rate spread data have become more relevant inputs than they were a few years ago.

5. How do I avoid ‘whipsawing’ on energy CFDs?

Whipsawing describes the experience of entering a trade in one direction, getting stopped out as the price reverses, then watching the price move back in the original direction.

Energy CFDs, particularly crude oil, are especially prone to this in volatile markets. And for traders in Asia, the combination of thin liquidity during local hours and sensitivity to geopolitical headlines can make this particularly challenging.

Why energy CFDs whipsaw

Crude oil is sensitive to a wide range of headline drivers: OPEC+ production decisions, US inventory data, geopolitical supply disruptions, and currency moves.

In high-volatility environments, the market can react strongly to each headline before reversing when the next one arrives.

- Price spikes on a headline, stops are triggered on short positions.

- Traders re-enter long, expecting continuation.

- A second headline or profit-taking reverses the move.

- Long stops are hit. The cycle repeats.

Approaches traders may consider to manage whipsaw risk

Some traders choose to change their risk controls in volatile conditions (for example, reviewing stop placement relative to volatility measures). However these may increase losses; execution and slippage risks can rise sharply in fast markets

Other approaches that some traders review:

- Avoid trading crude oil CFDs in the 30 minutes before and after major scheduled data releases.

- Use a longer timeframe chart to identify the prevailing trend before entering on a shorter timeframe, reducing the chance of trading against larger institutional flows.

- Scale into positions in stages rather than committing full size on initial entry.

- Monitor open interest and volume to distinguish between moves with genuine participation and low-liquidity fakeouts.

Whipsawing cannot be eliminated entirely in volatile energy markets. The goal of risk management in these conditions is not to predict which moves will hold, but to ensure that losses on false moves are smaller than gains when a genuine directional move follows.

Practical considerations for volatile Asian markets

Asian markets carry structural characteristics that interact with volatility differently from US or European markets:

- Thinner liquidity during local hours can exaggerate moves on thin volume, particularly in energy and FX CFDs.

- Events in China, including PMI releases, trade data, and PBOC policy signals, can move regional indices.

- BoJ policy decisions have become a more active driver of JPY and Nikkei volatility in recent years.

- Overnight gaps from US session moves are a persistent structural risk for traders unable to monitor positions around the clock.

- Margin requirements on leveraged products can change at short notice during high-VIX periods.

Frequently asked questions about volatility in Asian markets

What does a high VIX reading mean for Asian equity indices?

VIX measures expected volatility on the S&P 500, but elevated readings typically reflect global risk aversion that flows across markets. Asian indices such as the Nikkei 225, Hang Seng, and ASX 200 can often see increased volatility and negative correlation with sharp VIX spikes.

Can 0DTE options be traded during Asian hours?

Access depends on the platform and the specific instrument. US equity index 0DTE options are most actively priced during US trading hours. Asian traders may face wider spreads and less representative pricing outside those hours.

Are algorithmic trading strategies inherently riskier in high-volatility conditions?

Strategies calibrated during low-volatility periods may perform differently in high-VIX environments. Regular review of parameters against current market conditions is prudent for any systematic approach.

Has the JPY safe-haven trade changed permanently?

The Bank of Japan’s policy normalisation has introduced new dynamics, but JPY has continued to strengthen during some risk-off episodes. It may be more conditional on the nature of the shock and the BoJ’s concurrent posture.

What is the best way to set stops on energy CFDs in high-volatility conditions?

There is no universally best method. Many traders reference ATR to calibrate stop distances to prevailing conditions rather than using fixed levels. This does not guarantee exit at the desired price and does not eliminate whipsaw risk.