- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Cisco tops Wall Street expectations

17 February 2022Cisco Systems Inc. reported its second quarter results for the period ended January 29, 2022, after the closing bell on Wall Street today. The company topped both revenue and earnings per share estimates. Let’s take a closer look at the key numbers.

Total revenue reported at $12.72 billion (up 6% year-over-year) vs. $12.664 billion expected.

Earnings per share at $0.84 (up 6% year-over-year) vs. analyst forecast of $0.81 per share.

“We continue to see incredibly strong demand across our portfolio, emphasizing the criticality and relevance of Cisco’s innovation,” said Chuck Robbins, chair and CEO of Cisco.

“Our robust order strength, record backlog and double-digit growth in annual recurring revenue position us well to deliver growth,” Robbins added.

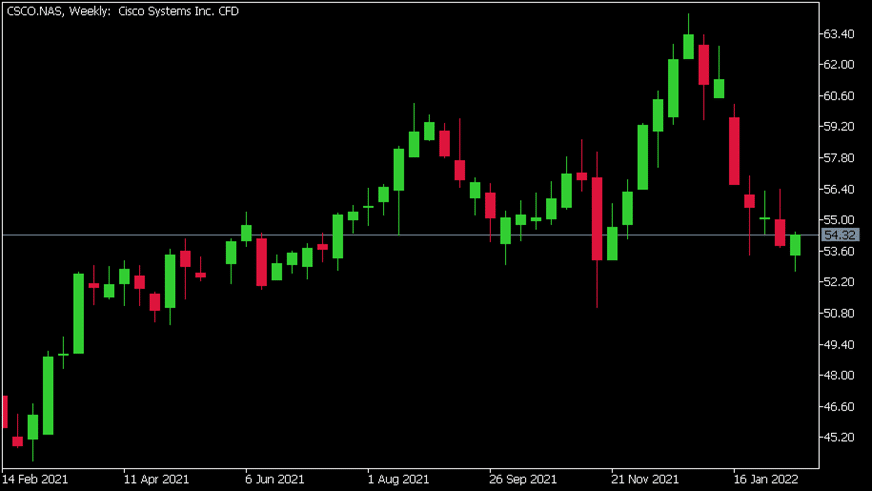

Cisco Systems Inc. (CSCO) chart (weekly)

Shares of Cisco down by 0.04% on Wednesday at $54.32 per share. Here is how the stock has performed in the past year –

- 1 Month: -7.89%

- 3 Month: -4.42%

- Year-to-date: -14.39%

- 1 Year: +17.30%

Cisco is the 43rd largest company in the world, with a total market cap of $228.80 billion.

You can trade Cisco Systems Inc. (CSCO) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Cisco Systems Inc., TradingView, CompaniesMarketCap

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

NVIDIA beats estimates

NVIDIA Corp. reported its fourth quarter financial results after the market close on Wednesday. The US technology giant reported revenue of $7.643 billion in the previous quarter (up by 53% from a year earlier) vs. $7.42 billion expected. Earnings per share reported at $1.32 (up 69% from a year earlier and up 13% from the quarter before) vs...

February 17, 2022

Read More >

Previous Article

What just happened to Mark Zuckerberg’s Facebook and Meta?

Mark Zuckerberg and his company Meta Platform Inc (formerly known as Facebook) have been in the news recently, and it is often not good news. They mig...

February 11, 2022

Read More >