- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

Iron ore skyrockets to six-month high as China eases Covid-19 restrictions

10 March 2022Iron ore prices have continued to rally to a six-month high this week, due in part to reports of potential easing of China’s strict COVID-19 policy and their signs of improved steel demand.

The Singapore Exchange has the iron ore futures price reaching $165 USD a tonne on Tuesday, this is the highest level since July 2021.

The price increase could have been attributed to a report that concluded that Beijing was considering potentially moving away from a zero-tolerance approach to COVID-19. If this occurs, it could potentially put an end to the stop-start nature of China’s economic activities which has been happening since the start of COVID-19 pandemic.

Another report indicated that experimental opening measures could arrive in a few select cities across China as early as June, which will coincide with the beginning of their Summer.

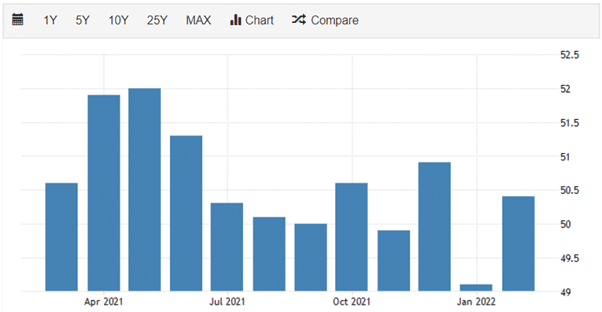

A potential sign that China’s stimulus is contributing to rebound in growth can be evident earlier this month with the release of China’s Manufacturing Purchasing Managers Index (PMI). The PMI had increased to 50.2, which was greater than the economists’ consensus of 49.8. Some experts and economists believe that the PMI’s figures released next month of March will likely provide a better indication of the true state of China’s economy, given the effects of the Lunar New Year period in the first two months of the year.

Iron ore supplies could also heavily affect its global price. There are concerns about the supply disruptions caused by the conflict between Russia and Ukraine, given their iron ore sector accounts for 100 million tonnes and 81 million tonnes a year, respectively. Heavy rain in the south-east of Brazil earlier this year, linked to the La Nina weather pattern, has forced producers to cease operations. Brazil is the second largest iron ore producer behind Australia, producing almost 400 million tonnes compared to Australia’s 900 million tonnes.

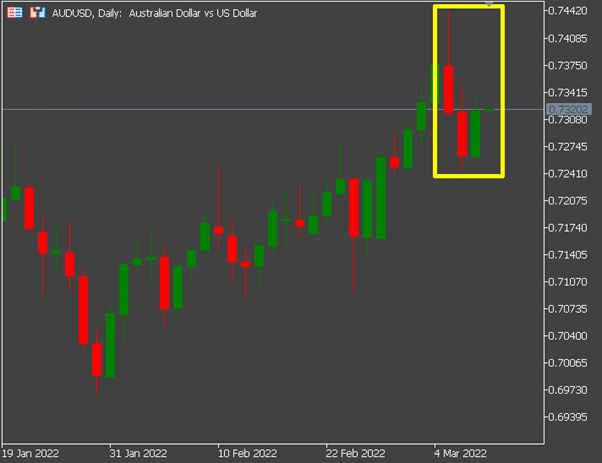

The increase in price to iron ore and energy has driven the AUD/USD to reach a new four month high of 74.41 US cents. Commonwealth Bank (CBA) believes that the currency is currently on track to end the first quarter near 74 US cents. They have updated the fair value estimate of the Australian dollar following the release of the RBA’s commodity price index for February. CBA’s fair value for the AUD/USD ranges between 78-90 US cents, centred on 84 US cents.

All in all, the AUD/USD has a healthy positive correlation with the price of iron ore due Australia being the largest producer. Investors can research the supply and demand of iron ore to achieve a good potential indication of the strength of the AUD/USD.

If you would like to take this opportunity to trade on the AUD/USD and require a trading account, you can open a trading account with GO Markets.

Source: GO Markets MT5, Tradingview, Tradingeconmics, Statista, WSJ, Science.org, AFR

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

JD.com Q4 numbers are in

JD.com Inc. (JD) announced its fourth-quarter earnings numbers on Thursday. The Chinese e-commerce company reported revenue of $43.422 billion (up by 23% year-over-year), slightly above Wall Street analysts forecast of $43.186 billion. Earnings per share reported at $0.35 per share vs. $0.28 per share expected. ''We are pleased to finish t...

March 11, 2022

Read More >

Previous Article

Potential for Ukraine and Russian Negotiations drives a market rebound

The global markets had a strong night of trading on the back of renewed peace talks between Russia and Ukraine. Equity indices were up, whilst commodi...

March 10, 2022

Read More >