- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

FX Analysis – Risk-Off Hits Equities, USD and JPY outperform on haven flows, AUD, NZD slump

3 August 2023US Equity markets slumped on Wednesday with a surprise Fitch credit downgrade of the US and a hot ADP employment figure pushing yields higher saw the risk-off trade firmly in control.

FX Markets

USD rallied strongly on Wednesday, with DXY rising from lows of 102.01 to highs of 102.78 before pulling back modestly to finish the session around 102.50. DXY blew through the major 102 level, rising above both its 50- and 100-day SMA on the back of higher Treasury yields and haven flows in risk-off session. A hot ADP employment print ahead of today’s NFP also supporting the USD.

EURUSD found further downside pressure on USD strength, pushing firmly below the key 1.10 level before find support at its 50-day SMA. However, compared to some of its peers , EUR performed relatively well with EURGBP rising above the big figure at 0.8600.

Along with the USD the JPY was the outperforming currency after its weakness this week, holding against a rampant and seeing USDJPY finishing flat for the session. JPY benefitted from haven flows by the risk-off tone in markets, but gains were capped by the rally in UST yields. USDJPY closing above 143 with 145 certainly in sight if risk-on returns to the market.

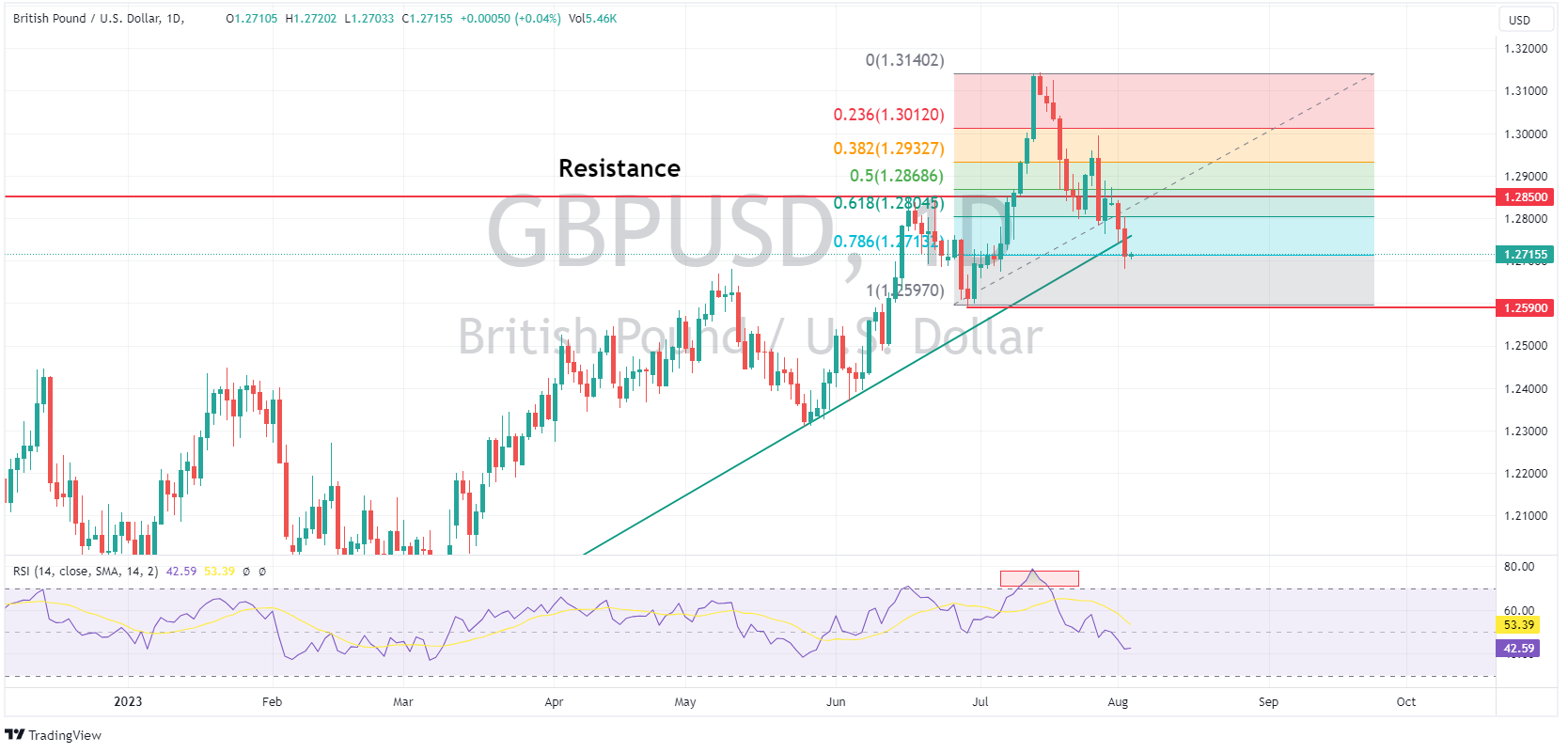

GBP saw further weakness vs both the EUR and USD with a risk-off session weighing on Sterling ahead of today’s BoE rate decision. GBPUSD breaching its lower trend line before finding some support at the 78.6 Fib retracement level. Markets are currently split on whether we will see a 25 or 50bp hike from this, futures showing a 66% probability of a 25bp hike with a 33% chance of a 50. Along with the actual rate decision traders will be closely watching on how the Bank guides future rate expectations within its accompanying statement and presser.

