- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- Asia looking to open in the red on Wall St lead, Bitcoin bounces, Gold and Silver tumble

- Home

- News & analysis

- Economic Updates

- Asia looking to open in the red on Wall St lead, Bitcoin bounces, Gold and Silver tumble

News & analysisNews & analysis

News & analysisNews & analysisAsia looking to open in the red on Wall St lead, Bitcoin bounces, Gold and Silver tumble

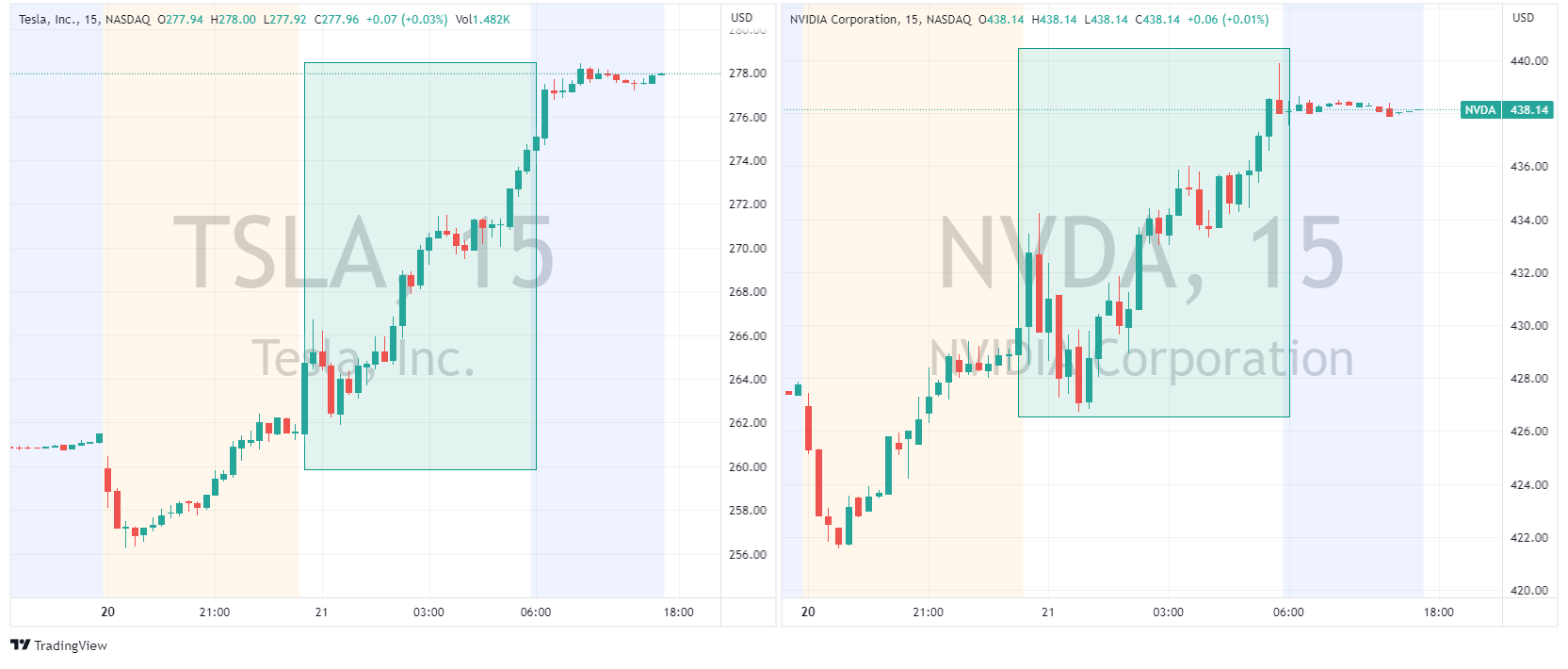

21 June 2023 By Lachlan MeakinUS indices drifted lower in Tuesday’s session in choppy action in what has been framed as preliminary month/quarter end selling in the absence of any US tier one economic releases. The Nasdaq was the “least worst” index (-0.16%) held up by another surge in momentum darlings Tesla (TSLA +5.34%) and Nvidia (NVDA +2.61%) which both surged on technicals and momentum chasing in the lack of any fundamental drivers.

FX Markets

The US Dollar Index finished marginally higher on Tuesday as US traders returned from the long weekend. DXY continuing its bounce off the 102 support level and hitting a high of 102.79 after big beat in US Housing Starts. The gains failed to hold in the afternoon though, with DXY following yields lower to eke out a gain for the session.

JPY saw gains vs the USD thanks to a decline in US Treasury yields. USDJPY fell from peaks of 142.25 in the Asian session to lows of 141.22 in the US afternoon as the 10yr yield hit a low of 3.71%. JPY traders attention on Wednesday will turns to the Tankan survey.

