- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Arista Networks tops estimates for Q1

3 May 2022Arista Networks Inc. reported its Q1 financial results after the closing bell in the US on Monday, beating Wall Street estimates.

The US computer networking company reported revenue of $877.066 million (up by 31.4% year-over-year) vs. $856.14 million expected.

Earnings per share reported at $0.84 per share (up by 35.48% year-over-year) vs. $0.81 per share estimate.

Jayshree Ullal, President and CEO of Arista Networks commented on the latest results: ”Arista has delivered record Q1 2022 sales despite the sustained supply chain challenges. I am pleased with our enterprise execution and cloud titan strength in these uncertain times.”

”We are pleased with the continued growth of our enterprise business in the first quarter, combined with robust next generation product qualification and deployment activity with our cloud customers,” Arista’s CFO, Ita Brennan said after the results were announced.

The company expects revenue between $950 million to $1 billion in Q2.

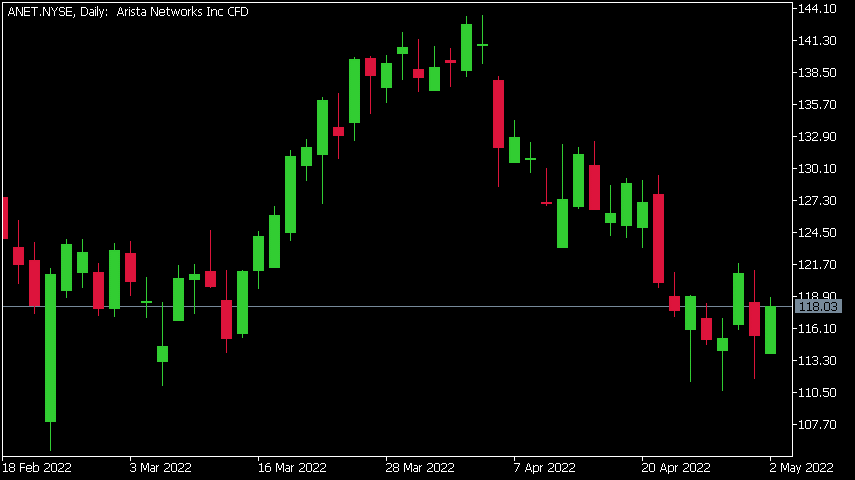

Arista Networks Inc. chart

Shares of Arista Networks ended the trading day on Monday at $118.03 per share, up by 2.33%. The stock price climbed by around 3% in the after-market trading hours.

Here is how the stock has performed in the past year:

- 1 Month -17.16%

- 3 Month -4.87%

- Year-to-date -17.73%

- 1 Year +31%

Arista Networks price targets

- Morgan Stanley: $144

- Wells Fargo: $160

- Citigroup: $160

- Barclays: $140

Arista Networks Inc. is the 474th largest company in the world with a market cap of $36.34 billion.

You can trade Arista Networks Inc. (ANET) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Arista Networks Inc., TradingView, CompaniesMarketCap

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

The Impact of China’s Lockdown

China’s recent covid shutdown has wreaked havoc on its economy and the impact may be felt globally. With the world so integrated the second largest global economy suffering through a lockdown has the potential to severely disrupt the global economy. China has had to face its worst covid outbreak since the beginning of the pandemic. To curb the...

May 3, 2022

Read More >

Previous Article

Amazon records its first loss since 2015

Amazon has followed some of the other tech sector players in providing weaker than expected quarterly results. The global giant saw its share price dr...

May 2, 2022

Read More >