- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

The Week Ahead – RBA and BoE Rate Decisions – AUDUSD, GBPUSD

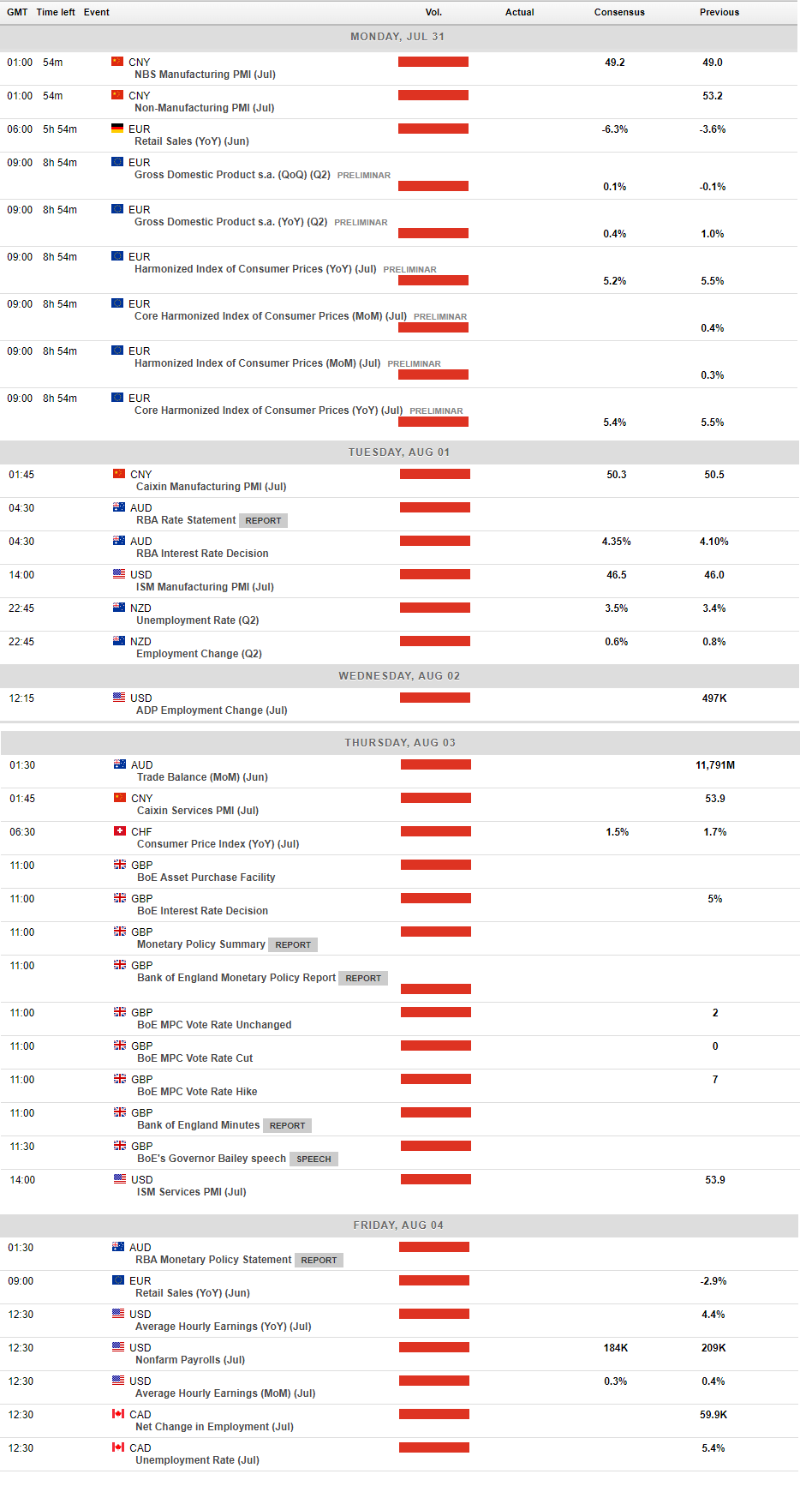

31 July 2023Coming off a big week in Central Bank action, risk events are set to continue this week with the Reserve Bank of Australia and Bank of England rate decisions on Tuesday and Thursday respectively, topped off with the always important non-Farm payrolls out of the US on Friday, which are set to keep traders on their toes.