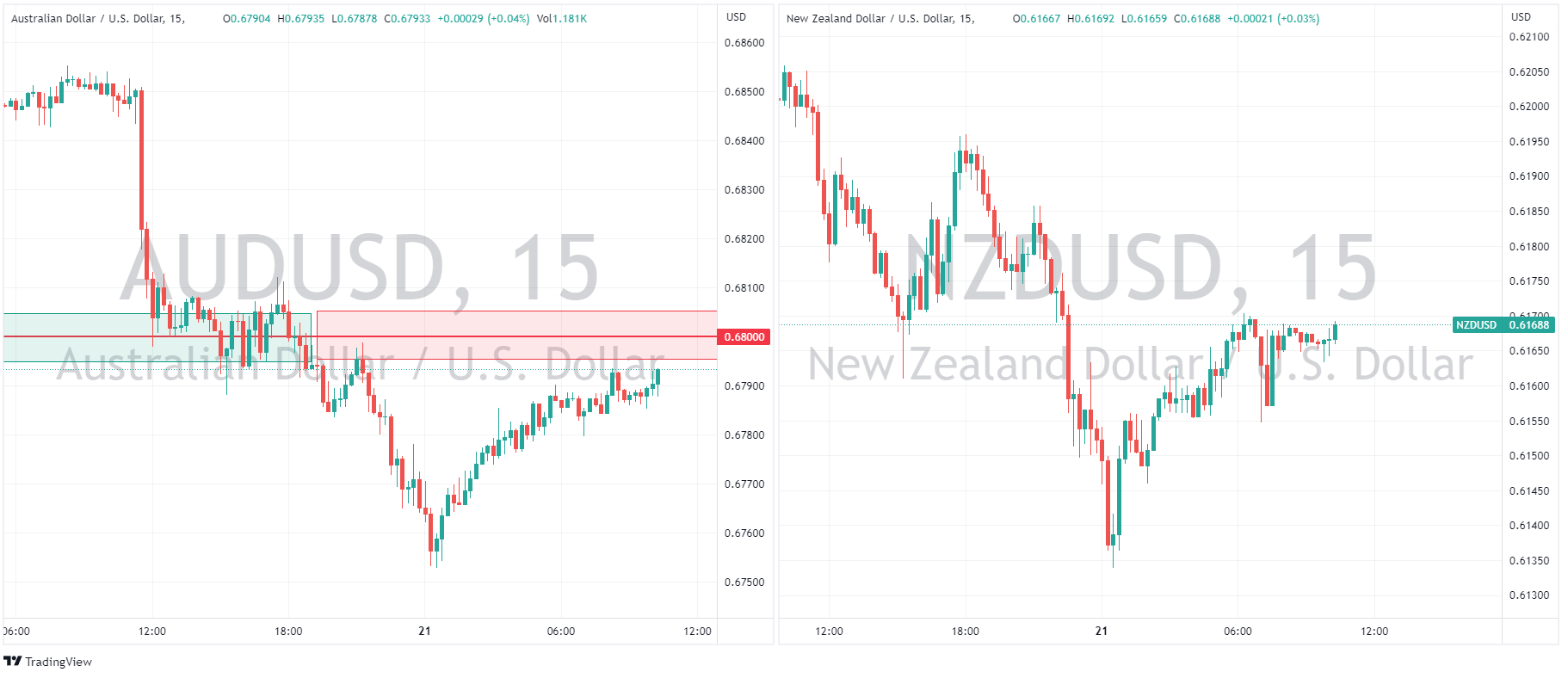

AUD and NZD saw notable weakness and were the underperforming currencies, particularly the Aussie after dovish RBA minutes saw the surprise June hike was “finely balanced” with the board also discussing leaving rates unchanged.. The dovish minutes and China growth concerns saw AUDUSD, push well below the 0.6800 support level, while NZDUSD also lagged on China woes ahead of New Zealand trade data Wednesday.

Gold and Silver were both hammered to one-week lows after strong housing data, both breaking the support of lower band of their recent ranges as the US dollar rallied, unlike the USD though neither XAUUSD or XAGUSD reversed course later in the session and settled near their lows.

Another big mover today was Bitcoin, with BTCUSD surging through the 28k level after EDX Markets, a new Cryptocurrency exchange backed by Citadel, Fidelity and Schwab unveiled the launch of its digital asset market on June 20.

Another fairly light economic calendar ahead for Wednesdays session, UK CPI, CAD Retails sales and a scheduled Jerome Powell speech being the main risk events.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Money in Motion: The Factors Influencing Currency Appreciation and Depreciation

Currency appreciation refers to the increase in value of one currency relative to another currency or basket of currencies. Depreciation refers to the opposite scenario where a currency loses value against another. When a currency appreciates, it takes more units of other currencies to purchase one unit of the appreciating currency, and of cours...

June 21, 2023Read More >Previous Article

AUDUSD testing key support after RBA minutes

The RBA minutes of their June meeting where another surprise hike had most of the market off side were released today, and they were surprisingly dovi...

June 20, 2023Read More >Please share your location to continue.

Check our help guide for more info.