- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

The Week Ahead – The charts to watch USD, GBP, AUD

17 July 2023The Dow Jones closed 100 points higher Friday, having its best week since March as US and global markets were solidly risk on solid US earnings and US data showing a cooling in inflation. The week ahead is looking to continue this theme with US data likely to hint at a softening growth story with industrial activity data set to remain subdued.

USD – US data expected to show slowing economy.

Last week’s softer private sector jobs growth and lower-than-expected inflation readings saw expectations for the terminal Fed funds rate move lower, dragging the US Dollar index under 100 for the first time since April 22 and having its worst week since November as treasury yields fell to match the new market expectation for Feds rates trajectory. Major data points this week are Empire State Manufacturing Index released today, Retails Sales on Tuesday and Unemployment claims on Thursday.

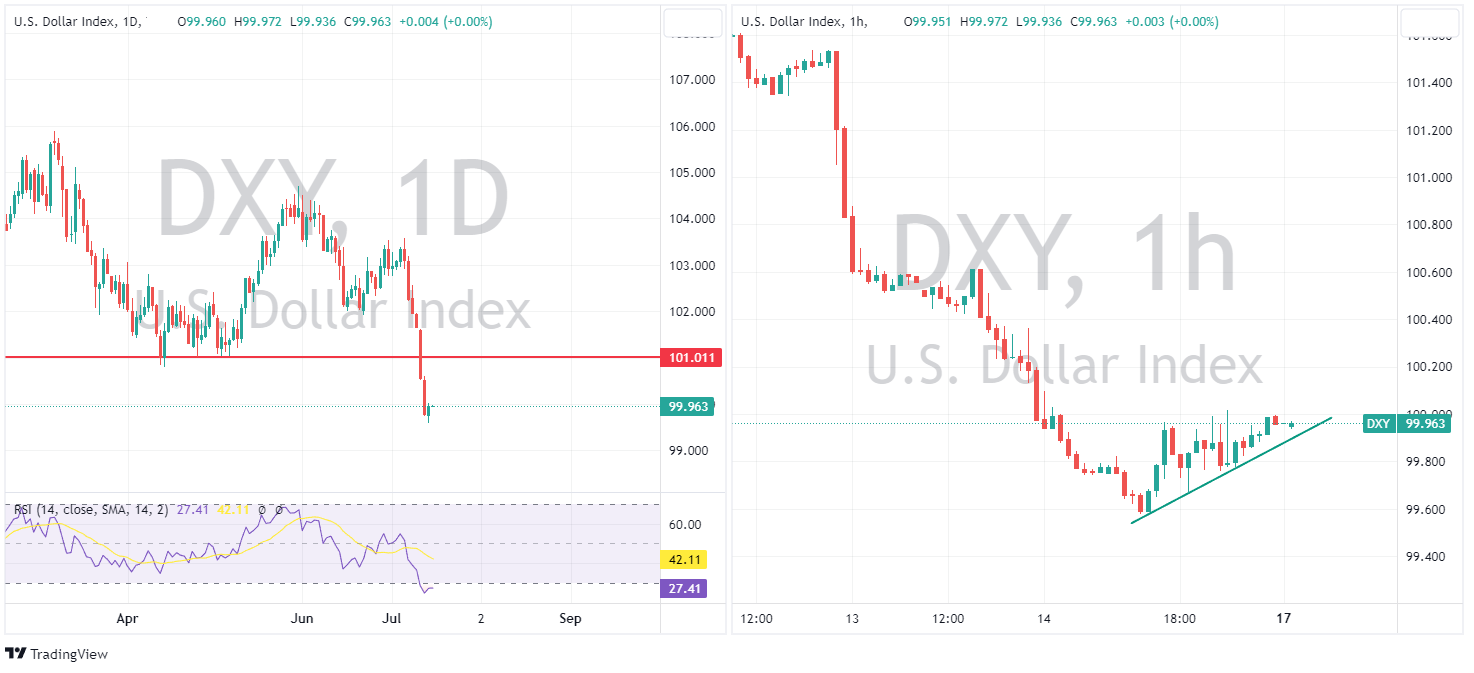

Dollar Index technical analysis

DXY blew through the major support of 101 last week, seeing the Daily RSI deep into oversold territory. The bounce on Friday was muted and found resistance at the psychological 100 level to the upside, this will be a key level to watch in Monday’s trading, whether resistance at 100 holds and we see a further leg down or a break above and the 100 level turns into support and the oversold rebound continues.

