- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

The Rally on Wall St continues – Tech leads on soft US data, FX markets choppy – range bound

18 July 2023US equities pushed higher again in Monday’s session with soft US manufacturing data (lowering rate expectations from the Fed) counteracting weak Chinese figures during the Asian session. This saw the NASDAQ outperform, breaking through resistance and hitting its highest level since January 2022.

FX Markets

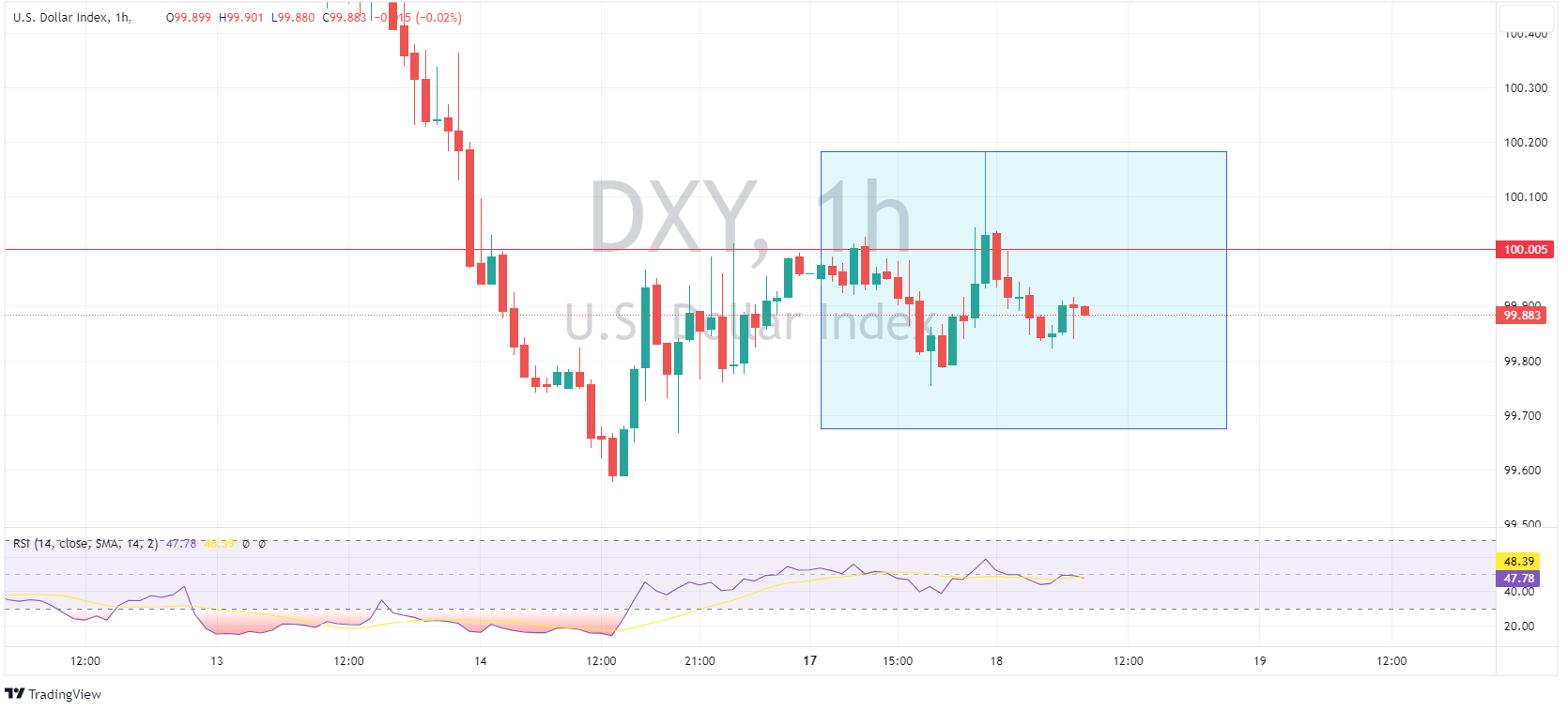

USD was flat on Monday, the US Dollar Index (DXY) trading either side of 100 in a low volatility, tight range session. Highs of 100.18 were seen just before the US cash session opened when US Treasury yields were at their highs, before sharply paring and trading sub 100 throughout the rest of the US. The US Federal Reserve is now in its blackout period ahead of its July 26th meeting, further adding to the low volatility.

EURUSD saw marginal gains, holding on to the 1.12 handle throughout the session. ECB’s Nagel spoke once again stating he expects a 25bp hike in July but is data dependent for September and he does not currently see a risk of over-tightening, helping to bolster EUR somewhat, also outperforming GBP in a choppy session, before finding resistance just below the big 0.86 figure.

