- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

US stocks choppy in a low volatility session ahead of pivotal CPI and FOMC minutes

12 April 2023US equities traded in tight ranges in a low volume session as traders remained cautious ahead of Wednesdays pivotal CPI figure out the US, followed by the release of FOMC minutes a few hours later.

Major indices eventually finished mixed with the defensive Dow and recently battered Russell 2000 finishing in the green, whilst the S&P500 and Nasdaq finished down as Tech stocks underperformed, with selling in cloud titans Microsoft (MSFT), Amazon (AMZN), and Google (GOOGL) after a UBS note saying street estimates for the sector are too high ahead of earnings.

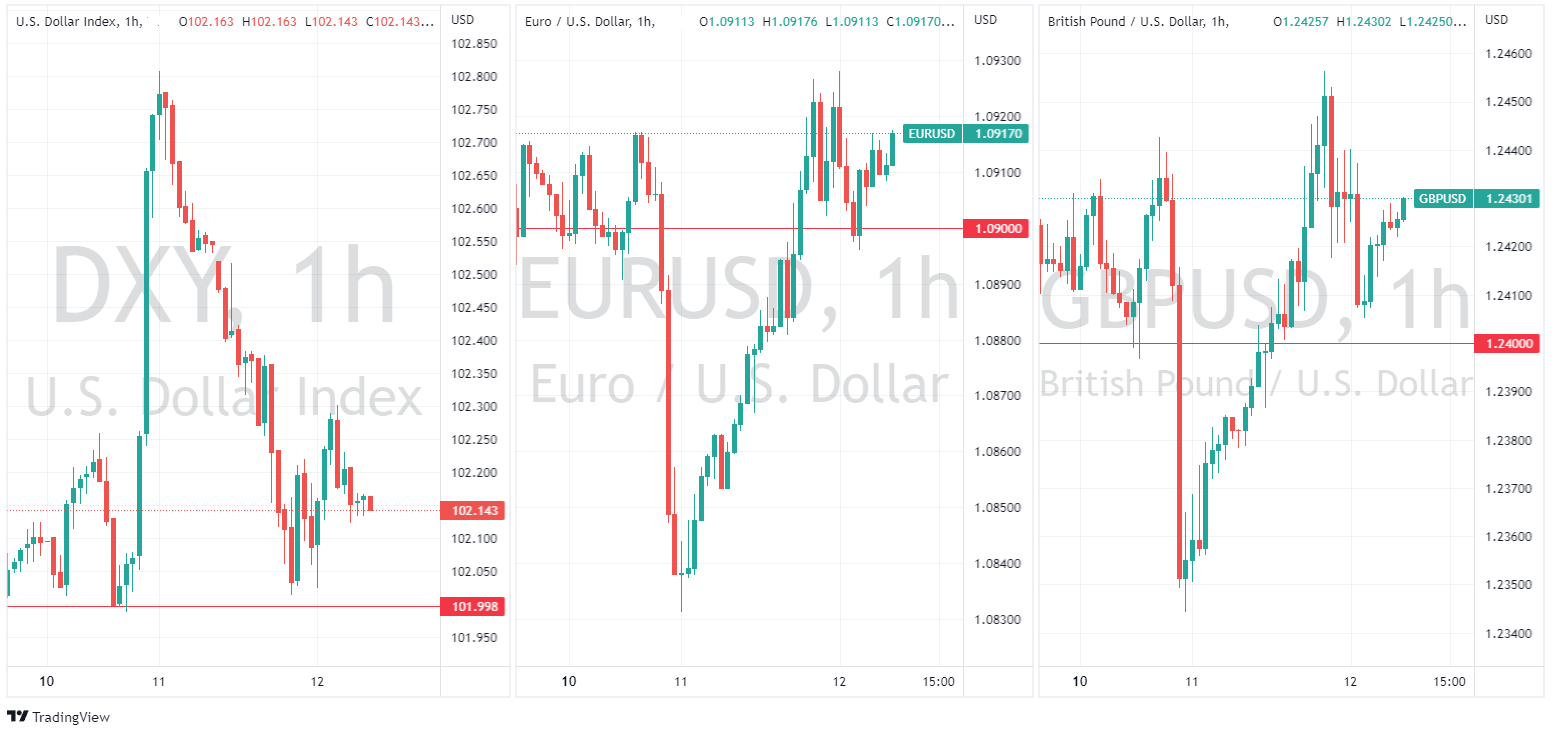

Forex markets saw the USD give back some of its post NFP gains , with the US Dollar Index falling to 102 before finding support and a small late session bounce.