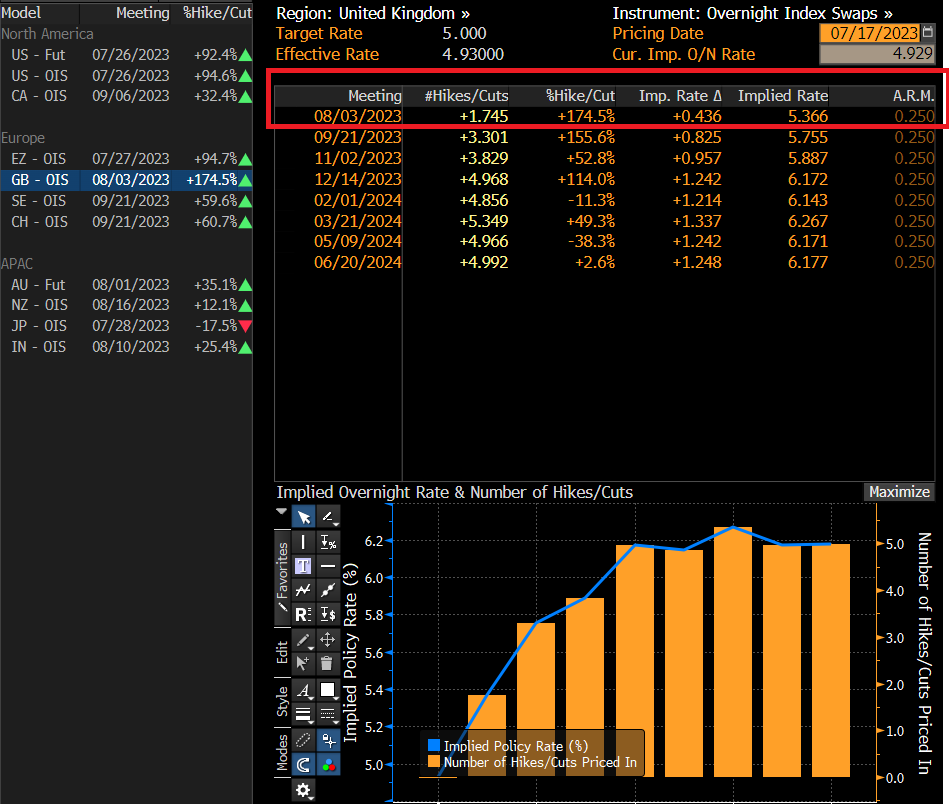

GBP – UK inflation data set to determine size of August rate hike.

Whether the Bank of England hikes by another 50 basis points in August, or is content with a smaller 25bp move, will almost entirely hinge on this week’s UK CPI reading. The BoE statement after their June meeting made it clear that the Bank is hyper-focused on CPI and wage numbers (which came in strong last week), currently the market is pricing in 43 bp, meaning a 100% chance of 25bp, and around a 70% chance of another 50bp hike, Wednesdays CPI will likely see a re-pricing of theses odds and volatility in the GBP.