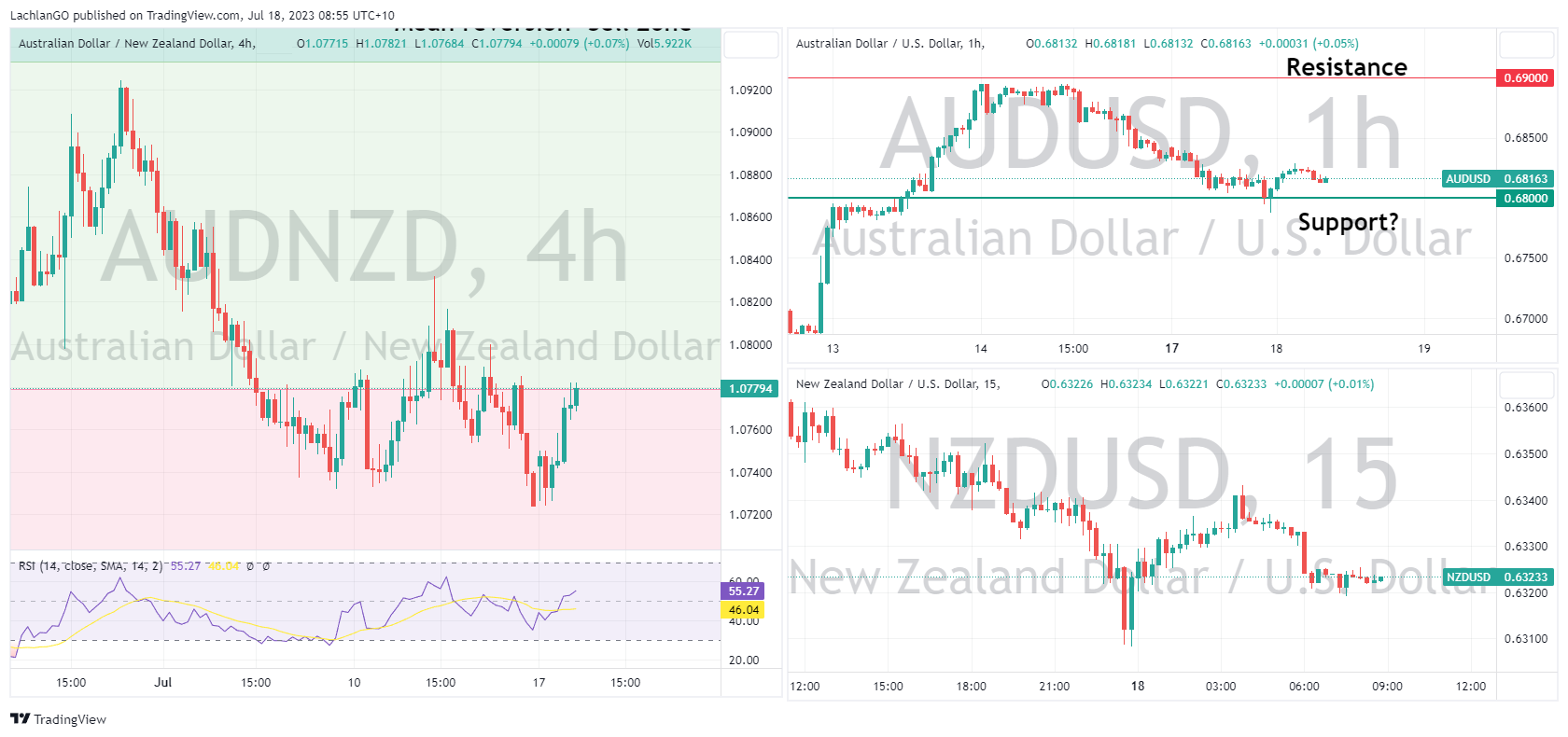

AUD and NZD were generally softer vs the USD, failing to benefit from risk on sentiment with the upside in US stocks. AUD and NZD both falling victim to soft Chinese GDP data released during the Asian session. AUDUSD briefly lost hold of 0.68 when the Dollar peaked but managed to reclaim the level shortly after and have held hold above it since. NZDUSD found support at 0.6300. AUDNZD rallied slightly, moving back to its 2023 mid-point.

Commodities

Oil had an exciting session, initially drifting lower after weak Chinese data only to explode higher early in the European session after Reuters printed a headline about Saudi Arabian production cuts , which was retracted minutes later seeing USOUSD give up all the gains in minutes.

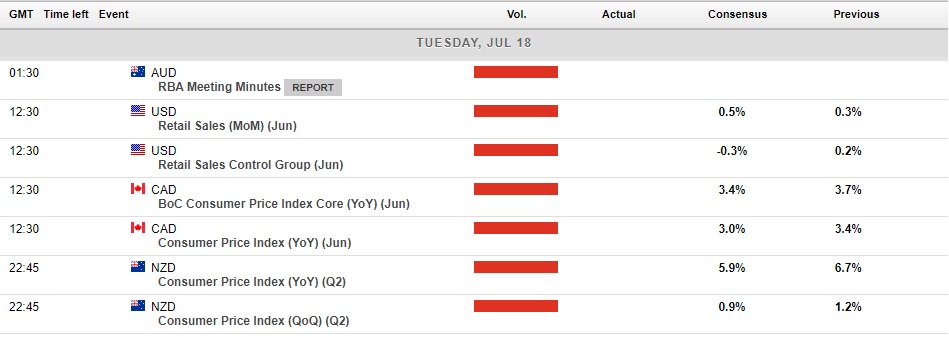

In today’s economic announcements, the RBA minutes from their July meeting will be released at 11:30 AEST, with the market split on the RBA’s next move (Rates markets pricing in a 25% of a hike in August) AUD traders could see some action at this time.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Eyes on EURUSD going into European inflation data

After surging close to 4% since early July off the back of a weakening USD, the EURUSD pair has stabilised around $1.123. With very little volatility seen this week in the pair, eyes now turn to the euro, as the European inflation data is set to be released today. Analysts are predicting a continued downward trend in inflation, with a Year-on-Ye...

July 19, 2023

Read More >

Previous Article

The Week Ahead – The charts to watch USD, GBP, AUD

The Dow Jones closed 100 points higher Friday, having its best week since March as US and global markets were solidly risk on solid US earnings and US...

July 17, 2023

Read More >