Noticias del mercado & perspectivas

Anticípate a los mercados con perspectivas de expertos, noticias y análisis técnico para guiar tus decisiones de trading.

La volatilidad no discrimina. Pero puede castigar a los no preparados.

Detiene ser golpeado en movimientos que se invierten en cuestión de minutos. Las primas en opciones de fecha corta están subiendo. Y el yen ya no se comportaba como el seto confiable que alguna vez fue.

Para los comerciantes de toda Asia, navegar por este entorno significa hacer preguntas más difíciles sobre el riesgo, el tiempo y las suposiciones incorporadas en estrategias creadas para mercados más tranquilos.

1. ¿Cómo puedo operar con CFDs VIX durante un choque geopolítico?

El Índice de Volatilidad CBOE (VIX) mide la expectativa del mercado de volatilidad implícita a 30 días en el S&P 500. A menudo se le llama el “indicador del miedo”. Durante los choques geopolíticos como las actuales escaladas de Irán, los anuncios de sanciones y las acciones sorpresa de los bancos centrales, el VIX puede repuntar bruscamente y rápidamente.

¿Qué hace que los CFDs de VIX sean diferentes en un shock?

VIX en sí no es comercializable directamente. Los CFD de VIX suelen tener un precio de los futuros de VIX, lo que significa que tienen un arrastre de contango en condiciones normales.

Durante un choque geopolítico, varias cosas pueden suceder a la vez

- El Spot VIX puede repuntar inmediatamente mientras que los futuros a corto plazo se quedan rezagados, creando una desconexión.

- Los diferenciales de los CFDs de VIX pueden ampliarse significativamente a medida que disminuye la liquidez.

- Los requerimientos de margen pueden cambiar intradiamente a medida que se ajustan los modelos de riesgo de los brókers.

- VIX tiende a la reversión promedio después de los picos, por lo que el tiempo y la duración son críticos.

Lo que esto significa para los comerciantes de horas asiáticas

Las horas del mercado asiático significan que muchos eventos geopolíticos pueden romperse mientras los comerciantes locales están activos o apenas comienzan su sesión.

Una conmoción que golpea durante las horas de Tokio ya podría estar cotizada en futuros de VIX antes de la apertura de Sydney.

Algunos operadores utilizan las posiciones VIX CFD como una cobertura a corto plazo contra las carteras de acciones en lugar de una operación direccional. Otros negocian la reversión (el retroceso hacia promedios históricos una vez que el pico inicial se desvanece). Ambos enfoques conllevan riesgos distintos, y ninguno garantiza un resultado específico.

2. ¿Por qué mis primas de opciones 0DTE son tan caras en este momento?

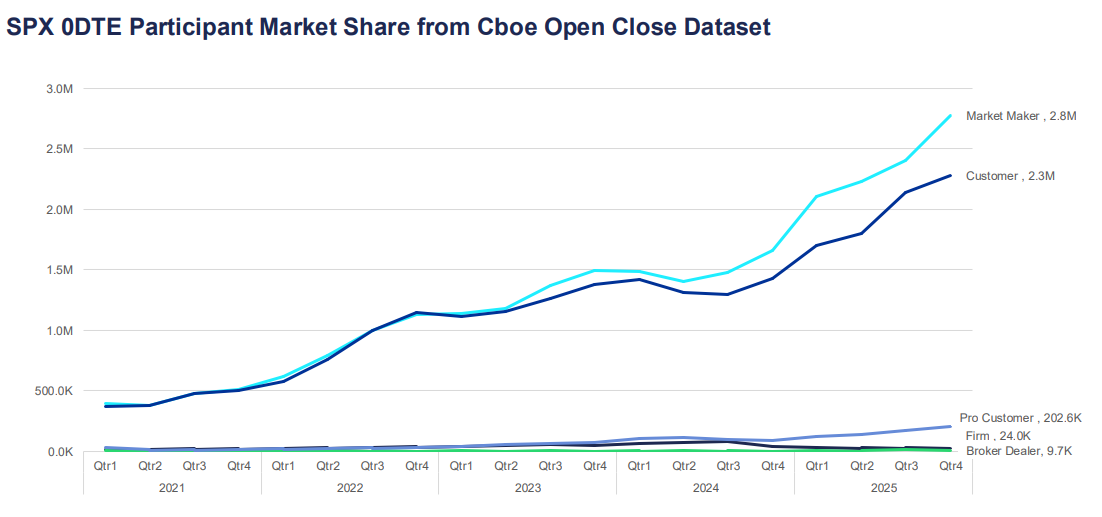

Las opciones de cero días hasta el vencimiento (0DTE) expiran el mismo día en que se negocian. Se han convertido en uno de los segmentos de más rápido crecimiento del mercado de opciones, representando ahora más del 57% del volumen diario de opciones del S&P 500 según datos de mercados globales de Cboe.

Para los participantes con sede en Asia que acceden a los mercados de opciones de Estados Unidos, las primas elevadas durante períodos volátiles pueden sentirse como un mal precio, pero por lo general reflejan factores estructurales de precios.

¿Por qué las primas se repuntan?

El precio de las opciones está impulsado por el valor intrínseco y el valor de tiempo. Para las opciones 0DTE, casi no queda valor de tiempo, lo que podría sugerir que deberían ser baratas pero el componente implícito de volatilidad compensa eso.