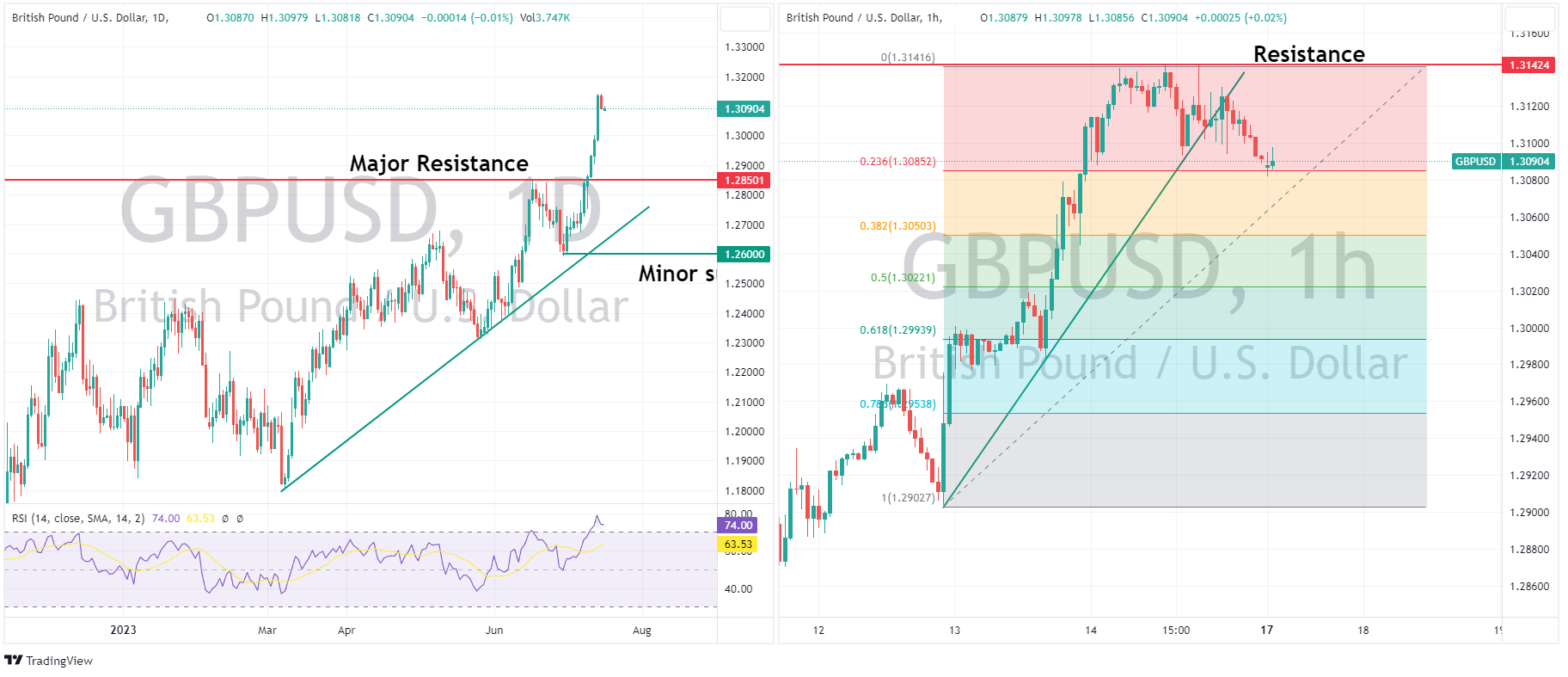

GBPUSD Technical analysis

Cable rallied strongly last week on the back of a big beat in UK wage data and a flailing USD. The 1.2850 major resistance level was breached, pushing GBPUSD to its highest level since April 22 and seeing the Daily RSI reading deep in overbought territory. On a 1-hour chart, resistance has formed at 1.3142, and a pullback seeing the I hour trend line broken, with cable dipping on Friday before finding support at the 23.6 Fib level. Key levels to watch are 1.3124 to the upside – Fib levels on the downside.

AUD – RBA Minutes and Employment data look to shape market expectations.

Tuesday will see the RBA will release the minutes from its July 4th meeting where the central bank kept rates unchanged at 4.10% vs near-evenly split analyst expectations between a 25bps hike and a hold. Rates markets are currently pricing in around a 37% chance of the RBA resuming hikes at its August 1st meeting, with a split market these Minutes will be closely scrutinized and will possibly see those odds re-price. Another key data point out of Australia will be employment data released on Thursday which traders will be eyeing to see if the labour market remains rampant after the blockbuster numbers in May where 76k jobs were added.

