- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Volume rebates

- Open account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- MetaTrader copy trader

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- PAMM

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & Analysis

- Forex

- FX analysis – USDJPY – Yield differentials pushing this pair higher

- Home

- News & Analysis

- Forex

- FX analysis – USDJPY – Yield differentials pushing this pair higher

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisFX analysis – USDJPY – Yield differentials pushing this pair higher

11 April 2023 By Lachlan MeakinUSDJPY

The USDJPY is on the march higher again after a better than expected Non-Farm payroll figure on Friday saw sentiment shift hawkishly toward Fed monetary policy with Fed fund futures now pricing in a 70% chance of a 25bp hike at the FOMC May meeting, up from around a 50-50 split earlier in the week.

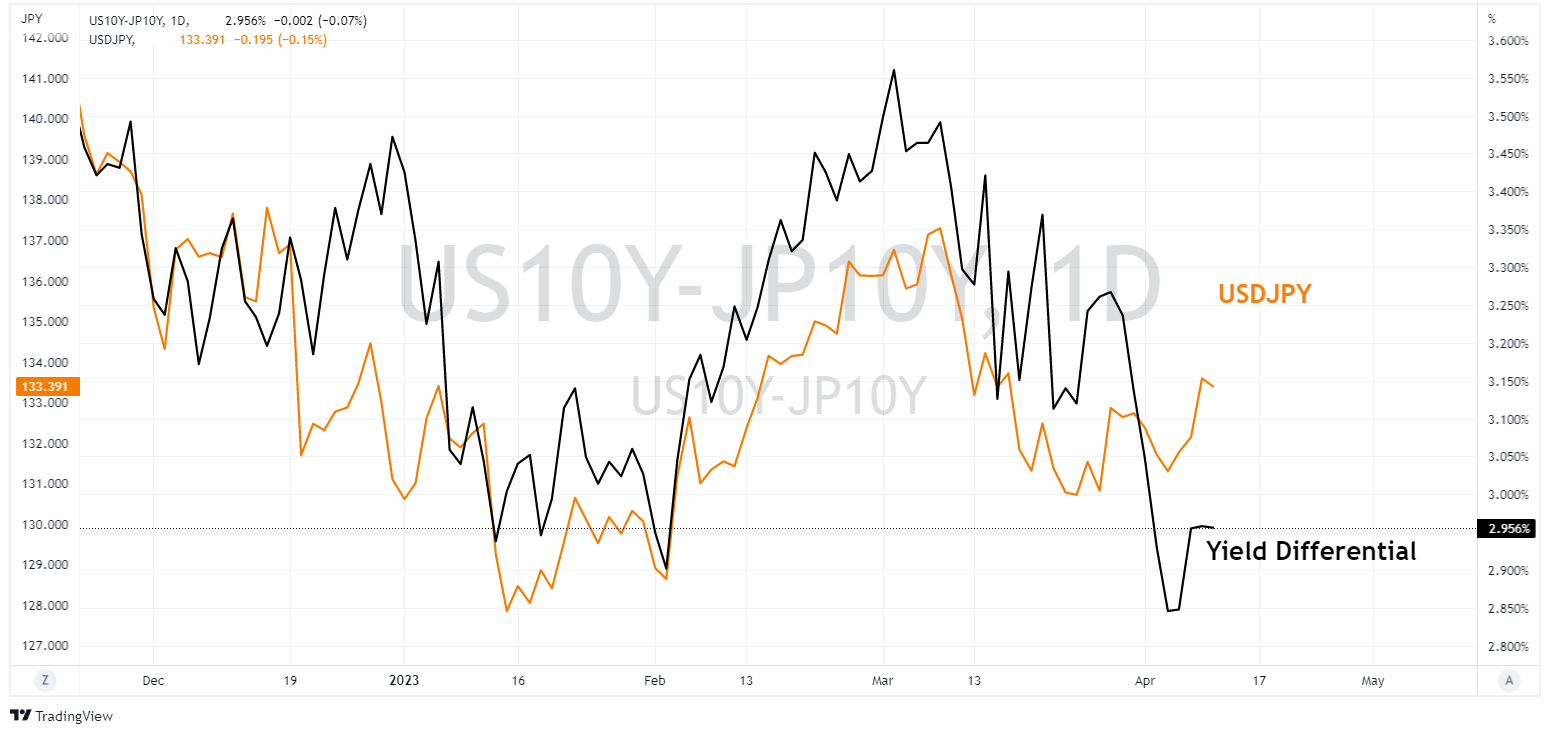

The policy divergence in the US and Japan and the subsequent yield differentials on their respective 10 year government bonds has been the main driver of this pair in the last 12 months. You can see the close relationship of this in the chart below. The black line is the difference between 10 year yields on US 10 years – Japanese 10 year years, the orange line, the USDJPY rate.

As the US yields increase their gap to their Japanese counterparts, the USDJPY will be pressured upwards as traders look for low risk carry trades. The Yen was also not helped recently by comments from the new incoming governor of the BoJ that indicated that any change to the current dovish policy was not imminent.

Key levels to watch

USDJPY has been forming a textbook uptrend since late March. With the upward trend line tested and holding as support on a handful of occasions, a resistance level of 133.85 has so far held any further upside, but is looking vulnerable.

Ways to trade this are

1, Playing the range, buying low at the trendline, selling high at the resistance level. Though whilst the uptrend is in place the more cautious approach would be to stick to buys.

2, Waiting for a break of these levels for the next push. The longer this takes, and the tighter the range gets the more explosive this move could be.

While economic announcements out of Japan are very light on the ground this week, The US will be releasing both CPI and PPI figures, how these inflation figures look will have a measurable effect on market sentiment towards Federal Reserve policy and will almost certainly see some big moves in the USD and rates markets, so the break of this range may come as early as tomorrow night.

Ready to start trading?

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice. If the advice relates to acquiring a particular financial product, you should obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) for that product before making any decisions.

Next Article

Market Analysis 10-14 April 2023

XAUUSD Analysis 10 – 14 April 2023 The gold price outlook is positive in the medium term. As last week's closing of the buying bar was above the 1960 support or the latest high in price on the Weekly timeframe, it indicates continued buying momentum that will allow the price of gold to recover. It can rise further to test the 2070 resistan...

April 11, 2023Read More >Previous Article

RBA leaves cash rate unchanged but leaves the door open for future hikes if needed

After 10 hikes on the trot and what will no doubt be a relief for mortgage holders the RBA held the official cash rate at 3.60%. The rate decision was...

April 4, 2023Read More >News and Analysis

Join our mailing list to receive market news and monthly newsletters, delivered directly to our inbox.