- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Wall St rallies on softer CPI ahead of FOMC, USD down, Yields up

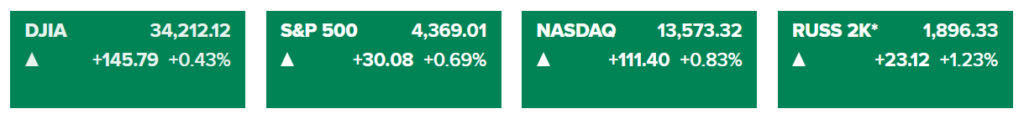

14 June 2023Another day, another stock rally on Wall St in Tuesday’s session with a softer than expected headline CPI print seeing US rate hike odds completely evaporate before today’s pivotal FOMC meeting. Small caps led the way with the Russell 2000 rising 1.23%, and another record for TSLA, surging 41% in the last 13 green trading sessions.

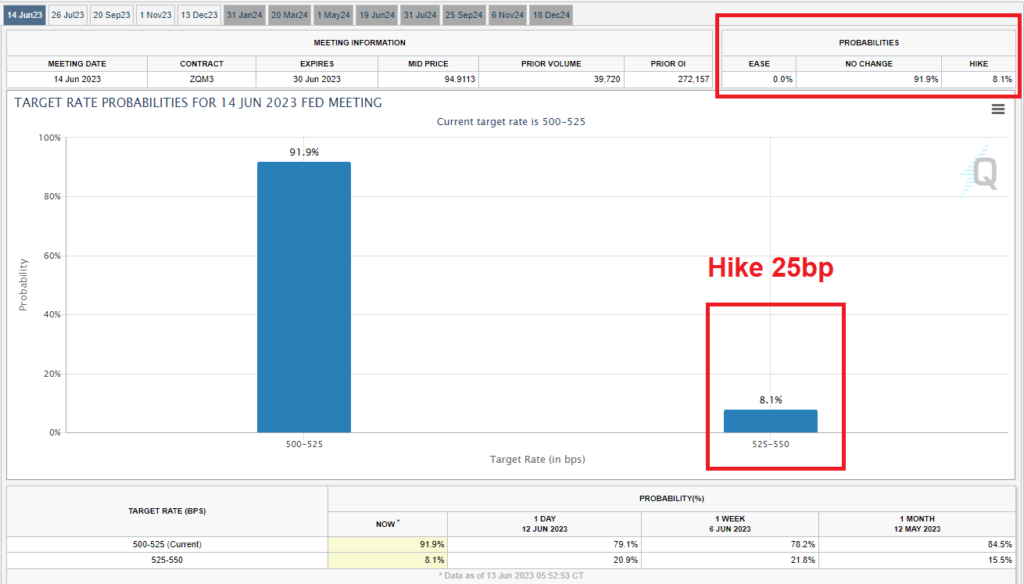

US May CPI reading came in at 0.1% m/m vs an expectation of 0.2%, thought the core reading did prove sticky coming in at 0.4% m/m, the headline figure was enough to send equity markets into a sharp rally as a rate hike in todays FOMC meeting was almost completely priced out, dropping to an 8% chance form the previous 25% according to Fed Fund Futures traders.

FX Markets

USD was lower on Tuesday in the wake of markets re-pricing lower the chance of a hike out of the FOMC today, but it did manage to pare some of its post-CPI losses as the DXY extended to lows of 103.040 in wake of the report. Today’s PPI released a few hours before the FOMC meeting will be another risk event for USD traders.

GBP saw strength with Cable hitting a high of 1.2624 , continuing to trend upwards, also breaking and finding support at Mondays highs. BoE tightening expectations ratcheted higher for June and well beyond on the back of the latest UK jobs report that was stronger than forecast. Today UK GDP and a scheduled speech by BoE Governor Bailey are on the calendar for GBP traders.