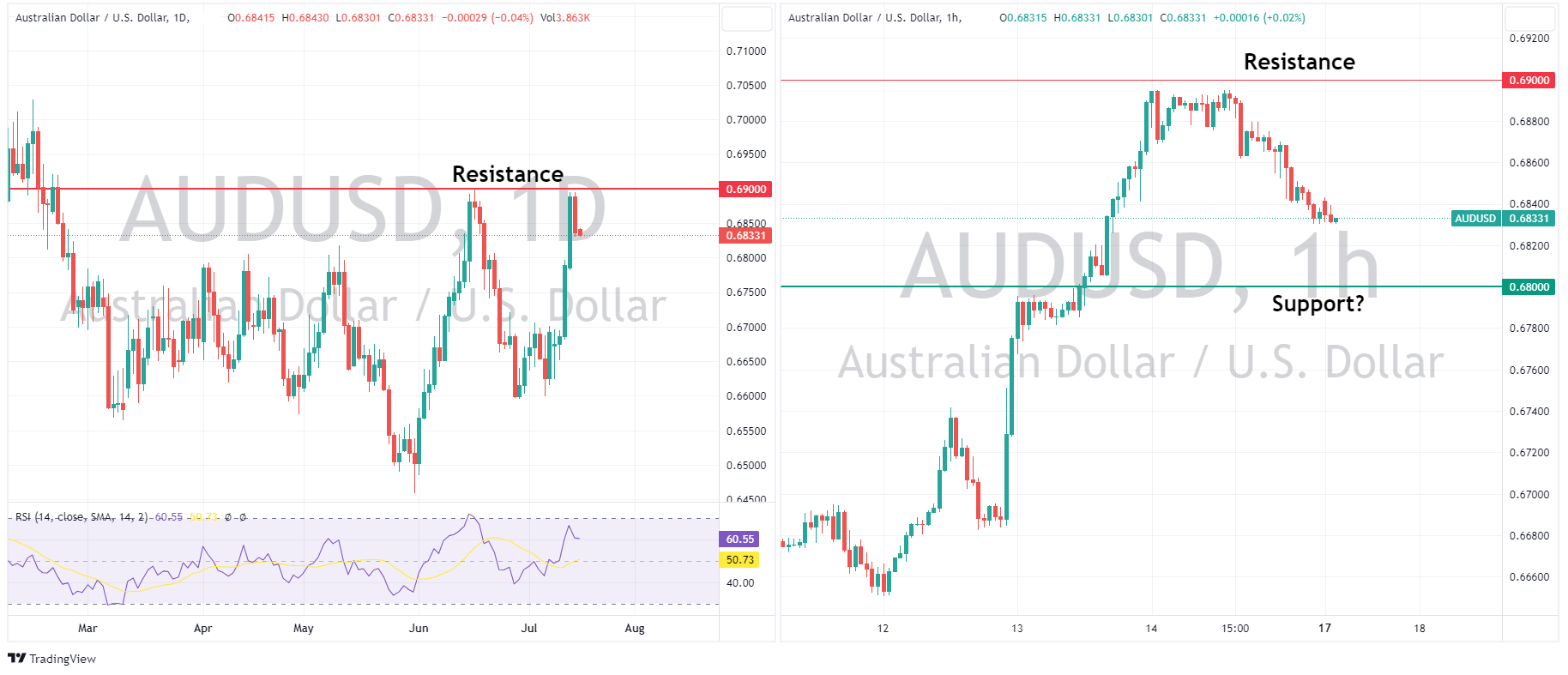

AUD technical analysis

AUDUSD is coming off a bumper week, blowing through the resistance at 0.68 to test the June highs at the 0.69 level before finding any major selling. With the market split on the RBA’s next move, elevated volatility can be expected in AUD this week on data releases especially. Key levels to watch on AUDUSD are the psychological 0.69 level to the upside, 0.68 to the downside, which could possibly become a support level, flipping from its previous resistance.

