Go further with GO Markets

Trade smarter with a trusted global broker. Low spreads, fast execution, powerful platforms, and award-winning customer support.

20 Years Strong

Celebrating 20 years of trading excellence.

Built for traders since 2006.

For beginners

Just getting

started?

Explore the basics and build your confidence.

For intermediate traders

Take your

strategy further

Access advanced tools for deeper insights than ever before.

Professionals

For professional

traders

Discover our dedicated offering for high-volume traders and sophisticated investors.

Get Started with GO Markets

Whether you’re new to markets or trading full time, GO Markets has an

account tailored to your needs.

Trusted by traders worldwide

Since 2006, GO Markets has helped hundreds of thousands of traders to pursue their trading goals with confidence and precision, supported by robust regulation, client-first service, and award-winning education.

*Trustpilot reviews are provided for the GO Markets group of companies and not exclusively for GO Markets Ltd.

*Awards were awarded to GO Markets group of companies and not exclusively to GO Markets Ltd.

Explore more from GO Markets

Platforms & tools

Trading accounts with seamless technology, award-winning client support, and easy access to flexible funding options.

Accounts & pricing

Compare account types, view spreads, and choose the option that fits your goals.

Go further with

GO Markets.

Explore thousands of tradable opportunities with institutional-grade tools, seamless execution, and award winning support. Opening an account is quick and easy.

Go further with

GO Markets.

Explore thousands of tradable opportunities with institutional-grade tools, seamless execution, and award winning support. Opening an account is quick and easy.

US inflation data on Wednesday is the week's centrepiece, but with oil nearing seven-month highs, Bitcoin (BTC) sentiment shifting, and the Australian dollar at three-year highs, traders have plenty to navigate in the week ahead.

Quick Facts

- US inflation rate (February) is the key binary event for rate cut pricing and equity direction.

- Brent crude is trading around US$82–84/bbl, near seven-month highs, with a $4–$10 geopolitical risk premium baked in from Iran/Hormuz tensions.

- Bitcoin is trading above US$70,000 as of 6 March, a potential trend change if it holds through the week.

United States: inflation in focus

Last month’s US inflation reading showed prices rising 2.4% year-on-year, still well above the Fed's 2% target.

February's inflation rate, due Wednesday, will be scrutinised for signs that tariff pass-through or rising energy costs are pushing prices back up, or whether the slow grind lower is still intact.

The March FOMC meeting on 17–18 March is now priced at only an 4.7% probability of a cut. A higher-than-expected inflation print this week could potentially push rate cut expectations further out.

A softer read opens the door to renewed cut pricing and potential relief across risk assets.

Key Dates

- US Inflation Rate (February CPI): Wednesday 11 March, 12:30 am (AEDT)

Monitor

- Core vs. headline inflation divergence as evidence of tariff pass-through in goods prices.

- 2-year and 10-year treasury yield sensitivity to the print.

- USD direction and FedWatch repricing in the lead up to the 18 March FOMC decision.

Oil: elevated and event-sensitive

Brent is currently trading around US$83–85 per barrel, with a 52-week range spanning $58.40 to $85.12, reflecting the dramatic move triggered by the Middle East conflict.

Analysts estimate the geopolitical risk premium already baked into oil at US$4–$10 per barrel, and average 2026 Brent forecasts have been lifted to US$63.85/bbl, up from US$62.02 in January.

The EIA's Short-Term Energy Outlook forecasts Brent to average $58/bbl in 2026, well below the current spot price.

The gap between spot and the forecast baseline could be a useful frame for traders this week: any de-escalation signal from the Middle East could rapidly close that gap.

Monitor

- Strait of Hormuz developments and any diplomatic signals from Iran nuclear talks.

- EIA weekly oil inventory data.

- Oil's knock-on to inflation expectations and whether it shifts central bank posture.

- Energy sector equity performance relative to the broader market.

Bitcoin: sentiment watch

BTC has been attempting to stabilise after a brutal 53% correction over the past 17 weeks, fuelled by escalating geopolitical tensions and renewed tariff concerns.

However, yesterday saw a 8% jump back above $72,000, and the crypto “fear and greed index” jumped up to 29 (fear), up from below 20 (extreme fear), where it has been sitting for over a month, indicating a potential sentiment shift.

A cooler-than-expected US inflation print on Wednesday could provide further fuel for the breakout; a hot print risks potentially pulling BTC back below the US$70,000 level it has just reclaimed.

Monitor

- Inflation print reaction on Wednesday as the primary macro catalyst for the move.

- Any rotation into altcoins following BTC strength.

- ETF inflow/outflow data as confirmation of institutional participation.

