- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Geopolitical Events

- China Taking Stock Of US Trade Deficit Figures

- Home

- News & analysis

- Geopolitical Events

- China Taking Stock Of US Trade Deficit Figures

News & analysisNews & analysis

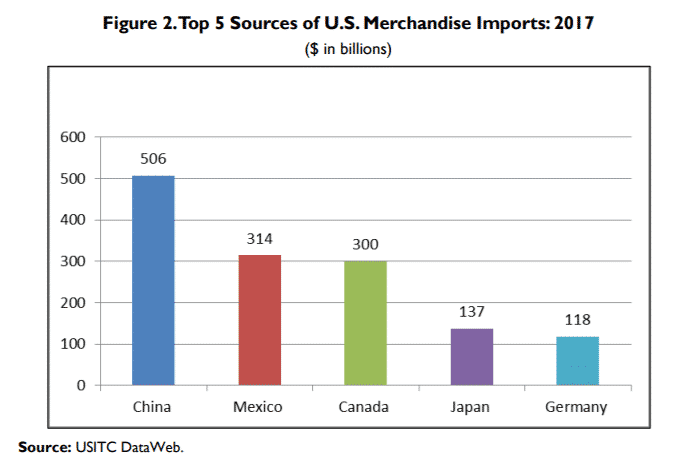

News & analysisNews & analysisThe US official trade deficit number with China is $375.2bn in 2017. But According to China Customs General Administration, this number should be $275.8bn. Notice there is a vast gap between the versions from two sides. So, which version is closer to the facts?

Firstly, let’s start this debate by looking at the US perspective.

Previously in the 1990s and early 2000s, most of the imports from China were low-value, labor-intensive products such as toys, clothes, footwear, etc. And even now, China are still producing these kinds of products.

However, over the past decade, an increasing proportion of US imports from China are more technologically advanced products (US calls it ATP). From the table below, we can see that, among the top 5 categories of import products, three of them are ATP by the US’s definition.

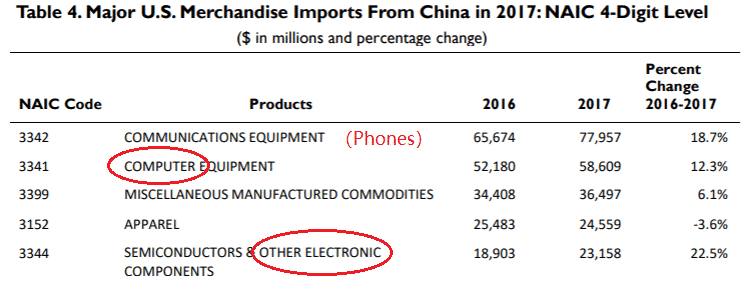

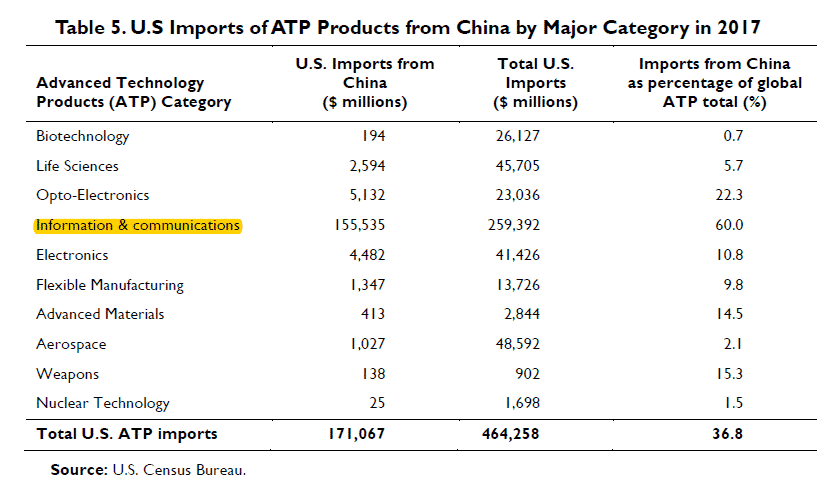

According to the U.S. Census Bureau, U.S. imports of ATP from China in 2017 totaled $171.1 billion. Information and communications products (i.e., Phones and Pads) were by far the most significant U.S. ATP import from China, accounting for 91% of U.S. ATP imports from China and 60% of U.S. global imports of this category (see table below).

