- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- CFD Trading

- CFD Trading

- CFD Markets

- CFD Markets

- CFD products overview

- Forex CFDs

- Commodity CFDs

- Metal CFDs

- Index CFDs

- Share CFDs

- Cryptocurrency CFDs

- Treasury CFDs

- ETF CFDs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Platforms & tools

- Platforms & tools

- Platforms

- Platforms

- Platforms overview

- TradingView

- GO TradeX™

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- VPS

- Genesis

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Earnings announcements

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Holiday trading hours

- Maintenance schedule

- Fraud and scam awareness

- Legal documents

- Home

- News & analysis

- Shares and Indices

- Netflix Q1 numbers are in

News & analysisNetflix reported their Q1 earnings after the closing bell on Tuesday.

The online streaming service reported total revenue of $7.16 billion in Q1 beating analyst forecast of $5.77 billion. Earnings per share were reported at $3.75 vs. $2.98 estimate.

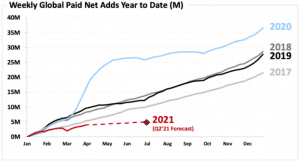

With both revenue and earnings per share higher than analysts’ expectations, the new paid subscriber additions came in way below analysts’ forecast of 6.29 million – at 3.98 million. The latest dip in new additions could be the beginning of a further slowdown in new subscribers as lockdown eases around the world and people return to normality.

”Revenue grew 24% year over year and was in line with our beginning of quarter forecast while operating profit and margin reached all-time highs. We finished Q1’21 with 208m paid memberships, up 14% year over year, but below our guidance forecast of 210m paid memberships. We believe paid membership growth slowed due to the big Covid-19 pull forward in 2020 and a lighter content slate in the first half of this year, due to Covid-19 production delays. We continue to anticipate a strong second half with the return of new seasons of some of our biggest hits and an exciting film lineup. In the short-term, there is some uncertainty from Covid-19; in the long-term, the rise of streaming to replace linear TV around the world is the clear trend in entertainment,” Netflix said in a letter to investors following the announcement.

Shares of Netflix was down by around 9% in post-market on Tuesday following the latest numbers, down at $495 per share after ending the trading day a $549.57 per share.

Netflix

Source: TradingView

You can trade Netflix (NFLX) and many other stocks from the NYSE, NASDAQ and the ASX with GO Markets as a Share CFD. Click here for more information. Trading Derivatives carries a high level of risk.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Intel reports Q1 earnings

Intel, the US technology giant reported its Q1 earnings after the closing bell on Thursday. The company reported revenue of $18.57 billion, above analyst forecast of $17.90 billion. Earnings per share were at $1.39, also beating analyst expectations of $1.15 per share. Intel’s data-centre group revenue fell by over 20% year-over-year to $5....

April 23, 2021Read More >Previous Article

European and US markets hit all time highs, Bitcoin breaks out, the Dollar slides

Equity markets US stocks jumped overnight to reach record levels as stronger than expected print on retail sales and a sharp improvement in the numbe...

April 16, 2021Read More >Please share your location to continue.

Check our help guide for more info.