Cuando aumenta la incertidumbre, los vendedores pueden exigir una mayor compensación por el riesgo de movimientos intradía brusca.

Esto puede reflejarse en

- Insumos de mayor volatilidad implícita.

- Mayor margen de puda-tarea.

- Ajustes más rápidos en cobertura delta y gamma.

En entornos de VIX más alto, los flujos de cobertura pueden contribuir a los bucles de retroalimentación a corto plazo en el índice subyacente. Esto puede amplificar las oscilaciones de precios, particularmente en torno a niveles clave.

Lo que esto significa para los comerciantes de horas asiáticas

Muchos contratos de opciones 0DTE ven sus flujos de precios y cobertura más activos durante las horas de negociación de EE. UU. Ingresar posiciones durante la sesión asiática puede significar enfrentar precios obsoletos o diferenciales más amplios.

Si está viendo primas costosas, puede reflejar que el mercado esté valorando con precisión el riesgo de una mudanza grande el mismo día. Si vale la pena pagar esa prima depende de su visión del rango intradiario probable y su tolerancia al riesgo, no solo de la cifra absoluta en dólares.

3. ¿Cómo ajusto mi bot de trading algorítmico para un entorno con alto nivel de VIX?

Muchos sistemas de comercio algorítmico se basan en parámetros calibrados durante regímenes de baja volatilidad. Cuando VIX alcanza picos, esos parámetros pueden quedar obsoletos rápidamente.

El problema del desajuste del régimen

La mayoría de los algoritmos comerciales utilizan datos históricos para establecer tamaños de posición, distancias de parada y umbrales de entrada. Esos datos reflejan las condiciones durante las cuales se probó el sistema. Si VIX pasa de 15 a 35, es posible que las suposiciones estadísticas que sustentan esas configuraciones ya no se mantengan.

Los modos de falla comunes en entornos con alto nivel de VIX incluyen

- Se detiene repetidamente provocada por el ruido antes de que se produzca el movimiento direccional previsto.

- Dimensionamiento de posiciones basado en el riesgo fijo en dólares, que se vuelve relativamente pequeño en comparación con los rangos intradiarios reales.

- Supuestos de correlación entre activos desglosando.

- Deslizamiento en la ejecución que erosiona el borde.

Enfoques que algunos comerciantes algorítmicos consideran

En lugar de ejecutar un único conjunto fijo de parámetros, algunos sistemas incorporan un filtro de régimen de volatilidad. Esta es una verificación en tiempo real en VIX o ATR que activa un interruptor a diferentes configuraciones cuando cambian las condiciones.

Ajustes de enfoque que algunos operadores revisan en entornos con alto nivel de VIX

- Ampliar las distancias de parada proporcionalmente al ATR para reducir las salidas impulsadas por ruido.

- Reducir el tamaño de la posición para mantener el riesgo constante en dólares en relación con rangos esperados más amplios.

- Agregue un umbral VIX por encima del cual el sistema hace una pausa o se mueve al modo de comercio en papel.

- Reducir el número de posiciones simultáneas, ya que las correlaciones tienden a aumentar durante el estrés del mercado.

Ningún ajuste elimina el riesgo. El backtesting de nuevos parámetros en períodos históricos de alto VIX puede proporcionar alguna indicación del probable desempeño, aunque las condiciones pasadas no son una guía confiable para los resultados futuros.

4. ¿Sigue siendo el yen japonés (JPY) un comercio seguro confiable?

Durante los períodos de aversión al riesgo global, el capital históricamente ha fluido hacia el JPY a medida que los inversores se desenrollan en las operaciones de carry y buscan tenencias de menor volatilidad. No obstante, la confiabilidad de esta dinámica se ha vuelto más condicional.

¿Por qué el yen se ha movido históricamente como un refugio seguro?

Las tasas de interés históricamente bajas de Japón hicieron del JPY la moneda de financiamiento preferida para las operaciones de carry y cuando llega el sentimiento de riesgo, esas operaciones se desenrollan rápidamente, creando demanda de yen.

Además, la gran posición neta de activos extranjeros de Japón significa que los inversores japoneses tienden a repatriar capital durante las crisis, apoyando aún más al JPY.

