- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

NVIDIA beats estimates

17 February 2022NVIDIA Corp. reported its fourth quarter financial results after the market close on Wednesday.

The US technology giant reported revenue of $7.643 billion in the previous quarter (up by 53% from a year earlier) vs. $7.42 billion expected.

Earnings per share reported at $1.32 (up 69% from a year earlier and up 13% from the quarter before) vs. $1.23 per share expected.

The company paid quarterly cash dividends of $100 million in the fourth quarter.

”We are seeing exceptional demand for NVIDIA computing platforms,” founder and CEO of NVIDIA, Jensen Huang said in a statement following the latest results.

”NVIDIA is propelling advances in AI, digital biology, climate sciences, gaming, creative design, autonomous vehicles and robotics – some of today’s most impactful fields.”

”We are entering the new year with strong momentum across our businesses and excellent traction with our new software business models with NVIDIA AI, NVIDIA Omniverse and NVIDIA DRIVE. GTC is coming. We will announce many new products, applications and partners for NVIDIA computing,” he added.

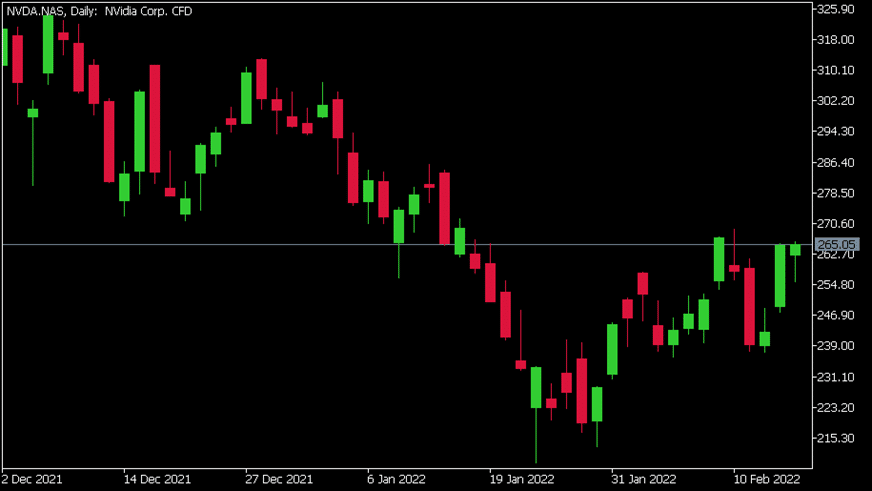

NVIDIA Corp. (NVDA) chart (daily)

Shares of NVIDIA were little changed at the end of the trading day on Wall Street, up by 0.06% at $265.05 per share. Here is how the stock has performed in the past year –

- 1 Month: +5.76%

- 3 Month: -9.40%

- Year-to-date: -9.86%

- 1 Year: +77.85%

NVIDIA is the 8th largest company in the world, with a total market cap of $660.65 billion.

You can trade NVIDIA Corp. (NVDA) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: NVIDIA Corp., TradingView, CompaniesMarketCap

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Tesla’s share price and Elon donates $5.74 BN

Tesla Inc, formerly known as Tesla Motors (2003–17), is an American manufacturer of electric automobiles, solar panels, and batteries for cars and home power storage. It was founded in 2003 by American entrepreneurs Martin Eberhard and Marc Tarpenning and was named after Serbian American inventor Nikola Tesla. Elon Musk took over as CEO in...

February 17, 2022

Read More >

Previous Article

Cisco tops Wall Street expectations

Cisco Systems Inc. reported its second quarter results for the period ended January 29, 2022, after the closing bell on Wall Street today. The company...

February 17, 2022

Read More >