- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Forex

- A Pivotal Moment For Sterling

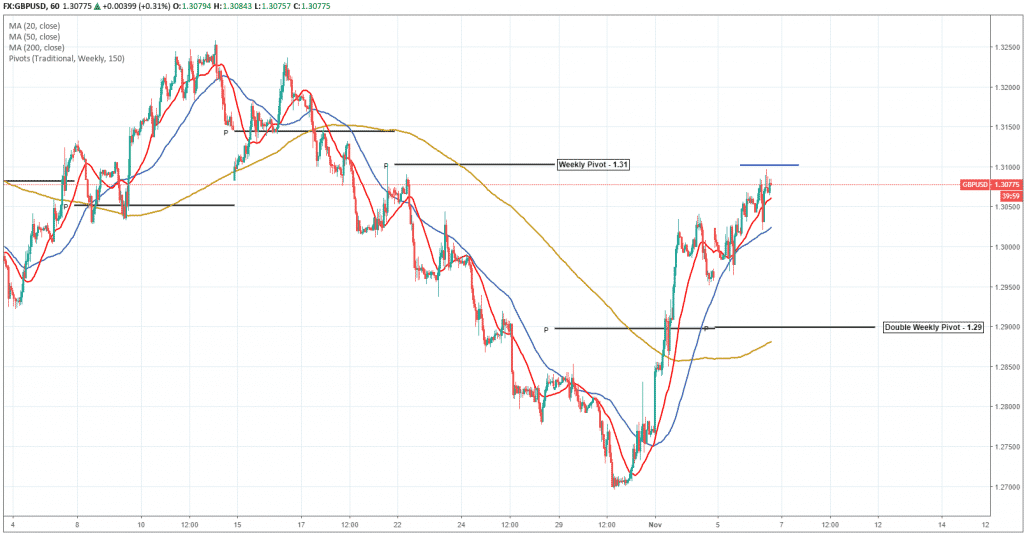

News & analysisGBPUSD – Has Cable run out of steam?

Looking at GBPUSD, we can see the month of November has kicked off with some impulsive moves higher off the back of potential Brexit deals concluding behind closed doors.

In the short-term, we might be witnessing the tail end of the recent rally as price action is showing signs of exhaustion, particularly as it reaches the previous weekly pivot region of 1.31. We can clearly see some resistance emerging here. Another element to remember is that the trend remains firmly bearish on the daily timeframe, so hints of selling pressure creeping in is perhaps to be expected.

If sellers do regain some control, the chart above suggests a key target for the pair would be the double weekly pivot area of 1.29. Generally speaking, whenever we see these type of pivots, price tends to gravitate towards them as market participants seek a middle ground.

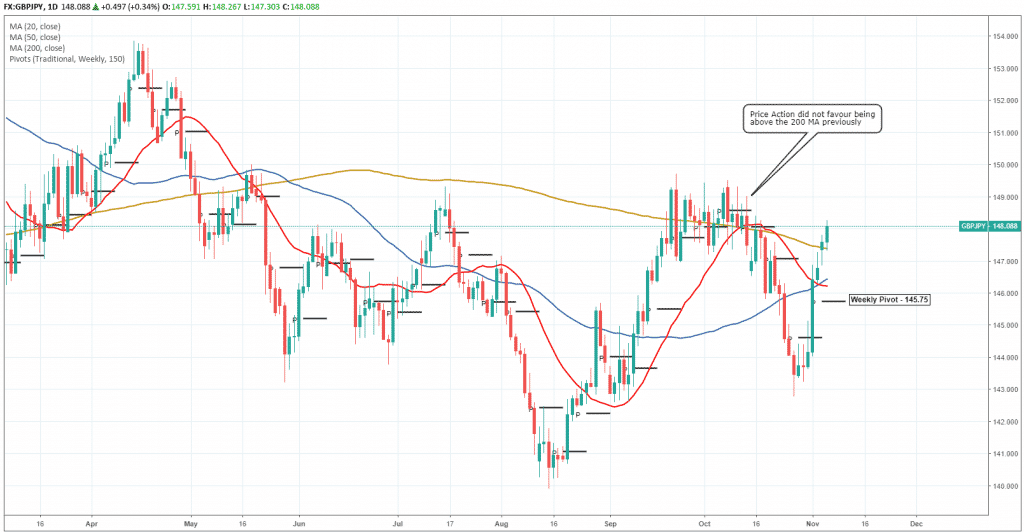

GBPJPY – Looking Shaky Above The 200 Day MA

Switching to GBPJPY, we are technically in bullish territory thanks to yesterday’s close above the 200 Day Moving Average (Gold Line). Considering how price reacted last time above these levels, it might be temporary unless we see further positive reports released for Sterling in the coming days.

Similar to GBPUSD, I see a potential drop on the horizon for the pair, targeting another weekly pivot. On the hourly chart below, we see evidence of some bearish divergence developing on the RSI (Relative Srength Index), coupled with price teetering around overbought levels. It may well become the fuel that sparks a shift towards the weekly pivot of 145.75.

If you would like to see more pivot point action, take a look at our Chart Of The Day on the daily report by Klavs Valters.

For more information on trading Forex, check out our regular free Forex webinars.

Sources: TradingView.com

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Tied In A Gridlock, Eyes Are Now On The FOMC Meeting!

The results of the US Mid-term election have been released and the Democrats took control of the House of Representatives, securing Washington in a legislative deadlock as widely expected. The talks of “impeachment” of the President will likely be making headlines as the Democrats are now empowered by investigative and procedural powe...

November 8, 2018Read More >Previous Article

European Round-Up: 5th November

Key Economic News Releases Today: GBP Markit/CIPS UK Services PMI (October) lower at 52.2 vs. 53.3 forecast GBP Markit/CIPS UK Composite PMI...

November 5, 2018Read More >Please share your location to continue.

Check our help guide for more info.