AUD/USD: Hawkish RBA meets geopolitical crosswinds

The Aussie is trading near more than three-year highs and heading for its fourth consecutive monthly gain, up more than 6% year-to-date, making it the top-performing G10 currency in 2026.

The driver is a clear policy divergence. RBA Governor Michele Bullock signalled the March policy meeting is "live" for a possible rate increase, and warned that an oil price shock from Iran tensions could reignite domestic inflationary pressures.

Market pricing now suggests around a 28% chance of a 25bp hike at the upcoming meeting, while fully pricing in tightening through May, and around a 75% chance of another increase to 4.35% by year-end.

This hawkish read, set against a Fed on hold and facing dovish political pressure, creates a potential structural tailwind for the Aussie.

Monitor

- AUD/USD reaction to Wednesday's US inflation data.

- RBA rate hike probability repricing through the week.

- Iron ore and commodity prices as secondary AUD drivers.

- China demand signals, given Australia's export exposure.

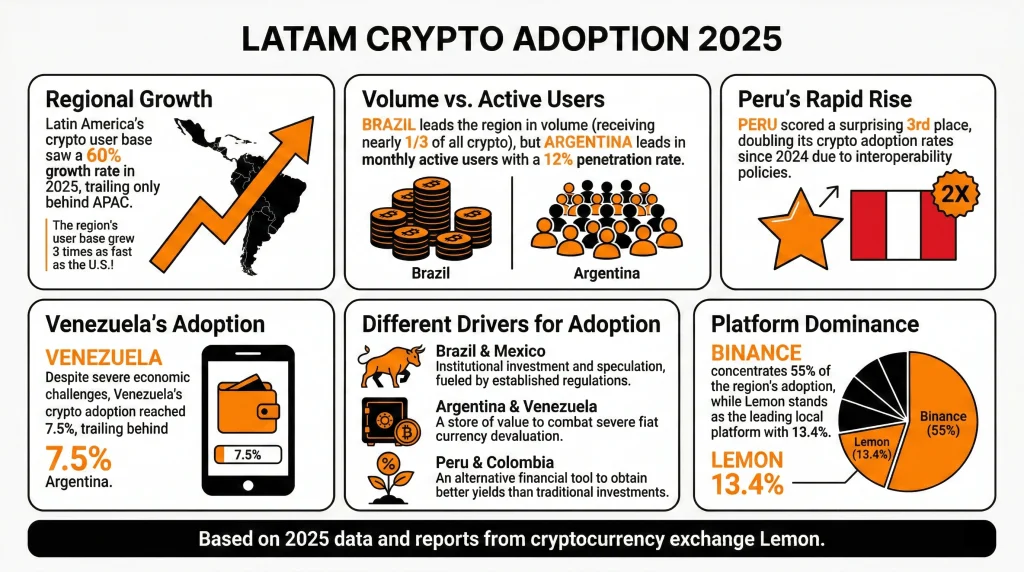

Latin America (LATAM) saw over $730 billion in crypto volume in 2025, a 60% year-on-year surge that made the region responsible for roughly 10% of global crypto activity.

In 2026, institutional players are starting to take the region seriously, regulation is crystallising, and the structural drivers from 2025 show no sign of fading. But the region is not a single story, and 2026 will test whether the current momentum is built on solid fundamentals or speculative optimism.

Quick facts

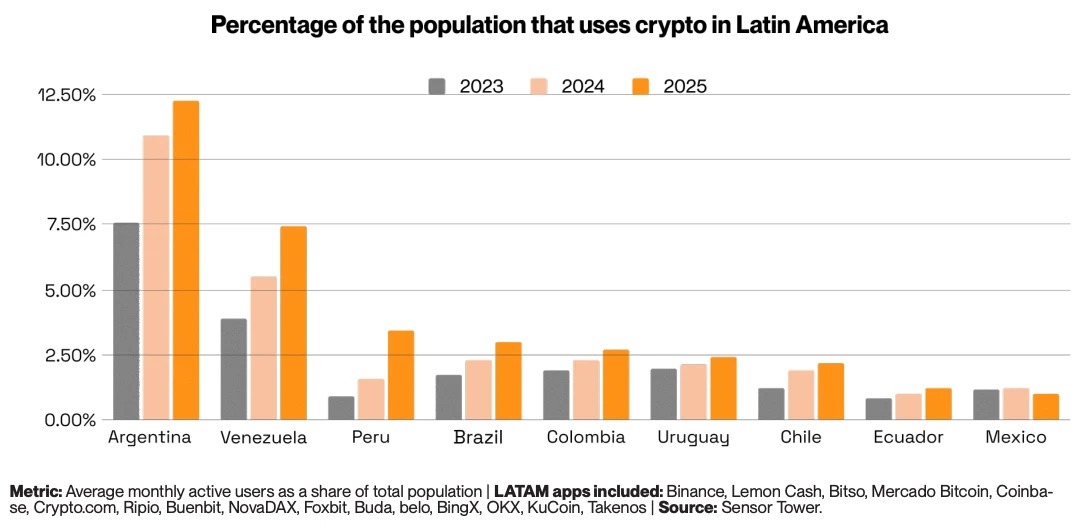

- LATAM monthly active crypto users grew 18% year-on-year (YoY), three times faster than the US.