Rising yields in the Eurozone saw the EURUSD regain the psychological 1.09 level and find support there, the GBPUSD had similar price action with the big 1..24 level, moving above and holding it as support.

Anitpodeans saw the AUD outperform, making gains against the Greenback and reclaiming 0.6650 after a strong beat in Australian consumer sentiment and rises in the NAB business confidence data. whilst the NZDUSD dropped below 0.62, AUDNZD surged past the 1.07, again showing that there is good value in this pair under that level.

The Yen also saw losses against the USD as yield differentials again were the main driver, the USDJPY pressing on the upper range and testing resistance at the top of its rising triangle pattern.

The battle of 2000 for Gold continued with XAUUSD regaining and whipsawing around that level as a weaker Dollar gave Gold price support, and rising bond yields caused a headwind for the precious metal. Though attention is starting to be focussed on Silver rising pretty much every day for the past month and seeing the Gold/Silver ratio drop below 80 for the first time since February

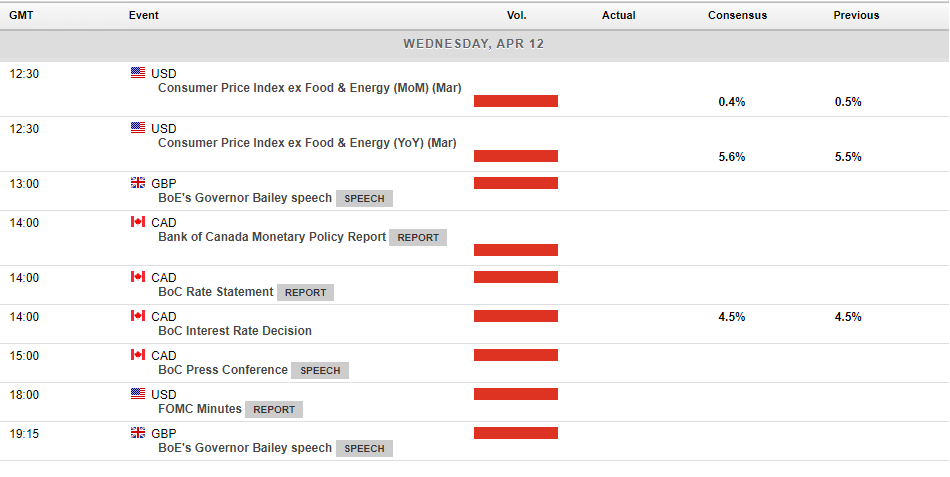

The Economic calendar really ramps up today after a slow start to the week with there not much chance we’re going to get another low volatility day today.

US CPI will start the show, with the markets still split on the result of the May FOMC meeting this figure will be closely watched and should see some nice moves in risk markets. We also have a Bank of Canada interest rate decision, followed by the release of the FOMC meeting minutes from their March meeting as the other main risk events.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

US Stocks give up gains on cool CPI as Fed minutes stoke recession fears

Major US stock indices slid in Wednesday’s session after a cooler than expected CPI figure gave them a boost only run out of steam and ultimately finish in the red after Fed minutes stoked recession fears. The Dow outperformed it’s peers, down around 38 points as investors continued to favour defensive stocks over more risk sensitive growth sto...

April 13, 2023

Read More >

Previous Article

Market Analysis 10-14 April 2023

XAUUSD Analysis 10 – 14 April 2023 The gold price outlook is positive in the medium term. As last week's closing of the buying bar was above ...

April 11, 2023

Read More >