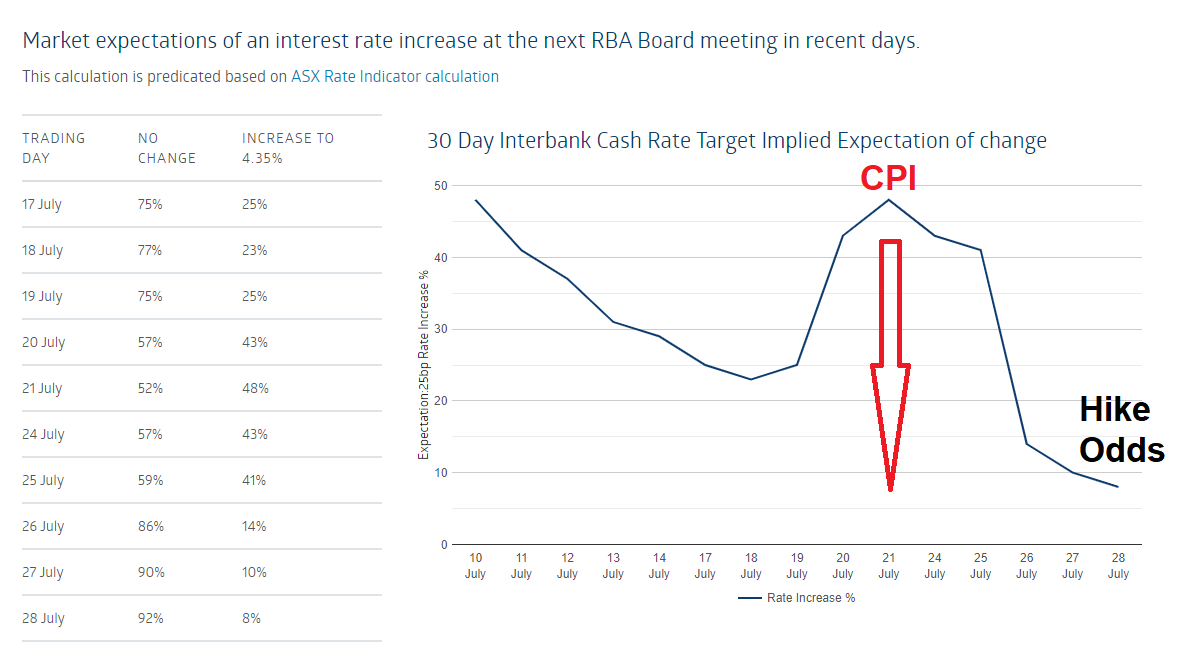

Australia – RBA rate decision

The Reserve Bank of Australia Rate decision on Tuesday is looking to be an interesting one, only a week ago the futures market was split 50-50 on a hike or a hold on Tuesday. However, things can change quickly in this market and the Q2 CPI figure released last week showing the slowest quarterly pace of increase since September 2021 has seen odds dive to be sitting at around 9% for a 25bp hike, with a hold the hot favourite according to bond traders. While futures traders are convinced of a hold, economists recently surveyed by Reuters are much more evenly split at around 50-50 of a hike or hold on Tuesday, with the Inflation rate still well above the RBA target range of 2-3% and Governor Lowe only having two meetings left before his replacement, there is certainly a chance of a surprise to the upside. The accompanying statement will also be key to the moves in AUD after the rate announcement.

Source: RBA Rate Tracker

Chart to Watch

AUDUSD – Has been trading in a holding pattern between 0.6600 and 0.6900 since March (besides a brief break to the downside in June). A hold on Tuesday should have little effect on its own, if that’s the path the RBA takes then the statement will be key to AUD action, 0.6600 to the downside could be tested on a dovish statement.

On the flipside a surprise hike or a hold with an overly hawkish statement will see a lot of AUD traders offside and should see a spike higher in AUD crosses, levels to the upside in AUDUSD to watch are the big figures 0.67, 0.68 to see if a break and hold of these levels can establish new support levels.