- Argentina reached 12% monthly active user penetration, accounting for over a quarter of the region's crypto activity.

- Over 90% of Brazilian crypto flows are now stablecoin-related.

- Three LATAM countries rank in the global top 20: Brazil (5th), Venezuela (18th), Argentina (20th).

- Peru's crypto app downloads grew 50% in 2025, with 2.9 million downloads.

From survival tool to financial infrastructure

Latin America did not embrace cryptocurrency because of speculation. It embraced it because traditional financial systems repeatedly failed ordinary people. Over the past 15 years, average annual inflation across the region's five largest economies ran at 13%, compared to just 2.3% in the US over the same period.

In Venezuela, it reached 65,000% in a single year. In Argentina, it exceeded 220% in 2024. For millions of people, holding savings in local currency was a slow act of self-destruction. Stablecoins became the natural response. Digital assets pegged to the US dollar offered a reliable store of value, borderless transferability, and access without a bank account.

Unlike in the West, where crypto is seen more as a speculative instrument, in LATAM it has become a necessary financial tool. However, adoption drivers are not entirely uniform across the region. Brazil and Mexico are institutional stories, driven by regulated market participation and established financial players.

Argentina and Venezuela remain store-of-value plays, with crypto serving as a direct hedge against fiat collapse. And Peru and Colombia are more yield-seeking markets, where crypto offers returns that traditional savings accounts cannot match.

How fast is LATAM adopting crypto?

LATAM’s on-chain crypto volume rose 60% year-on-year in 2025. The region has recorded nearly $1.5 trillion in cumulative volume since mid-2022, peaking at a record $87.7 billion in a single month in December 2024.

Monthly active crypto users across LATAM also grew 18% in 2025, three times faster than the US.

Stablecoins are the primary vehicle driving this adoption. Of the $730 billion received in 2025, $324 billion moved through stablecoin transactions, an 89% year-on-year surge. In Brazil, over 90% of all crypto flows are stablecoin-related, and in Argentina, stablecoins account for over 60% of activity.

Looking ahead, the Latin America cryptocurrency market is forecast to reach $442.6 billion by 2033, growing at a compound annual rate of 10.93% from 2025, according to IMARC Group.

For traders, the speed of adoption matters less as a headline than what is driving it: a region of 650 million people building parallel financial infrastructure in real time, with stablecoins as the foundation.

LATAM crypto by the numbers

Total on-chain crypto volume received across LATAM in 2025 (~10% of global total)

LATAM stablecoin transaction volume in 2025, reflecting surging demand for dollar-pegged assets

Of all LATAM on-chain volume received by Brazil in 2025, making it the region's dominant crypto market

Annual remittance flows across Latin America, with an increasingly large share now settled in stablecoins

The institutional turn

For most of LATAM’s crypto history, adoption was bottom-up. Unbanked or underbanked retail users drove volumes through local exchanges. That picture is now changing at the top end of the market.

In February 2026, Crypto Finance Group, part of the leading global exchange operator Deutsche Börse Group, announced its expansion into Latin America, targeting banks, asset managers, and financial intermediaries seeking institutional-grade custody and trading infrastructure.

Traditional banks and fintechs are following suit. Nubank now rewards customers for holding USDC. Brazil's B3 exchange approved the world's first spot XRP and SOL ETFs, ahead of the US, in 2025. Centralised exchanges, including Mercado Bitcoin, NovaDAX, and Binance, have collectively listed over 200 new BRL-denominated trading pairs since early 2024.

In March 2025, Brazilian fintech Meliuz became the first publicly traded company in the country to launch a Bitcoin accumulation strategy, now holding 320 BTC.

“Crypto adoption in LatAm is already global-scale. What the market needs now is institutional-grade governance, and that’s exactly why we’re here,” — Stijn Vander Straeten, CEO of Crypto Finance Group

Crypto remittance use case

Latin America receives hundreds of billions of dollars annually from workers abroad, making remittances one of the most concrete and measurable crypto use cases in the region. Traditional transfer services charge an average of 6.2% per transaction. On a US$300 transfer, that is roughly US$20 in fees.