Lo que ha cambiado

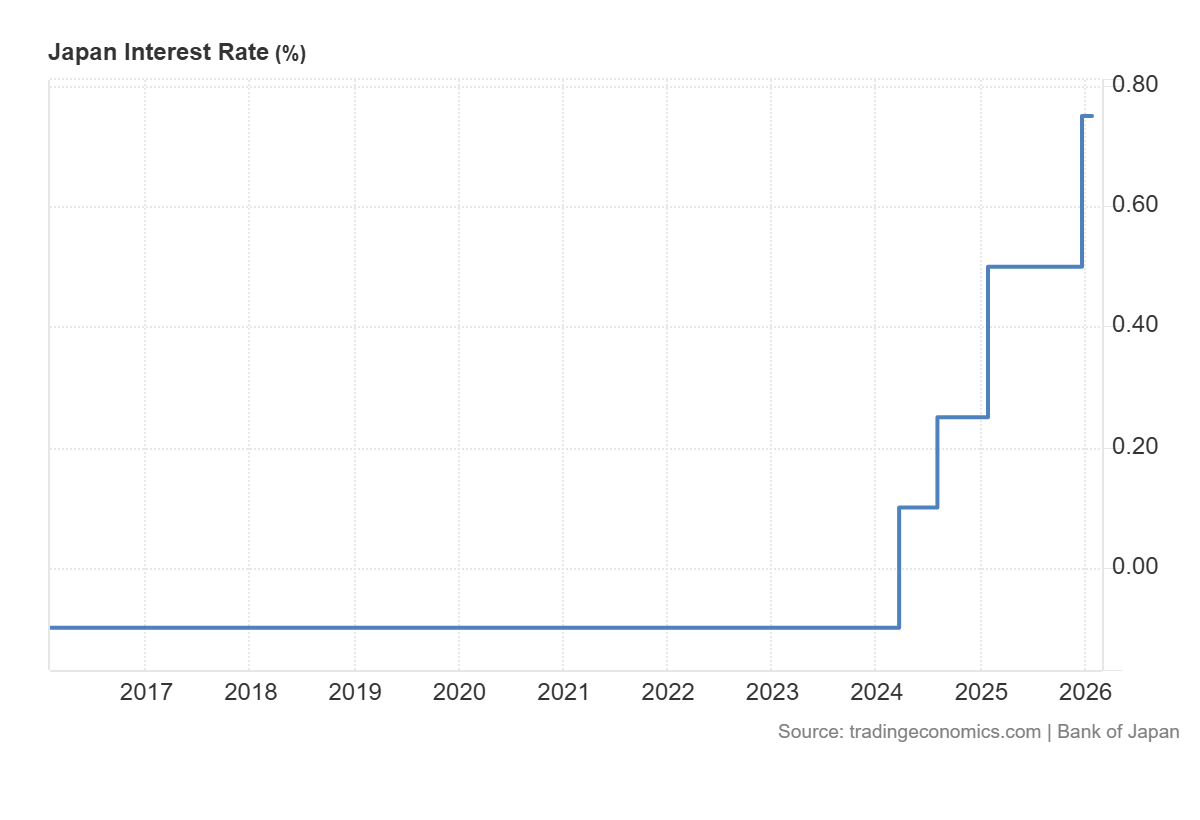

El alejamiento del Banco de Japón de la política monetaria ultra flexible en los últimos años ha complicado la dinámica tradicional de refugio seguro.

A medida que aumentan las tasas de interés japonesas:

- La escala de posicionamiento de carry trade puede cambiar.

- El USD/JPY puede volverse más sensible a los diferenciales de las tasas de interés.

- La comunicación del BoJ y los datos de inflación interna pueden influir en el JPY independientemente del apetito de riesgo global.

El yen aún puede comportarse como un refugio seguro, particularmente durante las fuertes vendas de acciones. Pero puede responder de manera más lenta o inconsistente en comparación con ciclos anteriores cuando la divergencia política entre Japón y el resto del mundo era más extrema.

Qué ver

Para los comerciantes que monitorean el JPY como una señal de refugio seguro, las fechas de reunión del BoJ, las publicaciones del IPC japonés y los datos de spread de tasas entre Estados Unidos y Japón en tiempo real se han convertido en insumos más relevantes que hace unos años.

5. ¿Cómo evito los 'azotes' en los CFDs sobre energía?

Whipsawing describe la experiencia de ingresar a una operación en una dirección, ser detenido a medida que el precio se invierte, luego ver el precio retroceder en la dirección original.

Los CFDs sobre energía, particularmente el petróleo crudo, son especialmente propensos a esto en los mercados volátiles. Y para los comerciantes en Asia, la combinación de poca liquidez durante el horario local y sensibilidad a los titulares geopolíticos puede hacer que esto sea particularmente desafiante.

¿Por qué los CFDs de energía whipsaw?

El petróleo crudo es sensible a una amplia gama de impulsores generales: decisiones de producción de la OPEP+, datos de inventario de Estados Unidos, interrupciones geopolíticas del suministro y movimientos de divisas.

En entornos de alta volatilidad, el mercado puede reaccionar fuertemente a cada titular antes de dar marcha atrás cuando llegue el siguiente.

- Los picos de precios en un titular, las paradas se activan en posiciones cortas.

- Los comerciantes vuelven a entrar largo tiempo, esperando continuación.

- Un segundo titular o toma de ganancias revierte la jugada.

- Se golpean paradas largas. El ciclo se repite.

Enfoques que los comerciantes pueden considerar para administrar el riesgo de Whipsaw

Algunos comerciantes optan por cambiar sus controles de riesgo en condiciones volátiles (por ejemplo, revisar la colocación de stop en relación con las medidas de volatilidad). Sin embargo, estos pueden aumentar las pérdidas; los riesgos de ejecución y deslizamiento pueden aumentar considerablemente en los mercados rápidos.

Otros enfoques que algunos comerciantes revisan:

- Evite operar con CFD de petróleo crudo en los 30 minutos antes y después de las principales publicaciones de datos programadas.

- Utilice un gráfico de plazos más largo para identificar la tendencia predominante antes de entrar en un período de tiempo más corto, lo que reduce la posibilidad de operar contra flujos institucionales más grandes.

- Escale a posiciones en etapas en lugar de comprometer el tamaño completo en la entrada inicial.

