- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Asian stocks looking to open in the green after a volatile post-FOMC session on Wall St

15 June 2023US markets finished mixed in a chaotic session as the long-awaited June FOMC monetary policy meeting concluded. As expected, the Fed held rates steady after 10 straight hikes, the tone of the accompanying statement was quite hawkish, signalling higher for longer in rates and the possibility of more hikes to come. More mixed signals were given by Chair Powell in his presser where he seemed to walk back some of the hawkish narrative, resulting in a real see-saw session in all risk assets.

FX Markets

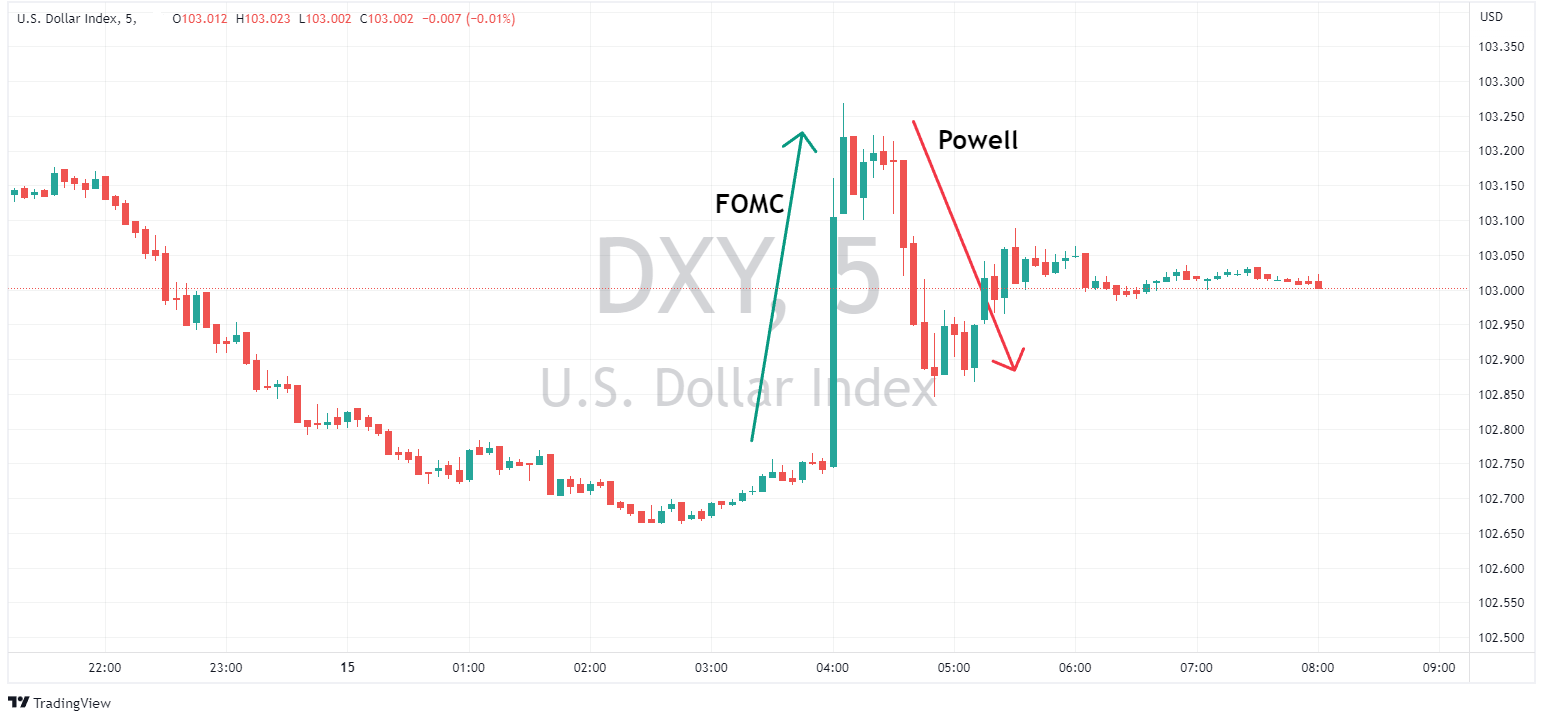

USD sold off pre-Fed with the Dollar Index sliding to hit a low of 102.66, after a cooler-than-expected PPI figure. Price action reversed after the hawkish FOMC statement seeing a steep rally in DXY rising from 102.75 to 103.27, to round off the volatile session, the “dovish” presser from Powell saw a good chunk of those gains disappear.