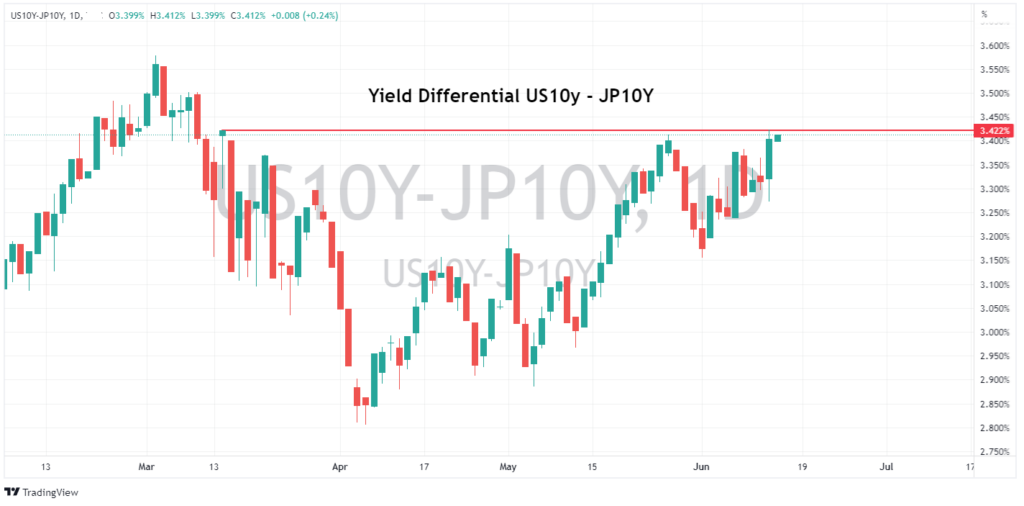

JPY was the G10 underperformer, seeing notable losses against the USD in particular after US Treasury yields rebounded to see USDJPY close in on 2023 highs and print a peak of 140.30. The yield differential between US 10Y and JGB 10Y bonds hitting its highest level since March.

Gold continued to trade in its May/June range, despite a weak USD, rising yields saw the precious metal price push sharply lower before XAUUSD found some support at the bottom of the range.

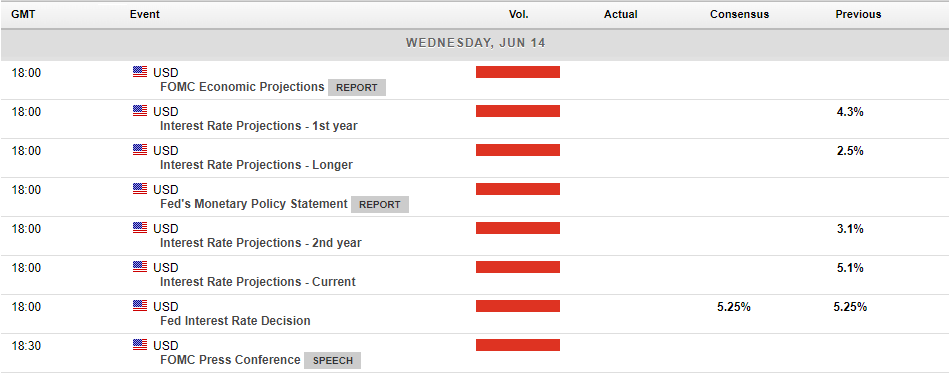

In today’s economic announcements the big one is finally here, with the FOMC meeting where the Fed is finally expected to pause in it’s rate hiking cycle after ten straight hikes. With the actual rate decision fully priced in as a hold, if the Fed sticks to that script, it will be the Jerome Powell presser post decision which should see the most volatility.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Asian stocks looking to open in the green after a volatile post-FOMC session on Wall St

US markets finished mixed in a chaotic session as the long-awaited June FOMC monetary policy meeting concluded. As expected, the Fed held rates steady after 10 straight hikes, the tone of the accompanying statement was quite hawkish, signalling higher for longer in rates and the possibility of more hikes to come. More mixed signals were given by Ch...

June 15, 2023

Read More >

Previous Article

Asian markets looking to open strongly as big tech pushes US markets higher ahead of CPI

US markets rallied strongly again to start the week with lower yields, on the back of hopes of a Fed pause this week, saw big tech surge and the Nasda...

June 13, 2023

Read More >