- Monitoree el interés abierto y el volumen para distinguir entre movimientos con participación genuina y faltas de baja liquidez.

Los latiguillos no se pueden eliminar por completo en los mercados energéticos volátiles. El objetivo de la administración de riesgos en estas condiciones no es predecir qué movimientos se mantendrán, sino asegurar que las pérdidas en movimientos falsos sean menores que las ganancias cuando sigue un movimiento direccional genuino.

Consideraciones prácticas para los mercados asiáticos volátiles

Los mercados asiáticos tienen características estructurales que interactúan con la volatilidad de manera diferente a los mercados estadounidenses o europeos:

- Una liquidez más delgada durante el horario local puede exagerar los movimientos en volúmenes delgados, particularmente en CFDs de energía y FX.

- Los eventos en China, incluidas las publicaciones del PMI, los datos comerciales y las señales de política del PBOC, pueden mover los índices regionales.

- Las decisiones políticas del BoJ se han convertido en un impulsor más activo de la volatilidad del JPY y el Nikkei en los últimos años.

- Las brechas de la noche a la mañana de los movimientos de la sesión de Estados Unidos son un riesgo estructural persistente para los operadores que no pueden monitorear las posiciones durante todo el día.

- Los requerimientos de margen de los productos apalancados pueden cambiar a corto plazo durante los períodos de alto VIX.

Preguntas frecuentes sobre la volatilidad en los mercados asiáticos

¿Qué significa una lectura alta de VIX para los índices bursátiles asiáticos?

VIX mide la volatilidad esperada en el S&P 500, pero las lecturas elevadas suelen reflejar la aversión global al riesgo que fluye a través de los mercados. Los índices asiáticos como el Nikkei 225, Hang Seng y ASX 200 a menudo pueden ver una mayor volatilidad y correlación negativa con fuertes picos de VIX.

¿Se pueden negociar las opciones de 0DTE durante el horario asiático?

El acceso depende de la plataforma y del instrumento específico. Las opciones del índice de acciones 0DTE de EE. UU. tienen un precio más activo durante las horas de negociación de Estados Unidos. Los comerciantes asiáticos pueden enfrentar diferenciales más amplios y precios menos representativos fuera de esas horas.

¿Las estrategias algorítmicas de trading son inherentemente más riesgosas en condiciones de alta volatilidad?

Las estrategias calibradas durante períodos de baja volatilidad pueden funcionar de manera diferente en entornos de alto VIX. La revisión periódica de los parámetros frente a las condiciones actuales del mercado es prudente para cualquier enfoque sistemático.

¿El comercio de refugio seguro del JPY ha cambiado permanentemente?

La normalización de las políticas del Banco de Japón ha introducido nuevas dinámicas, pero el JPY ha seguido fortaleciéndose durante algunos episodios de riesgo. Puede estar más condicionado a la naturaleza del choque y a la postura concurrente del BoJ.

¿Cuál es la mejor manera de establecer paradas en los CFDs de energía en condiciones de alta volatilidad?

No existe un método universalmente mejor. Muchos comerciantes hacen referencia a ATR para calibrar las distancias de parada a las condiciones prevalecientes en lugar de usar niveles fijos. Esto no garantiza la salida al precio deseado y no elimina el riesgo de whipsaw.