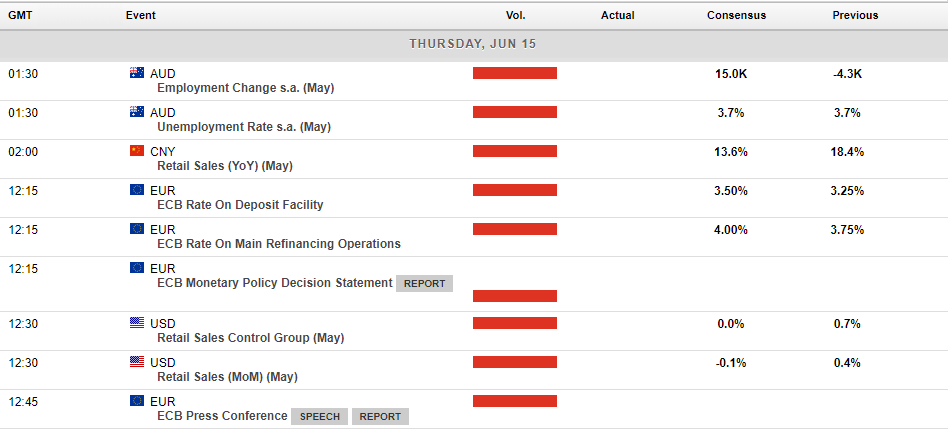

AUD and NZD were the G10 outperformers with the Kiwi seeing much stronger gains than the Aussie. Both the AUD and NZD were already outperforming pre-Fed, finding support from the positive risk environment and PBoC actions on Tuesday. NZDUSD and AUDUSD posted highs of 0.6236 and 0.6835, respectively. NZD has sold off early in the Asian session after a weak GDP reading, seeing NZ enter a technical recession after the economy shrank 0.1% in the first quarter., AUD traders will have employment figures released at 11:30 AEST to contend with.

GBP saw strong gains vs the USD. Cable tested 1.27 to the upside pre-Fed making a fresh YTD high and at the highest level since April 2022 as GBP continued to rally post the hot labour market data on Tuesday with the GBP gaining support as the markets price in a hawkish BoE going forward.

Gold bounced around in a similar path to the USD, XAUUSD tested it’s major support at 1939 with the USD surging post-FOMC, but sound solid buying at that level to again hold the lower band of it’s May/June range.

In the day ahead, the Asian session will see what could be an exciting AUD session, with Australian employment figures due, and Chinese Industrial production and retail sales not long after.

The ECB is also due to release their monetary policy later in the session, a hike of 25bp being fully priced in, but again as with the Fed it will be the accompanying statement and subsequent presser that have the most potential to cause volatility.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Asia Morning FX – AUD and EUR surge, USD takes a hit post FOMC, BoJ ahead

USD tumbled in Thursday’s session in the wake of a dovish Powell presser (relative to statement/dot plots) saw the Dollar bears in charge. This, coupled with a hawkish ECB and mixed US data saw DXY fall from highs of 103.38 in the European morning to a low of 102.08, with the psychological 102 level the next obvious support. A hawkish ECB, where ...

June 16, 2023

Read More >

Previous Article

Wall St rallies on softer CPI ahead of FOMC, USD down, Yields up

Another day, another stock rally on Wall St in Tuesday’s session with a softer than expected headline CPI print seeing US rate hike odds completely ...

June 14, 2023

Read More >