- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

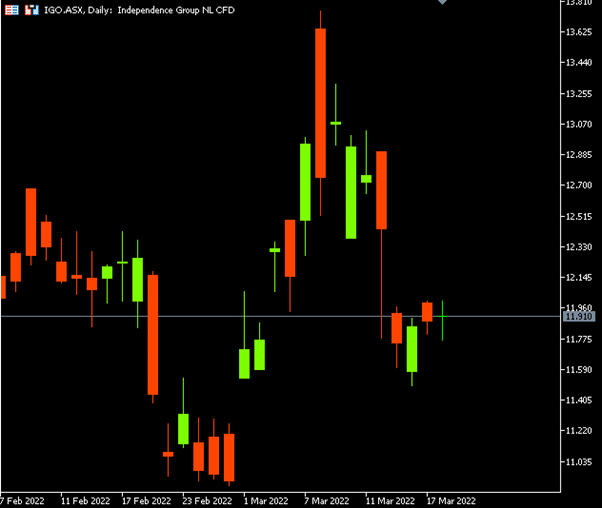

IGO’s big buyout delayed by nickel’s current volatile prices

21 March 2022IGO is a Nickel, Gold and Copper-Zinc silver mining, development and exploration company. They are based in Western Australia and control an array of mining companies.

The London Metals Exchange (LME) halted nickel trading on March 8th after an unprecedented price spike. This has forced IGO to delay their $1.09 billion buyout of Western Areas. The price spike is also causing a nightmare for brokers as they struggle to pay margin calls against heavily unprofitable short positions.

Western Areas shareholders had voted to push the all cash buyout offer to May, which is a month later than expected.

In a public statement, the IGO board announced that the move was in response to “the recent significant nickel price volatility” and they expect the deal to close by May/June.

IGO’s share price ended the week at $11.91, which is a 15% drop from last week’s high of $13.75.

“The Western Areas board and the Independent Expert are continuing to consider the implications, if any, on nickel market fundamentals and expectations for medium to long-term nickel prices,” IGO said.

Western Areas shareholders will receive a scheme booklet in April. This booklet will contain an independent expert’s assessment of whether IGO’s $3.36 per share offer is fair and reasonable.

The price of nickel has spiked briefly above $100,000 USD a tonne on the exchange. This was largely due to a short squeeze that had a major Chinese Bank in hot water. The spike has also spurred on the LME’s extreme decision to halt nickel trading.

The LME’s decision was the first time it has halted trading since the collapse of an international tin cartel in 1985. The decision came as Xiang Guangda, owner of Tsingshan, made a short position on the nickel. The price spike left Tsingshan exposed to $8 billion USD of trading losses whilst struggling to meet their margin calls.

The price continued to climb higher as one of the world’s largest nickel producers, Russia decided to invade Ukraine. As the market was picking up on the short squeeze of Tsingshan, the LME had decided to intervene.

All in all, the volatility of the price of nickel coupled with the LME’s decision to halt trading has left IGO in a tricky position in regards to the Western Areas buyout. They have reassessed the situation and have made a decision to push the completion date back a month.

If you would like to take this opportunity to invest in IGO and don’t already have a trading account, you can register for a Shares or Shares CFD account at GO Markets.

Source: GO Markets, IGO, ASX, Bloomberg, AFR

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Is the US Dollar at risk?

The US Dollar is as synonymous to us in life as the morning and night is. It has dominated as a reserve currency for decades. It’s paved the way for the United States to become the superpower that it is today, and be able to wield influence around the world, as it sees to work with other nations by investing or ramp up trade to keep the statu...

March 21, 2022

Read More >

Previous Article

Indices finish the week on a high as the technology sector builds momentum

Global indices ended the week on a high as the US indices all recovered some of their recent sell offs. The Nasdaq was the strongest performer risi...

March 21, 2022

Read More >