- Accounts

- About

- Trading

- Platforms

- Tools

- News & education

- News & education

- News & analysis

- Education hub

- Economic calendar

News & Analysis

FX Analysis – USD weaker, AUD , NZD up on firm Yuan fix, JPY jawboning

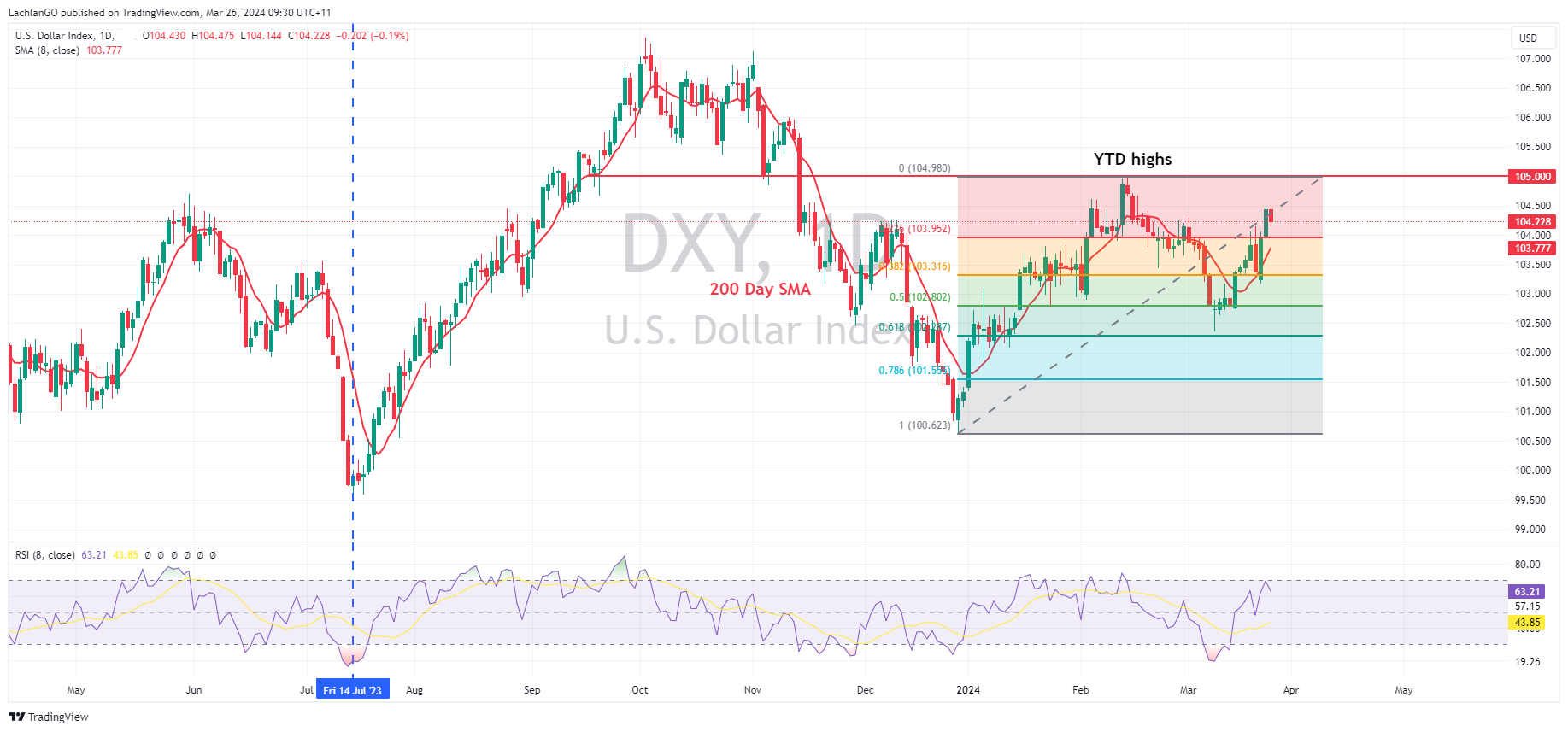

26 March 2024USD was slightly lower on Monday with DXY hitting a low of 104.140, holding above the 104 support level. News was light with only New Home Sales of any note, which missed modestly to the downside (662k vs the expected 675k). There was some Fed speak, the highlight being Fed hawk Bostic where he reiterated his desire of just one rate cut in 2024, this failed to make much impact on the Dollar though.

AUD and NZD saw gains to differing degrees against the USD with AUD outperforming, continuing the steep rally in AUDNZD to see the pair touching on 1.09 and firmly in overbought territory. Both AUD and NZD supported by the surprise Yuan fix by the PBoC that was much firmer than forecast. AUDUSD initially tested Friday’s low at 0.6510, before the fix and improving risk sentiment saw it reverse course to hit a high of 0.6546.

USDJPY was ultimately flat in a tight ranged session. Some more jawboning from top currency diplomat Kanda saying that the BoJ has been closely watching “FX moves with a high sense of urgency and will take appropriate steps to respond” saw the talk of intervention arise with Bank of America noting that intervention is seen as a ‘realistic option’ to support the Yen, especially if the USDJPY cross rises to the 152-155 zone.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Cintas exceeds estimates and raises guidance – the stock reaches a new all-time high

Q1 earnings season is nearly finished but there are still a few companies expected to release their latest results for the previous quarter. On Wednesday, Cintas Corporation (NASDAQ: CTAS) announced their latest financial results. American company that specializes in the manufacturing and sale of workwear and uniforms achieved revenue of $2.4...

March 28, 2024

Read More >

Previous Article

Accenture stock dips after earnings

Accenture plc (NYSE: ACN) announced Q2 of fiscal 2024 earnings results before the US market opened on Thursday. Irish-American professional service...

March 22, 2024

Read More >