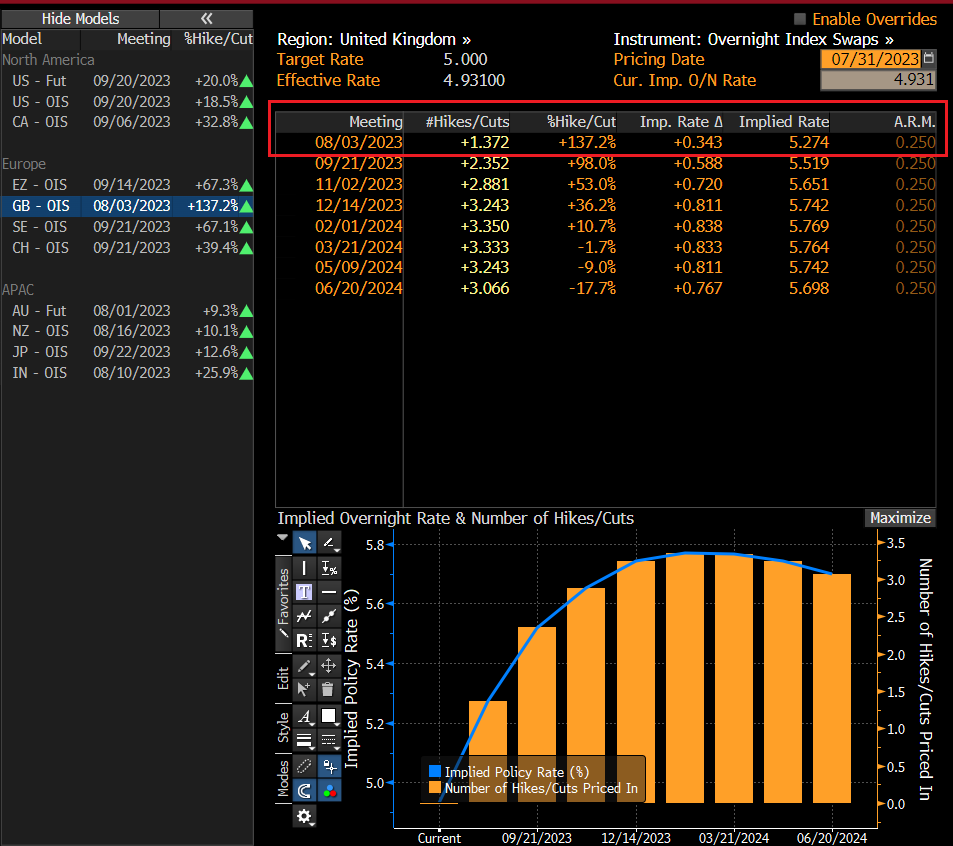

UK – BoE Monetary Policy Meeting

After some welcome news on UK inflation in the last two weeks, where CPI and PMIs showed a cooling of what has been red hot inflation in the UK, the pressure is off the BoE to repeat their June 50bp hike, with the market pricing in a 25bp hike as the likely outcome. Though rates futures are pricing in 34bp, which means they are expecting the 25bp to be a done deal, with around a 40% of a 50bp so 25bp is certainly not a given and some excess volatility in GBP should be expected over this.