The ASX 200 closed out the 2025 financial year on a high, reaching a new intra-month peak of 8,592 in June and within touching distance of the all-time record. The index delivered a 1.4% total return for the month, rounding off a strong final quarter with a 9.5% return and locking in a full-year gain of 13.8% — its best performance since 2021.This strong finish all came down to the postponement of the Liberation Day tariffs. From the April 7 lows through to the end of the financial year, the ASX followed the rest of the world. Mid-cap stocks were the standout performers, beating both large and small caps as investors sought growth opportunities away from the extremes of the market. Among the sectors, Industrials outperformed Resources, benefiting from more stable earnings and supportive macroeconomic trends tied to infrastructure and logistics.But the clear winner was Financials, which contributed an incredible 921 basis points to the overall index return. CBA was clearly the leader here, dominating everything with 457 basis points on its own. Westpac, NAB, and others also played a role, but nothing even remotely close to CBA. The Industrials and Consumer Discretionary sectors made meaningful contributions, adding 176 and 153 basis points, respectively. While Materials, Healthcare, and Energy all lagged, each detracting around 45 to 49 basis points. Looking at the final quarter of the financial year, Financials were by far the biggest player again, adding 524 basis points — more than half the quarter’s total return of 9.5%. Apart from a slight drag from the Materials sector, all other parts of the market made positive contributions. Real Estate, Technology, and Consumer Discretionary followed behind as key drivers. Once again, CBA was the largest individual contributor, adding 243 basis points in the quarter, while NAB, WBC, and Macquarie Group added a combined 384 basis points. On the other side of the ledger, key underperformers included BHP, CSL, Rio Tinto, Treasury Wine Estates, and IDP Education, which all weighed on quarterly performance.One of the most defining features of the 2025 financial year was the dominance of price momentum as a market driver — something we as traders must be aware of. Momentum strategies far outpaced more traditional, fundamental-based approaches such as Growth, Value, and Quality. The most effective signal was a nine-month momentum measure (less the most recent month), which delivered a 31.2% long-short return. The more commonly used 12-month price momentum factor was also highly effective, returning 23.6%. By contrast, short-term reversals buying last month’s losers and selling last month’s winners was the worst-performing approach, with a negative 16.4% return. Compared to the rest of the world, the Australian market was one of the strongest trades for momentum globally, well ahead of both the US and Europe, despite its relatively slow overall performance.Note: these strategies are prone to reversal, and in the early days of the new financial year, there has been a notable shift away from momentum-based trading to other areas. Now is probably too early to say whether this marks a sustained change, but it cannot be ignored, and caution is always advised.The second big story of FY26 will be CBA. CBA’s growing influence was a key story of FY25. Its weight in the index rose by an average of 2.1 percentage points across the year, reaching an average of 11.5% by June. That helped push the spread between the Financials and Resources sectors to 15.8 percentage points — the widest gap since 2018. Despite the strong cash returns, market valuations are eye-watering; at one point during June, CBA became the world’s most expensive bank on price metrics. The forward price-to-earnings multiple now sits at 18.9 times. This is well above the long-term average of 14.7 and higher than the 10-year benchmark of 16.1. Meanwhile, the dividend yield has slipped to 3.4%, down from the historical average of 4.4%. Earnings momentum remains soft, with FY25 growth estimates still tracking at 1.4%, and FY26 forecast at a moderate 5.4%. This suggests that recent gains have come more from expanding valuation multiples than from actual earnings upgrades, making the August reporting date a catalyst day for it and, by its size, the market as a whole.On the macro front, attention now turns to the Reserve Bank of Australia. The central bank cut the cash rate by 25 basis points to 3.6% at its July meeting. Recent commentary from the RBA has taken on a more dovish tone, with benign inflation data and ongoing global uncertainty expected to outweigh the strength of the labour market. The RBA appears to be steering toward a neutral policy stance, and markets will be watching for further signals on how that shift will be managed. Recent economic data has been mixed. May retail sales were weaker than expected, while broader household spending indicators held up slightly better. Building approvals saw a smaller-than-hoped-for bounce, employment remains strong, but productivity is low. Inflation is now at a 3-year low and falling; all this points to underlying support from the RBA’s easing bias both now and into the first half of FY26.As we move into FY26, the key questions are:

- Can fundamentals wrestle back control over momentum?

- Will earnings growth catch up to price to justify valuations?

- How will policy decisions from the RBA and other central banks shape investor sentiment in an ever-volatile world?

While the early signs suggest a possible rotation, the jury is still out on whether this marks a new phase for the Australian market or just a brief pause in the rally that defined FY25.

In the world of trading, few stories are as famous as the one behind the Turtle Traders. The Turtle experiment was simple in concept — could absolute beginners, given nothing but a set of rules and two weeks of training, beat the markets?The results of the experiment were extraordinary. Even today, four decades later, many of their principles still echo through our algorithm-dominated trading world.In this article, we’ll revisit the original Turtle strategy, examine how it worked, and explore how this legendary approach could be reimagined for modern traders.

Who Were the Turtles?

The Turtle Traders were the product of a famous bet between trading legend Richard Dennis and his partner William Eckhardt. Dennis believed that trading could be taught; Eckhardt thought that the ability to trade was a set of skills that you are born with. To settle the debate, Dennis placed an ad in the newspaper and selected a group of everyday individuals, none of whom had any prior trading experience.These recruits underwent a two-week crash course in trading, during which they were taught a complete, mechanical system. It was based on trend-following logic, relying on breakouts, strict entry and exit rules, and position sizing based on market volatility. The idea was simple — eliminate emotion, follow the rules, and let the trends do the work.The experiment was a runaway success. As a group, the Turtles reportedly achieved an average annual return of 80%, managing millions in capital and building one of the most talked-about trading systems in history.

Turtle Trading Rules and Instruments

Entry Rules:

The Turtles followed mechanical entry rules based on the concept of trading with the trend. The initial entry criteria were:

- Enter a long position if the price breaks above the 20-day high.

- Enter a short position if the price falls below the 20-day low.

- For a more conservative approach, a second strategy of a 55-day breakout was used as an alternative.

- Orders were placed using buy/sell stop orders triggered by the breakout.

Markets Traded:

The system was applied across a wide range of liquid futures markets:

- Currency Futures: EUR/USD, JPY/USD, GBP/USD, CHF/USD, CAD/USD

- Commodity Futures: Gold, Silver, Crude Oil, Heating Oil, Corn, Wheat, Soybeans, Sugar, Cocoa, Cotton

- Stock Index Futures: S&P 500, Nikkei 225, Dow Jones (DJIA)

- Interest Rate Futures: U.S. Treasury Bonds, Eurodollars

The Importance of Volatility:

They used the Average True Range (ATR) of a 20-days, termed “N”, in many of their calculations to account for the impact of volatility.

Pyramiding (accumulation): Adding to Winning Trades:

The Turtles were also taught to scale into winning trades. This method, known as pyramiding or accumulation, involved adding to a trade if the price moved in their favour. If N (ATR) was 40 points, they would add 0.5 × the Average True Range to the trade. For example, accumulation of a new position would be actioned at 20 and then again at another 20, adding up to a maximum of four positions: the original trade plus three additional entries.

Exits and Risk Management

Initial Stop Loss:

Each trade was initiated with a stop loss placed 2N away from the entry price. This ensured that no single trade risked more than 2% of the account balance.

