- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Bank of England Decision could send the Pound Lower

2 August 2023Since March 2023, the GBPUSD had been trading higher as the US Federal Reserve and the Bank of England (BoE) maintained along their path to continue raising rates, as they battled to bring inflation down to their 2-3% target level.

As the DXY recovered in strength, this led the GBPUSD to reverse from the high of 1.3130, trading down toward the lower bound of the bullish channel, along the 1.28 price level. Although the Consumer Price Index (CPI) data in July had a signaled a slowdown of inflation growth to 7.9%, this is still well above the BoE’s target level and significantly higher, compared to the other major economies.

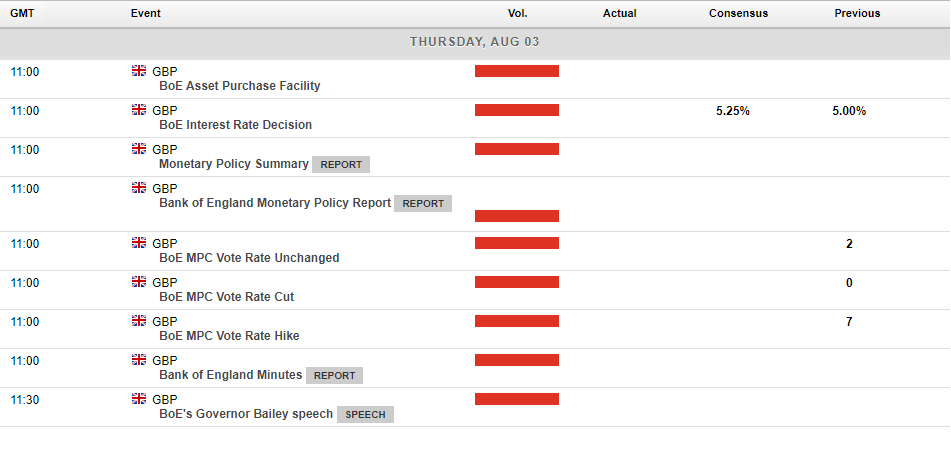

At the upcoming meeting on 3rd August, the BoE is expected to raise rates by 25bps, a fourteenth successive tightening, taking rates to 5.25% the highest since December 2007. However, it cannot be ruled out that the BoE could further surprise markets with a 50bps rate hike, similar to its actions in June.

At the upcoming meeting on 3rd August, the BoE is expected to raise rates by 25bps, a fourteenth successive tightening, taking rates to 5.25% the highest since December 2007. However, it cannot be ruled out that the BoE could further surprise markets with a 50bps rate hike, similar to its actions in June.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

FX Analysis – Risk-Off Hits Equities, USD and JPY outperform on haven flows, AUD, NZD slump

US Equity markets slumped on Wednesday with a surprise Fitch credit downgrade of the US and a hot ADP employment figure pushing yields higher saw the risk-off trade firmly in control. FX Markets USD rallied strongly on Wednesday, with DXY rising from lows of 102.01 to highs of 102.78 before pulling back modestly to finish the session around 1...

August 3, 2023

Read More >

Previous Article

Nasdaq cements its best start to a year since 1975

The Nasdaq Composite Index has kicked off 2023 with a historic performance, achieving its most impressive start since 1975. Despite concerns about a p...

August 2, 2023

Read More >