- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Goldman Sachs top Q3 expectations

18 October 2021Goldman Sachs reported their third quarter financial results before the opening bell on Friday. The company topped Wall Street analyst expectations, beating both total revenue and earnings per share estimates.

Total revenue was reported at $13.61 billion vs. $11.68 billion expected. Earnings per share at $14.94 a share vs. $10.18 per share forecast.

David Solomon, Chairman and CEO commented on solid Q3 results: ”The third quarter saw strong operating performance and an acceleration of our investment in the growth of Goldman Sachs. We announced two strategic acquisitions in our Asset Management and Consumer businesses which will enhance our scale and ability to drive higher, more durable returns. Looking forward, the opportunity set continues to be attractive across all of our businesses and our focus remains on serving our clients and executing our strategy.”

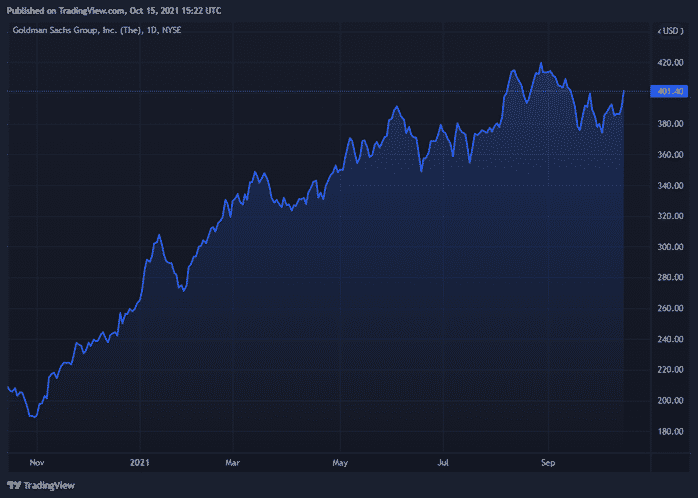

Goldman Sachs Chart (year-to-date)

The share price of Goldman Sachs was trading higher after the latest results, up by around 2% during the session on Friday. The stock price has climbed by over 90% in past year at $401.40 a share.

You can trade Goldman Sachs (GS) and many other stocks from the NYSE, NASDAQ and the ASX with GO Markets as a Share CFD. Click here for more information. Trading Derivatives carries a high level of risk.

Sources: Goldman Sachs, Refinitiv, TradingView

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Netflix beats Q3 expectations

Netflix reported its third-quarter financial results after the closing bell on Tuesday, delivering solid numbers and beating Wall Street analyst predictions. The online streaming service reported earnings per share at $3.19 per share vs. $2.56 a share expected. The total revenue was $7.48 billion (up 16.3% from the same time last year) in the th...

October 20, 2021

Read More >

Previous Article

Earning season continues – US banking giants report Q3 results

The third quarter earnings season is heating up nicely over in the US, with some of the world’s largest banks reporting their latest financial resul...

October 15, 2021

Read More >