Trailing Stop:

As the trade progressed and additional units were added, the stop loss was dynamically adjusted using the most recent entry as a reference.The trailing stop for all positions was 2N on the latest (most recent) added position. If the stop was hit, all positions in that trade were closed simultaneously, locking in gains and controlling downside risk.

How Have Markets Changed Since the 1980s?

- Algorithmic and high-frequency trading (HFT) now dominate markets, often resulting in faster and more erratic price movements.

- Trading costs (commissions, spreads) have significantly decreased, enabling more frequent entries and tighter stops.

- Trend persistence has diminished. Markets often reverse more quickly, making it harder for long-trend strategies to succeed without adaptation.

- Forex and futures markets are more liquid, making it easier to execute large positions with less slippage.

- Futures markets have seen changes in volume and type, enabling a greater selection of asset choices.

- Stock indices tend to exhibit more mean reversion, demanding smarter trend filters.

- Breakouts from common levels are less reliable, often resulting in quick reversals due to stop hunting and market manipulation.

- A greater need for confirmation signals before acting on a breakout.

- ATR-based sizing remains relevant but may benefit from more dynamic scaling.

- Rigid stop-loss rules (like 2× ATR) are more likely to be hit due to shorter trend durations.

How Could the Turtle System Be Used Today?

Although the principles underpinning the turtle systems remain valid for trading today, some tweaking of the original criteria and parameter levels would be worth exploring.

Entry Modifications:

Requiring confirmation from trend filters, such as price being above the 200 EMA or RSI values above 55, or perhaps looking for confirmation on larger timeframes, could reduce false signals and improve win rates.Additional volume filters, including relative volume, OBV, and average volume, may add value to decision-makingIncorporating indicators developed since the turtle experiment, such as other variations of the ATR and RSI, Bollinger bands, and Keltner channels, may be worth consideration for the confluence of the basic trend following structure.

Exit and Risk Enhancements:

In the turtles experiment, the ATR was static once the initial trade was entered; the N value remained fixed for that position and all subsequent accumulated positions. Arguably a dynamic ATR instead of a fixed level may be worth consideration to adjust to changing volatility over time.This especially makes sense if you are considering adding additional confluence from other indicators for the initial position.

Trade Like a Turtle

Using the original Turtle approach could be considered a checklist for good practice. Especially when it comes to rule-based system designs, risk management, emotional discipline in execution, and equal attention to entry, accumulation, and exit.Consider testing a “Turtle-inspired” strategy using current instruments and enhanced filters before taking it live. The spirit of the Turtle experiment lives on not just in its rules, but in the key message that trading can be taught. You can learn it, but success depends on sticking to a well-thought-out plan and adhering to the golden rules of trading that still apply today.

Most traders obsess over entries, indicators, and setups, but often overlook a simple factor — the time of day that you trade.Time of day affects volatility, liquidity, and when new information enters the market. Ignoring it can turn good setups into frustrating inactivity, or even losses, while embracing it can help you trade with the market, not just the setup.

Why Time of Day Is Important

Markets are not equally active during the whole period they are open. Price action is driven by human behaviour, either on an individual or organisational level. Behaviour commonly follows routines:

- Economic data is released at scheduled times

- Institutions trading during business hours

- Retail traders are more active during specific sessions — in terms of volume and location.

This invariably creates rhythms in the market. By learning to trade with these rhythms, your trades will often require less confirmation, you improve stop placement, and have cleaner follow-through on trading ideas.

The Global Trading Clock

The trading day is broadly broken into three main sessions: Asia, Europe, and the US. Each has its own “character,” and benefits vary based on which time zone best aligns with your strategy.

1. Asia (Tokyo)

10pm –7am GMT: Markets are generally quieter except JPY and AUD FX pairs and index CFDs. Common characteristics include:

- Lower liquidity

- Range-bound behaviour

- Risk of false breakouts

Reversion strategies may do well in such market conditions as well as setting up highs and lows, which may be useful references for sessions later in the day.

2. Europe (London)

7am–4pm GMT: Increased volatility and volume are seen during the European session across many asset classes. The opening of the LME can influence metals prices, and US futures may respond accordingly to increased volatility. Common characteristics include:

- Large institutional flows

- Strong trends can begin

- Overlaps with NY for 2 hours

Breakout strategies using Asian session highs or lows as reference (or previous days' US session) may outperform. And trend continuation and reversal approaches on the back of new data coming out of Europe may also be common. The two-hour crossover with the subsequent US session can also be an important change in market conditions.

3. US (New York)

12pm–9pm GMT: Volatility spikes may occur at US equity market open and significant data releases with global asset class impact are often released at 8.30am US Eastern time. Common characteristics include:

- Major economic releases

- US equity open creates short-term momentum

- Slower into the late session

Fast moves might be prevalent early in the day, suggesting short-term momentum-supported new trend set-ups may outperform. Reversals around the middle of the day are also not uncommon.The Federal Reserve interest rate decisions are always in the early afternoon in the US, which can flip market sentiment.