Blockchain-based infrastructure more broadly offers dramatic fee reductions. Bitcoin brings costs to around US$3.12 per US$100 transferred. While cheaper alternatives like XRP or Ethereum layer-2 infrastructure can reduce that to less than US$0.01.

For a migrant worker sending US$1,500 home to Peru, switching from a legacy bank saves more than the average Peruvian weekly wage in fees alone.

LATAM’s crypto regulatory environment

The variable that will most determine whether LATAM lives up to its 2026 potential is crypto regulation. And here, the picture is genuinely mixed.

Brazil leads the region with its Virtual Assets Law, which covers asset segregation, VASP licensing, AML/KYC requirements, and capital standards. It also implemented the Travel Rule for domestic VASP transfers, which came into force in February 2026. However, some more controversial proposals, including a US$100,000 cap on cross-border stablecoin transactions and a ban on self-custody wallet transfers, remain under active consultation.

Mexico's 2018 Fintech Law remains one of the world's earliest formal recognitions of virtual assets. Chile's 2023 Fintech Law established licences for exchanges, wallets, and stablecoin issuers, formally recognising digital assets as 'digital money.'

Bolivia reversed a decade-long crypto ban in June 2024 by authorising regulated digital asset transactions. Argentina introduced mandatory exchange registration in 2025. And El Salvador continues to expand tokenised economic initiatives despite removing Bitcoin's legal tender status.

Ten countries across the region now have formal crypto frameworks of some kind. But for traders, regulatory divergence remains a live risk, and given Brazil receiving nearly one-third of all LATAM crypto volume, any significant policy reversal there could have outsized consequences.

What traders should watch

Brazil's institutional momentum is the most significant structural trend. With $318.8 billion in on-chain volume in 2025, Brazil effectively is the LATAM market.

The outcome of the Brazil stablecoin consultation could have a big influence. A restriction on foreign stablecoins in domestic payments would directly impact the most traded asset class in the region's dominant market.

Argentina is the volatility play. Monthly active user penetration of 12% and 5.4 million crypto app downloads in 2025 signal deep and growing retail engagement.

Colombia is an early-warning market to watch. The peso's 5.3% depreciation in 2025 and deepening fiscal crisis are driving stablecoin inflows in a pattern that mirrors Argentina's trajectory in earlier years. If Colombia's macro situation deteriorates further, crypto adoption could accelerate.

There is also an exchange concentration risk at play. Binance crypto exchange is the primary exchange for over 50% of LATAM crypto users. If the exchange faces any regulatory action, operational disruption, or competitive shock, it could have an outsized market impact.

Bottom line

Latin America's crypto market has entered a new phase. The structural drivers that caused initial crypto-demand in the region have not gone away: inflation, remittances, financial exclusion, and currency instability are all still at play.

What has changed is the layer being built on top of them. Institutional infrastructure, regulatory frameworks, corporate treasury adoption, and global exchange capital flowing into a region that was, until recently, largely self-contained.

Brazil's near-250% volume growth in 2025 and its position receiving nearly one-third of all LATAM crypto are the defining market developments. Its regulatory trajectory, stablecoin policy decisions, and ETF pipeline will effectively set the tone for the region in 2026.

For traders, the headline growth figures are real, but so are the concentration risks, regulatory uncertainties, and country-level divergences that sit beneath them.

On February 28, 2026, as the joint US and Israeli attack began, the numbers on the screens started moving in ways that felt clinical, even as the reality on the ground with the tragic deaths of civilian casualties in Iran, felt anything but. Markets, as they say, do not have a moral compass, rather they have a weighing machine and right now, they are weighing the transition of the entire global economy from a "just-in-time" model to a "just-in-case" cycle.

What markets were signalling

On March 2, the index tape stayed cautious while defence rose. Historically, conflicts can speed up restocking and orders but how big it gets (and how fast) still depends on budgets, approvals and delivery bottlenecks.

The Winners

1. Hanwha Aerospace (012450.KS)

Hanwha is one of the more actively traded names linked to the “K-Defence” theme, a company markets increasingly view as a scalable supplier into a tightening global artillery and munitions cycle. Capacity and delivery credibility.

When replenishment becomes urgent, the ability to produce at scale often matters as much as the platform itself. Export demand tied to systems like the K9 Thunder and Chunmoo has reinforced the narrative of durable order flow even when outcomes still hinge on budgets, approvals and delivery timelines.

Key things that can move sentiment: order-book updates, production cadence, and any follow-on export announcements.