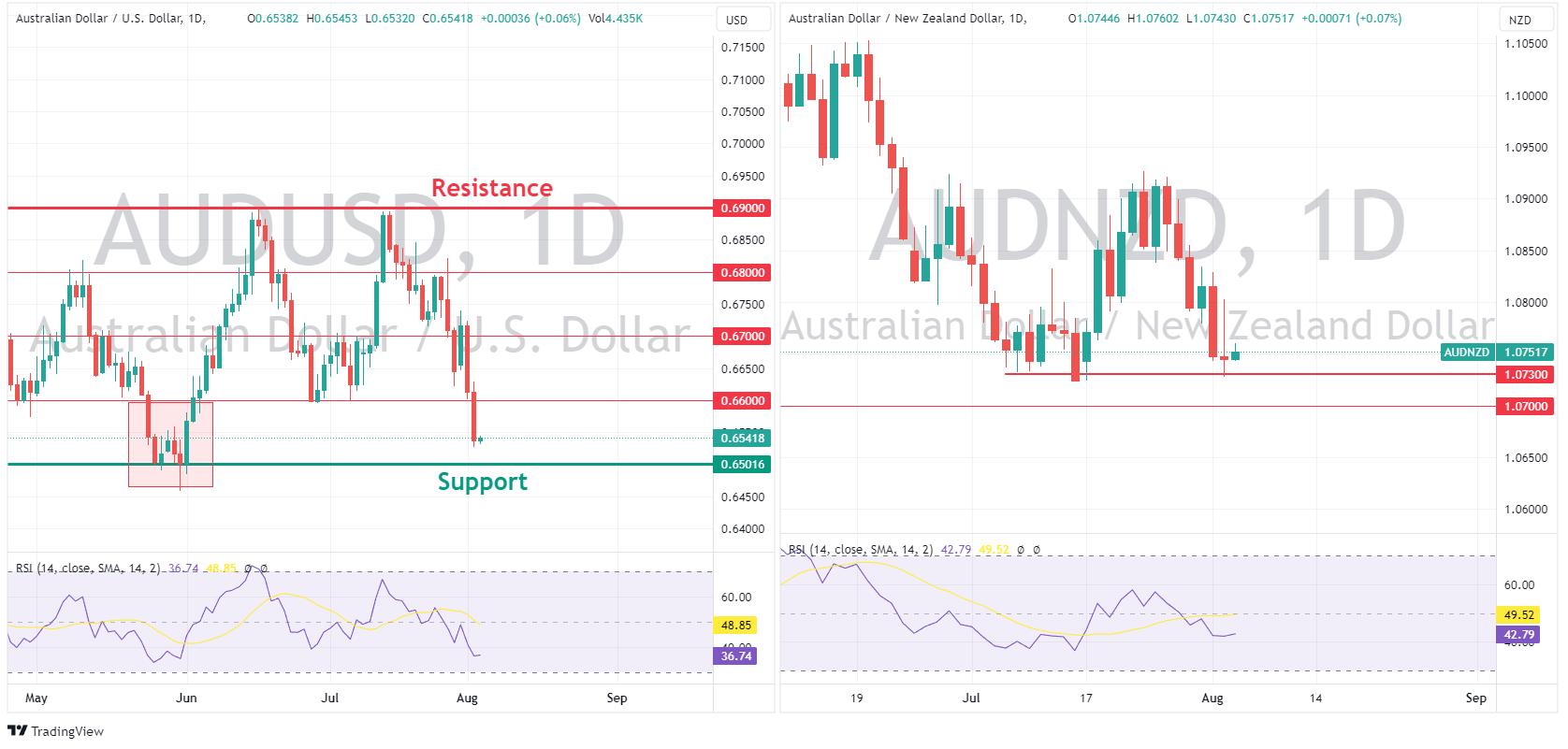

AUD and NZD underperformed on their sensitivity to risk. AUDUSD continuing from its decline from the RBA rate decision on Tuesday, breaking support at 0.6600 and looking to test its next big figure support at 0.6500. Losses in NZDUSD were comparable seeing choppy price action in AUDNZD, which had a wide range for the day but ended the session flat after the cross found some support at the July lows around 1.0730.

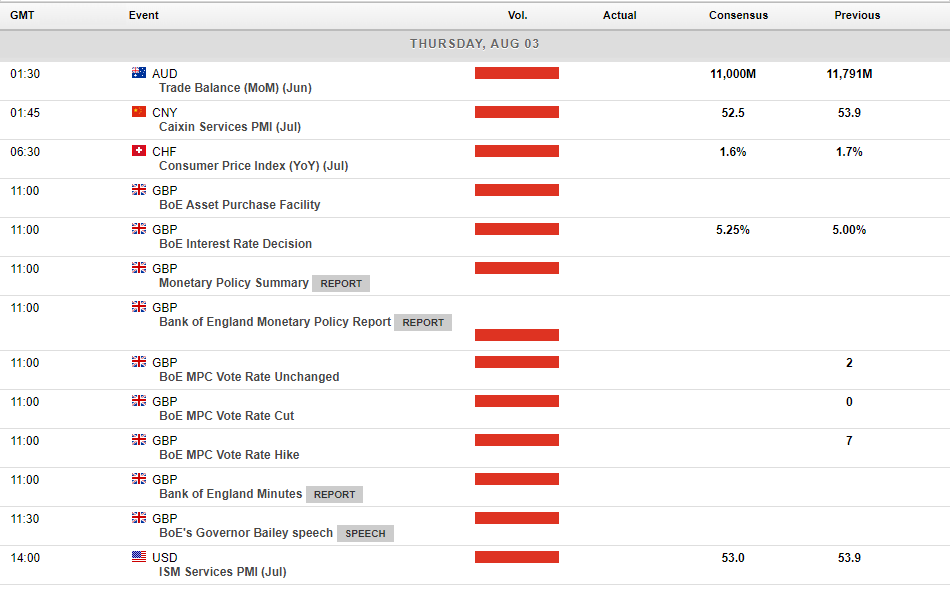

Todays Calendar:

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Non-Farm Payrolls Preview – Charts to watch – DXY – US10Y

Todays NFP figure out of the USA is shaping up to be a pivotal moment in market expectations as to whether we’ve seen peak rates from The Federal Reserve, or if there is more to come and the ramifications that will have for the FX market. NFP figures are always interesting, traditionally the biggest market moving figure of the month on the US ...

August 4, 2023

Read More >

Previous Article

Bank of England Decision could send the Pound Lower

Since March 2023, the GBPUSD had been trading higher as the US Federal Reserve and the Bank of England (BoE) maintained along their path to continue r...

August 2, 2023

Read More >