- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

The Impact of China’s Lockdown

3 May 2022China’s recent covid shutdown has wreaked havoc on its economy and the impact may be felt globally. With the world so integrated the second largest global economy suffering through a lockdown has the potential to severely disrupt the global economy.

China has had to face its worst covid outbreak since the beginning of the pandemic. To curb the spread, it placed its two largest cities, Shanghai, and Beijing in lockdown. China is one of the last places to continue with a ‘Covid Zero’ strategy. Shanghai for instance, has a population of 25 million people has barred its citizens from doing anything except for shopping for essentials. This has had an obvious negative effect on the economy.

Economic Repercussions

Manufacturing and Services activity slipped to their lowest levels since February 2020. China’s economy was already struggling, with major construction company Evergrande, struggling to stay afloat for much of last year. Companies such as Tesla, Sony, Ford, and Apple were forced to shut down their factories. President Xi had previously committed to keeping China’s growth at 5.5% GDP growth. However, economists struggle to see how this will be possible with the current covid measures.

The government did concede some concessions by creating a ‘whitelist’

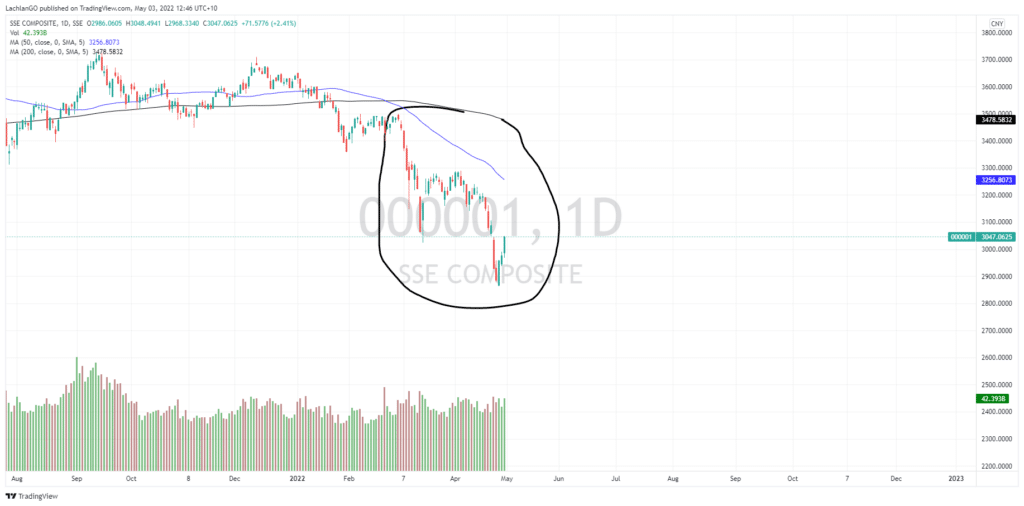

on 18th April of 666 companies that could resume production to keep the economy running. Almost 40% these companies are automakers or companies involved in supplying parts to the auto industry. Due to the lockdown, the most recent economic figures showed retail sales figures slipping by 3.5%, unemployment rising by 5.8%, the highest figures since May 2020 and property was down 26% year on year. The Shanghai stock exchange also saw a dramatic drop and continues to struggle as the country deals with the outbreak. The chart below captures much of the drop off since the outbreak. In recent times a slight recovery has occurred. However, the trend is still bearish overall and without the prospect of significant easing of restrictions there is no guarantee of a sustained move strong reversal.

Global Effects of the shutdown

China’s economic crackdown is being felt globally with global supply chains suffering. Figures show that suppliers are facing their longest delays in two years for products. In addition, as shortages become more problematic it will add further inflationary pressure. Products that may be in short supply and increase inflationary pressure such as electronics and cars may suffer the most. On the contrary, with lower demand for commodities such as oil and gas coming from China it may balance out the negative impact of the supply crunch for electronics and cars.

Effect on Australia

As China is such a large importer of Australian resources, specifically Coal and Iron Ore, if the lockdown drags on it may affect the Australian economy. Large mining companies such as RIO, BHP, FMG and WHC may suffer. In addition, the property market in Australia is heavily influenced by South East Asian buyers and investors who play a big role within the Australian property market.

Ultimately, an economic problem in China is an economic problem for the entire world. Whilst the country is under lockdown it increases the pressure on the global supply chain and inflationary pressure. The world must be on alert for the threat of a weakened Chinese economy.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

The Impact of China’s Lockdown

China’s recent covid shutdown has wreaked havoc on its economy and the impact may be felt globally. With the world so integrated the second largest global economy suffering through a lockdown has the potential to severely disrupt the global economy. China has had to face its worst covid outbreak since the beginning of the pandemic. To curb the...

May 3, 2022

Read More >

Previous Article

Arista Networks tops estimates for Q1

Arista Networks Inc. reported its Q1 financial results after the closing bell in the US on Monday, beating Wall Street estimates. The US computer n...

May 3, 2022

Read More >