- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- Are the Iron Ore players set to rebound?

News & analysisAustralian Iron ore miners have faced a tough period after a golden era largely due to the strong economic growth in China. The industry was pumping whilst China was reliant on the material for its own industry and growth. However with China’s economy slowing down and the pandemic adding restraints on this, the sector has seen a slowdown and the price of Iron Ore has pulled back almost 50% from the highs in 2021, reflecting the slowdown in growth.

Sector catalysts

China’s economic growth is the primary driver of the Iron ore industry in Australia. The ore is a key component for the creation of steel which is needed for any infrastructure or property projects. Consequently, the price of iron ore and the success of the iron ore miners is significantly affected by the demand from China.

Recent lockdowns have caused havoc to the Chinese economy with Beijing and Shanghai both enduring lengthy and restrictive lockdowns. This slowed the economic growth bringing down the price of Iron Ore. In response to the slowdown on May 23 the government cut its interest rate margin for mortgages in order to support economic growth and indicated it will continue to support economic stimulus.

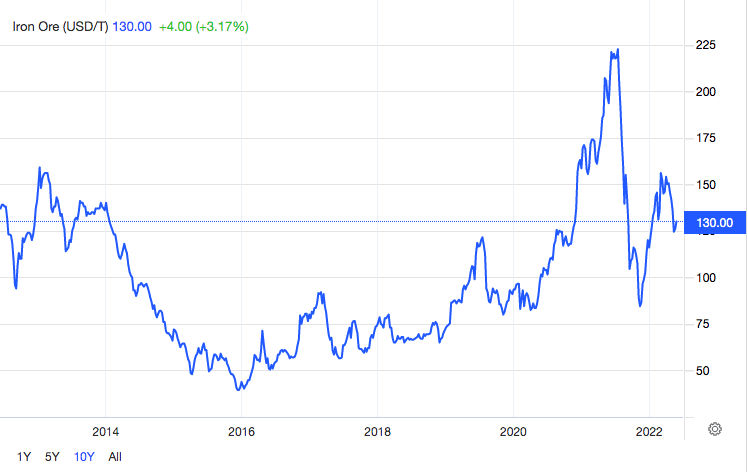

Below the weekly chart for the price of Iron Ore is displayed. The price has retraced significantly from its peak in 2021 before finding support at the 2019 peak near USD 125/130 a tonne.

The Iron Ore landscape in Australia

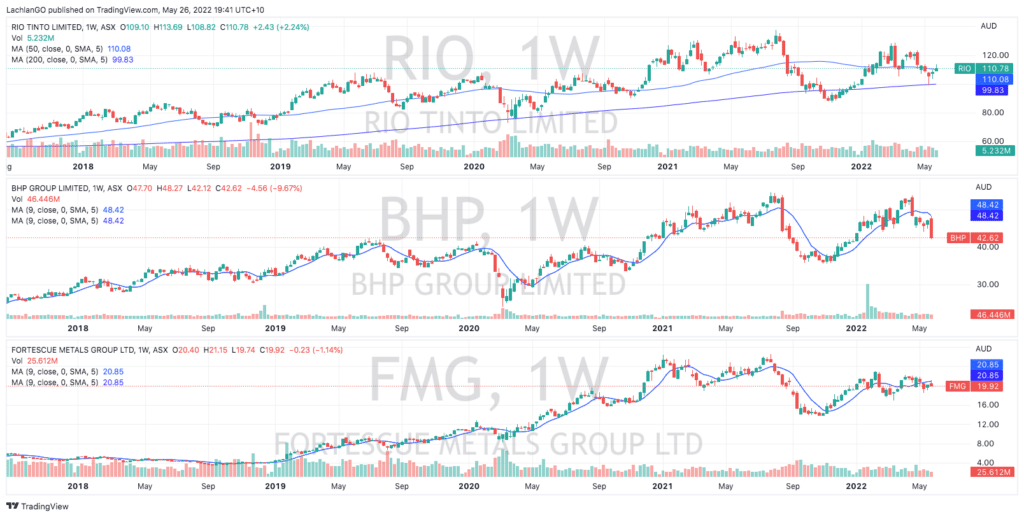

There are three main players in the market in Australia, Rio Tinto (RIO), Fortescue Metals Group (FMG) and BHP Billiton, (BHP). Smaller, junior companies also exist but do not have the weight of the larger cap companies. As they are such large companies they can have a big impact on the direction of the XJO, the general market and also the Australian dollar. In fact the three companies alone make up almost a quarter of the weight of the entire XJO.

Below, the three companies follow a very similar price pattern. Their collective prices have tapered off their highs seen in 2021. They then bounced off the 200 period weekly moving average. All are currently sitting near their 50 period moving average as they look to find some short term support. This may represent a potential short term/medium term buying opportunities as they consolidate for the time being.

Potential Threats

The obvious threat to the performance of these companies would be the reduction in Chinese imports of Iron Ore. This may occur if the economy slows down or China increases domestic production. China has outlined that it wishes to increase its production of Iron Ore by 30%. Other concerns may flow from defaults from major construction companies in China such as the events that surrounded Evergrande which brought volatility and fear to the sector.

Despite these concerns the Iron Ore market is still expected to remain highly profitable according to Vivek Dhar, director of Mining and Energy at the Commonwealth Bank. The larger factors that may impact the price negatively l be sustained growth in the infrastructure and property sector in China. Furthermore, if China does move away from Australian Ore imports, opportunities from other Pacific nations may open up including from India and Indonesia.

Ultimately, the Iron Ore industry remains strong, yet it is not immune from macroeconomic threats.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

AGL and The Mike Cannon-Brookes Take Over. Part 2.

Continuing from my previous article on Mike Cannon-Brookes and the take over of AGL, there has been some very important breaking news from the Australian giant and the country’s biggest polluter, AGL Energy. To give you some background information; Mike Cannon-Brookes (MCB) had launched a takeover of the company as he felt he could change the...

May 31, 2022Read More >Previous Article

Alibaba beats estimates – the stock is rising

Alibaba Group Holding Limited (BABA) reported its latest financial results for the quarter ended March 31, 2022 before the market open on Thursday. Th...

May 27, 2022Read More >Please share your location to continue.

Check our help guide for more info.