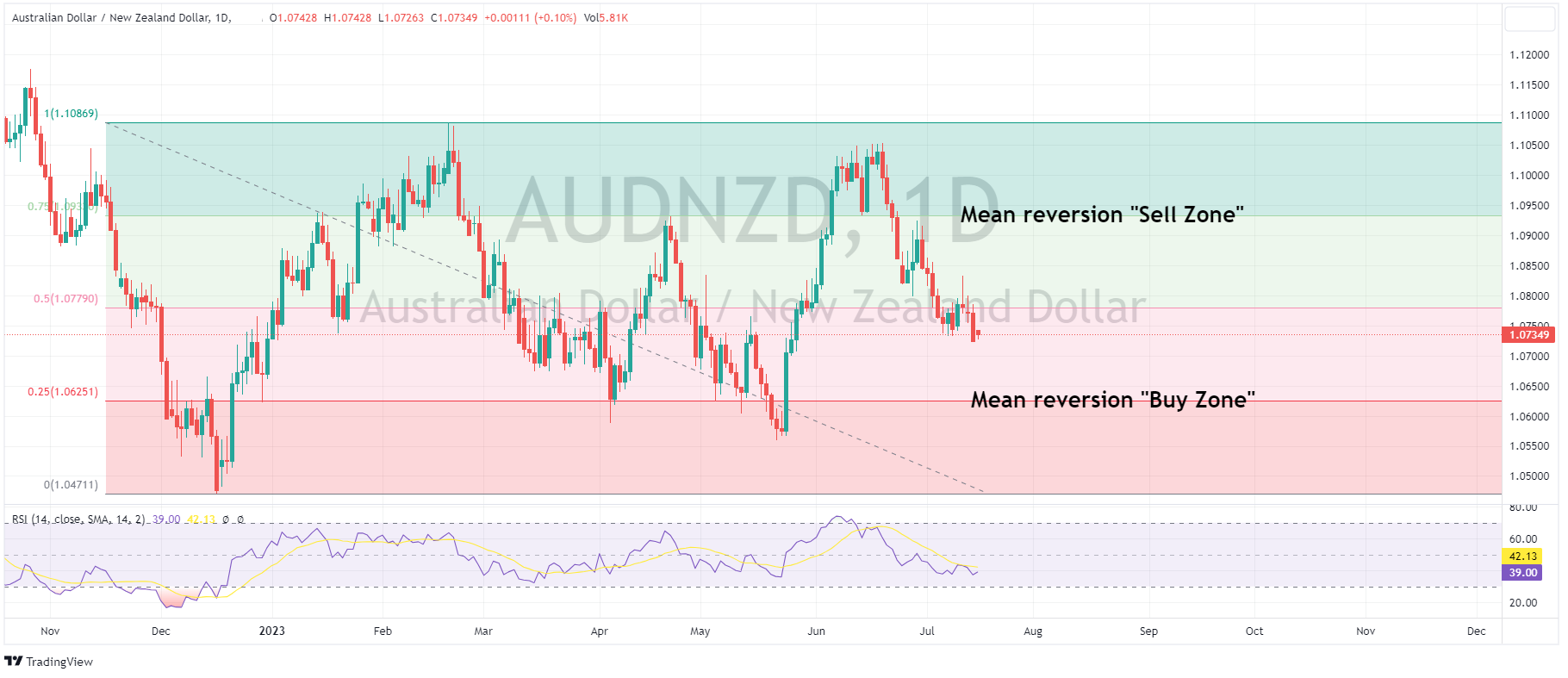

Another AUD chart to watch is the AUDNZD which has entered the “buy zone” for mean reversion traders.

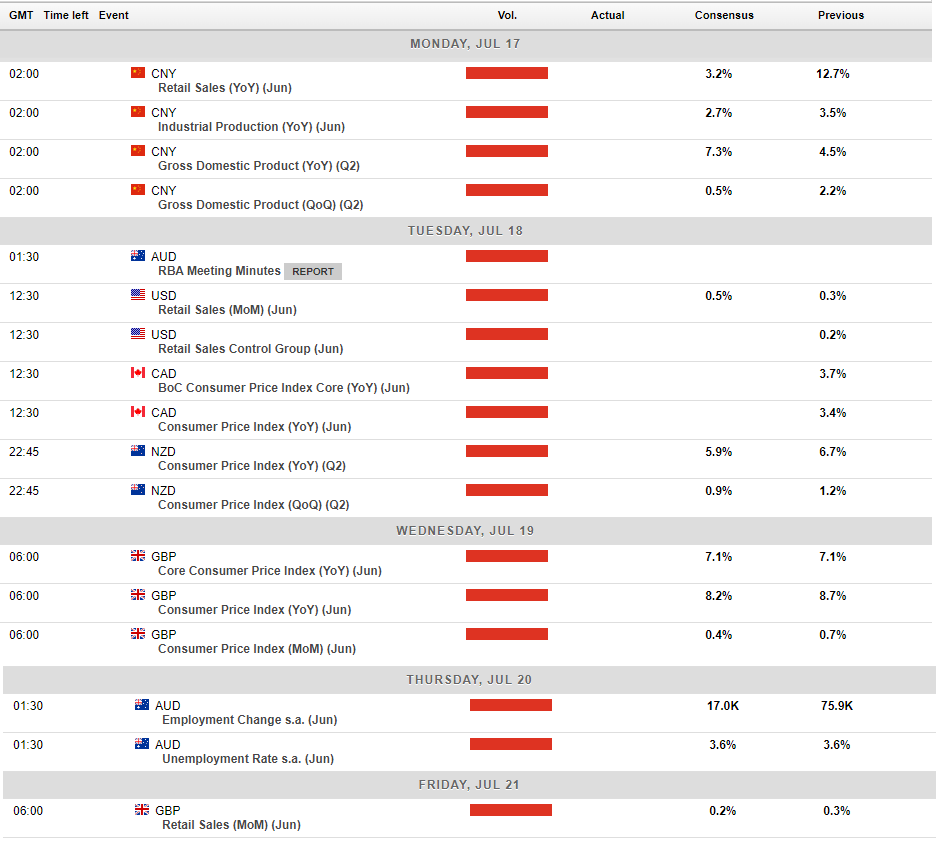

Full calendar of major economic releases below:

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

The Rally on Wall St continues – Tech leads on soft US data, FX markets choppy – range bound

US equities pushed higher again in Monday’s session with soft US manufacturing data (lowering rate expectations from the Fed) counteracting weak Chinese figures during the Asian session. This saw the NASDAQ outperform, breaking through resistance and hitting its highest level since January 2022. FX Markets USD was flat on Monday, the US...

July 18, 2023

Read More >

Previous Article

US Dollar analysis ahead of pivotal CPI reading

The US Dollar Index (DXY) has closed its fourth consecutive day in the red, reaching levels last seen in early May 2023. Despite the recent decline...

July 12, 2023

Read More >