The Intra-Session Rhythm

It is not only session-to-session changes that can often be seen on price charts. Within each session, price often has a tendency to move in waves. So, as a general rule, you may see:

- Early session: bursts of volatility and institutional positioning

- Mid-session: consolidation or retracements

- Late session: thinning liquidity, profit-taking, fakeouts

Why Most Traders Miss This

During strategy development, many strategies are tested on charts without considering what time the setup occurred.A 15-minute candle during the London open isn’t the same as one during the Australian lunch break.So, if you start taking breakouts in low-volume periods, trading reversals just before news, or entering trends during midday doldrums, these may have less chance of meeting the goals for that particular trade.

How to Use Time of Day as a Filter Practically

1. Mark Your Session Windows

On your chart, visually block out the London open, NY open, and overlap. Use vertical lines or shading — this will help you historically see what happens at these key times.*Note: We are developing a free indicator for this that you can place on a chart. Email [email protected] if you are interested.

2. Backtest by Session

You can split potential trades by session ‘time blocks’ that look back over time. Strategy types often work better during specific hours:

- Breakouts work 7am–10am GMT

- Mean reversion thrives 2am–5am GMT

- Reversals occur more often post-3pm GMT

Using your existing setups (or even previous trades), look at a sample to see what may have happened. 3. Add Time as a Trade FilterOnce you have some evidence from, test out simple rules like:

- “Only take trend trades between 7am–11am GMT”

- “No breakout entries after 3pm NY”

If you can code (or have access to someone who can), then you can backtest this quickly to see the impact of these filters.

4. Know the News Calendar

Most high-impact data is released at predictable times — make knowing what is happening and when part of your daily trending agenda. These contribute to the characteristics of a session, but also may flip what is standard on its head. Reference in your plan the major data points and how you are going to manage potential entry setups.

Trade With the Market — Not Just the Setup

The best trades don’t just have good structure; they also happen at the right time.Logically, if you want cleaner trade setups, high-probability entries, and improved consistency, then aligning your trading strategies with the market clock makes sense.It’s a simple shift that most traders ignore — perhaps to their detriment. Finding the best time of day to trade for your trading strategy could be one of the things that helps develop your trading edge.

There is an apparent enthusiasm among traders nowadays to add indicators to charts that resemble modern art more than market analysis. RSI, MACD, moving averages, stochastic oscillators, Bollinger Bands, volume profiles, and so many more. While these tools do have their place in some strategies, many traders forget the fundamental truth: price is the source, everything else is a reaction.Learning to read price as a narrative, showing a sequence of events that reveals the intentions and psychology of both buyers and sellers, can offer the trader a level of understanding that no single or even multiple indicators can give.

Indicators Are the Supporting Act — Not the Main Show

Don’t take from the opening that I think for one moment that Indicators are inherently bad. They can be helpful when used correctly as a way to offer some confluence to what the current price may be suggesting.But by design, most indicators are lagging. They take price and/or volume data and apply mathematical formulas to summarise or smooth the past.Moving Averages tell you where the price has been over the period of the MA setting. RSI shows whether the recent move has been relatively strong, even if it doesn’t tell you why. MACD illustrates the relationship between two moving averages and whether it's changing, but not necessarily market intent.Indicators are descriptive, not predictive. They are great at confirming bias but may not produce desired outcomes when used as your primary decision-making tool.

Price Action is a Language

Every candlestick is a snapshot of a battle occurring between buyers and sellers over a fixed point in current time. The shape and size of each bar contain a message.A large bullish candle (close near the high) indicates strong buyer control during that bar.A long wick above the body shows attempted movement upward but failure to hold — in other words, a rejection at higher prices.A doji (small body, long wicks) suggests indecision — neither side in control.And of course, the reverse is the case for a bearish candle.These are not random. They reflect the psychology of where market participants are now and can imply a degree of confidence, hesitation, exhaustion, or even reversal pressure.

Key takeaway:

There could be merit in starting each trading session by scanning the last 5–10 candles on your timeframe and asking: Who was in control? Are they still in control? And is there evidence that this may continue or be changing on THIS candle?”These simple questions can dramatically shift your perspective from reaction to anticipation.

What is Market Structure?

While individual candles can show immediate intent, structure reveals progression.A trend is never a continued straight line; market structure is the pattern of swing highs and swing lows that form the underlying skeleton of a trend.An uptrend forms higher highs (HH) and higher lows (HL).A downtrend forms lower highs (LH) and lower lows (LL).A range is where highs and lows are roughly equal, showing balance between buyers and sellers.Structure tells you where traders are likely to place orders and whether a trend may continue.There may be stops placed below swing lows, creating potential support. There may be profit targets at prior highs, creating potential resistance.Breakout or breakdown movement may be triggered if there is a break of these structural key levels, e.g., a break of a previous swing high may suggest continuation.

Key takeaway:

Try to map out the most recent swing highs/lows on your chart. Ask the question: Are we building a structure to continue, or is there a potential pause point where the market may decide to shift direction? And how should this impact my decision to enter a trade or stay in an open trade?This framing, based on current market structure, helps you align with momentum rather than chase it.

Volume: The Emotion in the Story

While price tells you what is happening, volume gives a sense of how much conviction is behind it. Volume adds depth and credibility to the story of price. Although there are those who would be reluctant to use tick volume with Forex and CFD trading, there is still potential legitimacy in testing this in your trading. As it is leading, not lagging, volume with price (arguably) acts as an important market gauge. High volume on a breakout = genuine interest with evidence of market convictionLow volume breakout = potential trap. Lack of participation means the move may fail.Effort vs. Result = if price moves very little despite high volume, it suggests absorption — large opposing orders are sitting there.