Source:Bloomberg

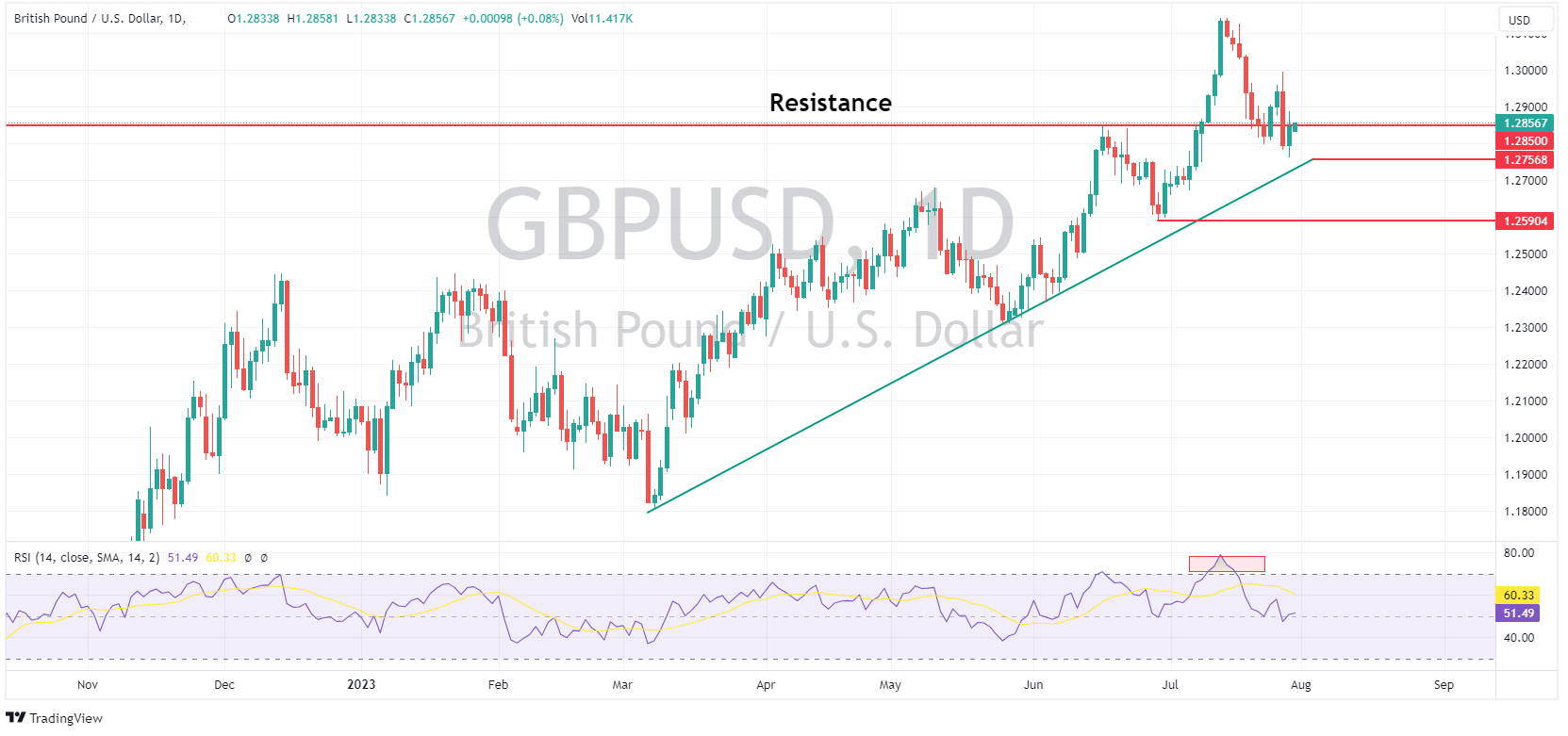

Chart to Watch

GBPUSD – Has had a strong run upwards since March as the BoE hawkish policy divergence with the Fed has supported interest rates and the Pound to recover some of the steep losses in 2022. GBPUSD has been in a classical technical uptrend since then, making higher highs and higher lows while holding a strong upward trendline. A recent break through the resistance level at 1.2850 saw Cable push to an extreme overbought level, before retracing to test the 1.2850 support and upward trendline. Levels to watch will be 1.2850 – whether it established itself as resistance or support, Trendline support at around 1.2756 and also the last cycle low of 1.2590, a break of this could confirm a new trend to the downside.

Besides the Central Bank meetings, traders have a pretty full calendar to look forward to, including US no-farm payrolls on Friday, full weeks calendar below:

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

FX Analysis – USD Catches a Bid, AUD outperforms ahead of RBA, JPY struggles

USD rallied modestly into month end with DXY pushing to the top of its recent range to again test the big 102 resistance level. The data highlight out of the US was the Chicago PMI figure which rose from the prior 41.5 to 42.8, but missing expectations of 43.3. in FedSpeak, Governor Goolsbee added little new from the FOMC statement last week st...

August 1, 2023

Read More >

Previous Article

FX analysis – USD up on rising yields, EUR down on dovish ECB, JPY surges ahead of BoJ

US equity markets snapped a record-breaking run of up sessions in Thursdays trading, with the Dow Jones looking set to close in the green for a 14th s...

July 28, 2023

Read More >