This would generally go against common sense, right? Let me explain.

As we all know, Apple is the largest company in the world to produce mobile phones and IPads, and the second largest is Samsung, which is a Korean company. Although Huawei is the third largest mobile phones producer, the US government entirely banned Huawei from entering the US market due to “national security” reasons.

So how did phones and pads become the largest category that the US imported from the Chinese? An explanation from China’s point of view helps reveal this mystery.

Firstly, there are two terms that we learned in Economics 101, Finished Product and Intermediate goods. An intermediate good is a product used to produce a finished product.

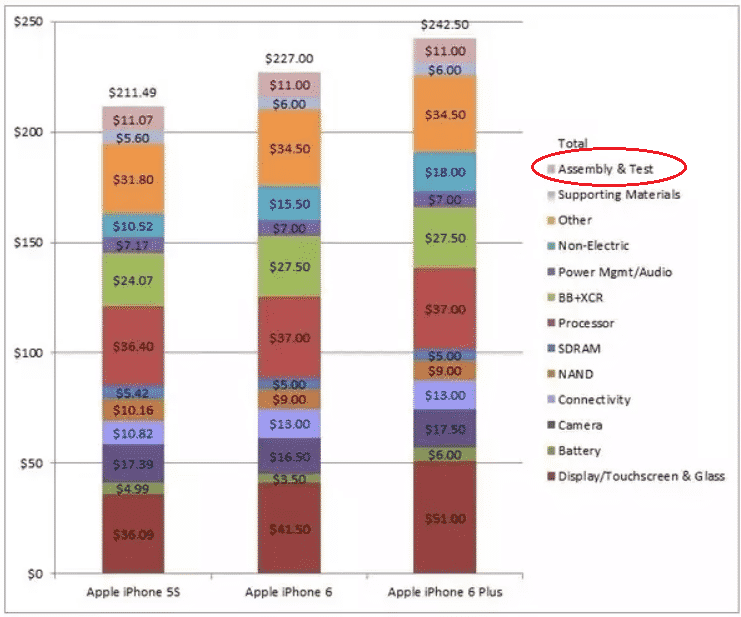

For example, in the case of producing an iPhone, Chinese factories contribute only 6% of the components (which is Assembly). All the other significant parts such as Hardware, Touchscreen& Glass, Battery, etc. these typically come from other countries such as South Korea and Japan.

If we take all those parts which come from Korea & Japan out of the US/China Trade Balance, the trade deficit will decrease one-third straight away.

Below is a breakdown of the costs for various components of an average iPhone.

Moreover, when an iPhone finished assembly and shipped and sold to US customers, it was Apple, a US company, who earned most of the profits, not Chinese assembly factories. However, just because the assembly is the last step of the manufacturing process, and the phones did “shipped from China to the US,” the US government defined this as “imports from China.” Based on this knowledge, it appears the US might be deliberately twisting the terminology to fool the general public, helping to fuel the current dispute against China.

There are hundreds more similar examples like this. These include iPhone, Dell who assembles their laptops in Shanghai, Boeing who assembles their planes in Tianjin, and most recently, Elon Musk who announced that he wants to open an assembly factory in Shanghai.

In conclusion, the US government seems to be exaggerating the trade deficit figures to help justify starting a trade war with China. This idea may sound like a conspiracy, but when you consider the many influential world powers throughout history who have leveraged their strength and resources to suppress their competitors, it makes more sense. Particularly those deemed to be in second place. Think about the cold war between the US and Soviet Union; it just passed not too long ago.

Lanson Chen

GO Markets Analyst

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Sources: USCITC DataWeb, US Census Bureau, Teardown.com

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#GeoPolitical #GeoPolitics #Markets #CurrenciesNext Article

GBPAUD – Brexit ‘No Deal’ To Spark A 1000 Pip Move?

Since September last year, the British Pound has enjoyed a relatively easy time against the Australian Dollar, often described as a solid bull run. However, many fundamental drivers have turned sour for the Sterling crosses, and with GBPAUD in particular, we may be in for a significant price reversal. What's Driving the Pound Aussie Pairing? The...

August 13, 2018Read More >Previous Article

Venezuela – The New Zimbabwe?

Venezuela: A Latin American Crisis Venezuela’s economy has been in turmoil in recent times with its inflation skyrocketing and with no signs of slo...

August 8, 2018Read More >Please share your location to continue.

Check our help guide for more info.