Volume as a Visual Lie Detector?

Sometimes price action looks bullish, but volume says otherwise. For example, A bullish engulfing candle that forms with lower-than-average volume is often a false signal. A reversal candle that forms with a volume spike often suggests a strong shift in sentiment.To use this practically, consider a volume average line to highlight when it may be time to act (or time not to).

How to Practice Your Trading Story Creation

Through the key fundamental principles covered above, you can start training how to create a market story.

Daily Market Story Exercise:

- Strip off all indicators apart from volume!

- Look at the last 10–20 candles.

- Say out loud or write the story you see in front of you — e.g., “Price was rising but slowed near resistance. After a rejection candle, sellers stepped in with conviction as evidenced by the candle formation and volume. Now it’s testing the prior support zone…”

Do this each day, and you’ll build the ability to trade based on understanding of what market psychology is telling you rather than just guesswork.

When to Use Indicators — and When to Walk Away

As stated before, indicators aren't useless but can play an important part in confirming or disputing your market story. They work well when they confirm what price action already suggests, smooth out trends or help define zones, and help filter conditions (e.g., only trade long above 200 EMA).If you find yourself staring at indicator crossovers or waiting for an RSI line to tick over 30 without looking at price, you are reading the footnotes, not the full plot.Use indicators in the background, not the foreground of your decision-making.

Summary

Price is not just data, it’s market dialogue. It’s the collective voice of every trading participant in the market NOW. It demonstrates emotion, logic, and intention. When you learn to read the price like a story, you start anticipating rather than reacting. You reduce overtrading with a focus on price action that is compelling, not just suggestive. And arguably, your interaction with the market becomes clearer, simpler, and potentially far more powerful.

1. Inflation Uncertainty

While recent data has shown core inflation moderating, core PCE is on track to average below target at just 1.6% annualised over the past three months.Federal Reserve Chair Jerome Powell made clear that concerns about future inflation, especially from tariffs, remain top of mind.“If you just look backwards at the data, that’s what you would say… but we have to be forward-looking,” Powell said. “We expect a meaningful amount of inflation to arrive in the coming months, and we have to take that into account.”While the economy remains strong enough to buy time, policymakers are closely monitoring how tariff-related costs evolve before shifting policy. Powell also stated that without these forward-looking risks, rates would likely already be closer to the neutral rate, which is a full 100 basis points from current levels.

2. The Unemployment Rate anchor

Powell repeatedly cited the 4.2% unemployment rate during the press conference, mentioning it six times as the primary reason for keeping rates in restrictive territory. At this level, employment is ahead of the neutral rate.“The U.S. economy is in solid shape… job creation is at a healthy level,” Powell added that real wages are rising and participation remains relatively strong. He did, however, acknowledge that uncertainty around tariffs remains a constraint on future employment intentions.If not for a decline in labour force participation in May, the unemployment rate would already be closer to 4.6%. Couple this with the continuing jobless claims ticking up and hiring rates subdued, risks are building around labour market softening.

3. Autumn Meetings are Live

While avoiding firm forward guidance, Powell hinted at a timeline:“It could come quickly. It could not come quickly… We feel like the right thing to do is to be where we are… and just learn more.”This suggests the Fed will remain on hold through the July meeting, using the summer to assess incoming data, particularly whether tariffs meaningfully push inflation higher. If those effects prove limited and unemployment begins to rise, the stage could be set for a rate cut in September.

The US has entered the Israel-Iran war. However, despite an initial 4 per cent surge on the open, oil has settled where it has been since the conflict began in early June — around US$72 to US$75 a barrel.Trump claims the attacks from the US on Iranian nuclear facilities over the weekend are a very short, very tactical, one-off. This is something his base can get behind — some really big conservative players do not want a long-contracted war that sucks the US into external disputes.Whether this will be the case or not is up for debate, but there is a precedent from Trump's first presidency that we can look to. Iran had attacked several American bases in 2019, as well as attacking Saudi Arabia's most important oil refinery with Iranian drones. There wasn't a huge amount of damage; it was more a symbolic movement and display of capabilities by Iran.Initially, Trump didn't react — it took pressure from Gulf allies like the UAE and Israel for him to respond, which saw him order the assassination of the head of the Iranian Defence Force, Qasem Soleimani. This led to an Iranian response of ‘lots of noise’ and ‘cage rattling’, but minimal real action events, just a few drone attacks. Trump is betting on the same reaction now.If Iran follows the same patterns from the previous engagement, the geopolitical side of this is already at its peak.As of now, Iran is not going after or destroying major Gulf energy capabilities. Nor have there been any disruptions to the shipping traffic through the Strait of Hormuz. In fact, apart from a posturing vote to block the Strait, Iran has not made any indication that it is going to disrupt oil in any way that would lead to price surges.Additionally, despite the U.S. military equipment buildup in the region being its highest since the Iraq war, critical Iranian energy infrastructure is running largely unscathed.This all suggests that the geopolitics and the physical and futures oil markets remain disconnected. Oil will spike on news rumours, but the actual impacts in the physical realm to this point remain low. Of course, this could change in future. But, for now, the risk of seeing oil move to US$100 a barrel is still a minority case rather than the majority.