- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Economic Updates

- US equities snap five day losing streak, Oil tumbles on recession fears

- Home

- News & Analysis

- Economic Updates

- US equities snap five day losing streak, Oil tumbles on recession fears

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS equities snap five day losing streak, Oil tumbles on recession fears

9 December 2022 By Lachlan MeakinUS equities rose in Thursday’s session in a subdued risk environment ahead that saw traders tiptoeing ahead of next week’s US CPI figures and FOMC meeting.

US indexes broke a five-day losing streak with the Nasdaq advancing 1.1% after having its worst first week of December since 1975 and being the best performer in the session.

It was another relatively quiet day for macro news but recessionary fears were re-ignited somewhat after US continuing unemployment claims jumped to a 10-month high with Bloomberg noting, “claims data is pointing to a recession as continuing claims are above their one-year low by a margin that has always preceded a slump.”

This recession-threatening jobs data saw crude oil crashing after an earlier rip higher on news the Keystone pipeline was shut down due to a leak (halting flows up to 600,000 b/d)

The US dollar drifted lower through the session with USDCAD testing support at 1.3560 before finding some buyers. CAD being helped along by a 50bp Hike from the Bank of Canada on Wednesday.

Bitcoin surged higher from the low of its recent range of 16500 – 17500, on the way to testing the top end which will be a critical level to see if the push higher in cryptos has any legs after recent controversies.

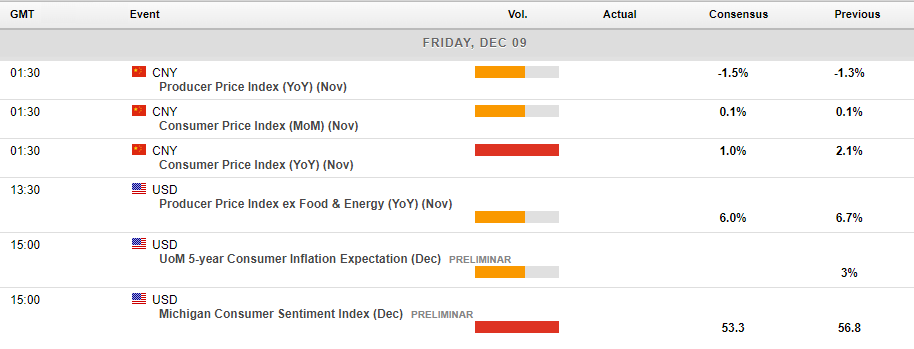

Todays economic calendar is fairly light again with CPI figures out of China expected to show a slight slowdown in inflation, out of the US we have consumer confidence, which may play into the recession them, and PPI figures.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Can the market ever be wrong?

The capital markets are complex, volatile, and dynamic. A collection of buyers, sellers, market makers and many other participants all working together to facilitate the transfer of assets between different parties. However, can the market ever be wrong What is ‘Getting it wrong?' It is often one of the first lessons a market participant lear...

December 9, 2022Read More >Previous Article

Oil continues to fall amid news of price cap

The primary reason for the drop in price is the economic slowdown that has become prevalent in the global market. As fears of a recession continue to ...

December 8, 2022Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.