- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

JD.com Q4 numbers are in

11 March 2022JD.com Inc. (JD) announced its fourth-quarter earnings numbers on Thursday.

The Chinese e-commerce company reported revenue of $43.422 billion (up by 23% year-over-year), slightly above Wall Street analysts forecast of $43.186 billion.

Earnings per share reported at $0.35 per share vs. $0.28 per share expected.

”We are pleased to finish the year with a set of strong results on both the top and bottom lines as we continued to execute and deliver on our strategic priorities,” said Sandy Xu, Chief Financial Officer of JD.com.

”During the quarter, we further optimized our operational efficiency through technology and innovation, increasing our competitiveness as well as our ability to support our business partners. In 2022, we will continue to execute our business strategies and focus on sustainable high-quality growth across all of our business lines,” Xu added.

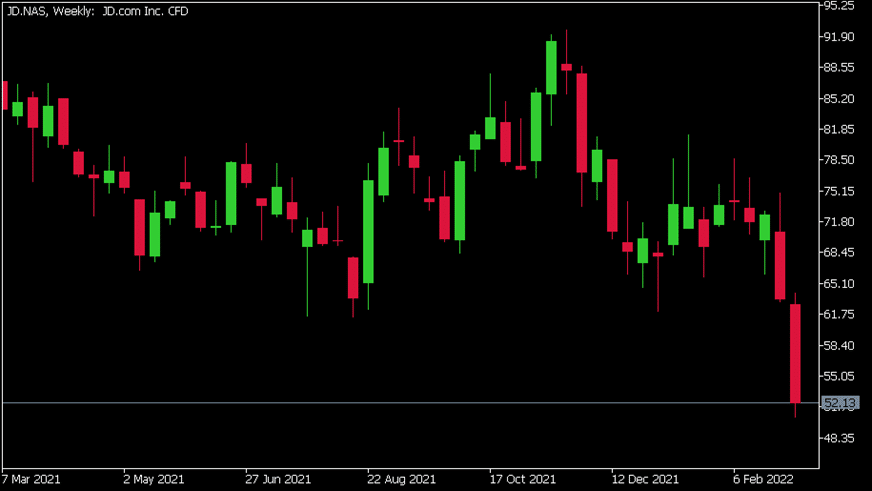

JD.com Inc. (JD)

Share price of JD dropped following the latest financial results on Thursday, after the weakest revenue growth in six quarters. The stock was down by around 16% at $52.13 pe share.

Here is how the stock has performed in the past year –

- 1 Month: -31.40%

- 3 Month: -34.13%

- Year-to-date: -25.20%

- 1 Year: -41.77%

JD.com Inc. is the 163rd largest company in the world with total market cap of $85.95 billion.

You can trade JD.com Inc. (JD) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD. Trading Derivatives carries a high level of risk.

Sources: JD.com, TradingView, MetaTrader 5, CompaniesMarketCap

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Oracle latest financial results announced

Oracle Corporation reported its fiscal 2022 third quarter financial results after the closing bell on Wall Street today. The US software and hardware manufacturer reported revenue of $10.513 billion vs. $10.506 billion expected. Earnings per share at $1.13 per share, falling short of analyst estimate of $1.18 per share. The company also an...

March 11, 2022

Read More >

Previous Article

Iron ore skyrockets to six-month high as China eases Covid-19 restrictions

Iron ore prices have continued to rally to a six-month high this week, due in part to reports of potential easing of China’s strict COVID-19 policy ...

March 10, 2022

Read More >