2. Northrop Grumman (NOC)

Northrop moved into focus as investors repriced exposure to strategic modernisation and large, long-running programs. Defence markets often seen as mission-critical can persist across cycles. It’s less about one quarter and more about whether momentum stays steady if modernisation priorities remain in place (and whether timelines shift if they don’t).

Key variables that can move sentiment: Procurement pace, contract timing, and program-related funding language.

3. RTX Corporation (RTX)

RTX returned to the centre of the tape as investors priced an interceptor replenishment cycle and the economics of high-tempo air defence. Attrition is expensive and when usage rates rise, governments typically have to replenish inventories and, in many cases, fund production expansion which can extend backlog and lift revenue visibility.

Key variables that can move sentiment: Replenishment orders, manufacturing expansion indicators, and delivery throughput.

4. Lockheed Martin (LMT)

Lockheed drew attention as markets focused on missile-defence demand and the question every procurement desk faces in a high-tempo environment: how fast can inventories be rebuilt? If utilisation stays elevated, the winners tend to be the contractors best positioned to scale production and deliver reliably. Lockheed’s missile defence exposure keeps it closely tied to that replenishment narrative.

Key variables that can move sentiment: production ramp signals, unit economics, and budget-driven order cadence.

5. BAE Systems (BA.L)

With an £83.6 billion backlog and a central role in the AUKUS submarine program, BAE moved into focus as parts of Europe signalled higher defence spending ambitions. The stock rose 6.11% to a 52-week high amid a “risk-off” rotation, with traders watching AUKUS milestones and European air and missile defence procurement, including “Sky Shield”.

Key variables that can move sentiment: A potential catalyst is any clear step-up in German spending that lifts order flow across BAE’s European units, while key risks include a sharp spike in UK gilt yields, renewed pound sterling volatility, or “threat of peace” profit-taking.

The Losers: not every ‘war stock’ rises

6. AeroVironment (AVAV)

AeroVironment surged 18% at the open before falling 17% intraday after reports that the US Space Force was reopening a US$1.4 billion contract. The move highlights how procurement processes and contract risk can drive volatility, even in supportive thematic environments.

7. Kratos Defence (KTOS)

Kratos sits in the drone and loitering munition theme that gained attention as the Middle East conflict intensified. The stock still sold off after earnings, highlighting a common defence-sector risk. Kratos announced a large follow-on equity offering in the US$1.2 billion to US$1.4 billion range, the move strengthens the balance sheet and can support future program investment.

For traders focused on short-term “conflict premium” narratives, dilution can quickly change the setup. Even when demand conditions appear supportive, the market may reprice the stock if each shareholder ultimately owns a smaller portion of the business.

8. Intuitive Machines (LUNR)

Some speculative space-tech names lagged as investors appeared to favour companies with more established defence-linked revenue.

9. Boeing (BA)

Boeing was down around 2.5% on the session. While its defence division is meaningful, its commercial business can be more sensitive to aviation demand, airspace disruptions and oil-price moves.

10. Spirit AeroSystems (SPR)

Spirit AeroSystems remains closely tied to the global aircraft production cycle as a major aerostructures supplier. Recent results showed widening losses despite higher sales, reflecting ongoing production cost increases on major aircraft programs. These pressures have weighed on investor confidence in the near-term outlook. The planned acquisition by Boeing may ultimately reshape the company’s position in the supply chain, but execution risk and production stability remain central to how the market prices the stock.

What to watch next

- Escalation vs de-escalation: A shift toward diplomacy or ceasefire discussions can quickly change sentiment around defence stocks.

- Oil and shipping: Energy spikes can tighten financial conditions and pressure cyclical sectors.

- Budgets and awards: Price moves can sometimes precede contract decisions, with clarity arriving when awards are finalised.

- Production capacity: Companies with proven production and delivery track records often attract the most investor attention.

- Supply chain constraints: Rare earths, propulsion and electronics remain potential bottlenecks that can limit how quickly production scales.

The longer term lens

The 2026 Iran conflict is first and foremost a human tragedy. For markets, it may also represent a shift in how national security spending is prioritised within fiscal frameworks. If defence spending remains elevated over a multi year horizon, companies with scalable manufacturing capacity and integrated technology stacks could attract sustained investor attention. That said, markets move in cycles. Structural themes can persist, but they can also reprice quickly when assumptions change. Staying analytical and risk aware remains critical.

References to specific companies, sectors or market movements are provided for general market commentary only and do not constitute a recommendation, offer or solicitation to buy or sell any financial product.Market reactions to geopolitical or macroeconomic events can be volatile and unpredictable, and outcomes may differ materially from expectations.