- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- Asian stocks looking to open in the green after a volatile post-FOMC session on Wall St

- Home

- News & analysis

- Economic Updates

- Asian stocks looking to open in the green after a volatile post-FOMC session on Wall St

News & analysisNews & analysis

News & analysisNews & analysisAsian stocks looking to open in the green after a volatile post-FOMC session on Wall St

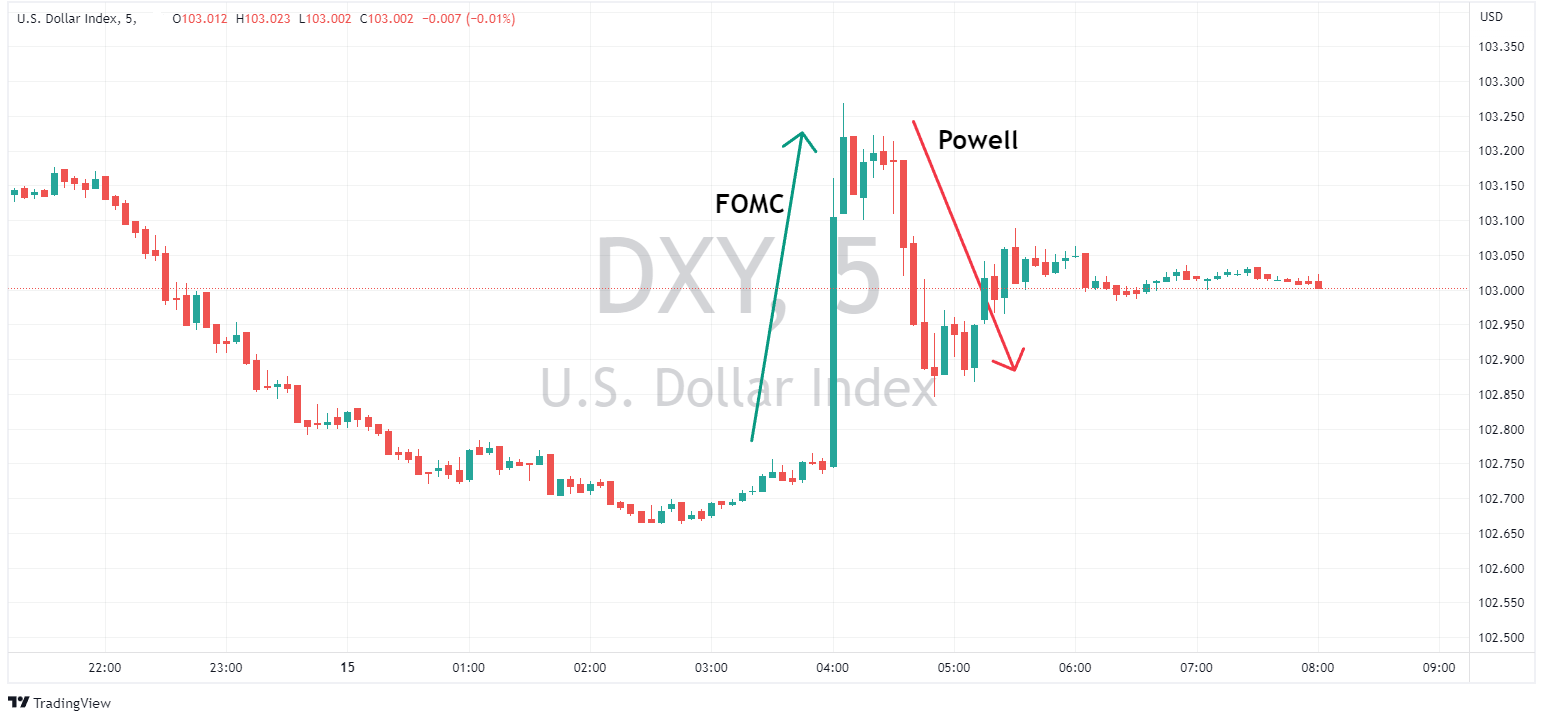

15 June 2023 By Lachlan MeakinUS markets finished mixed in a chaotic session as the long-awaited June FOMC monetary policy meeting concluded. As expected, the Fed held rates steady after 10 straight hikes, the tone of the accompanying statement was quite hawkish, signalling higher for longer in rates and the possibility of more hikes to come. More mixed signals were given by Chair Powell in his presser where he seemed to walk back some of the hawkish narrative, resulting in a real see-saw session in all risk assets.

FX Markets

USD sold off pre-Fed with the Dollar Index sliding to hit a low of 102.66, after a cooler-than-expected PPI figure. Price action reversed after the hawkish FOMC statement seeing a steep rally in DXY rising from 102.75 to 103.27, to round off the volatile session, the “dovish” presser from Powell saw a good chunk of those gains disappear.

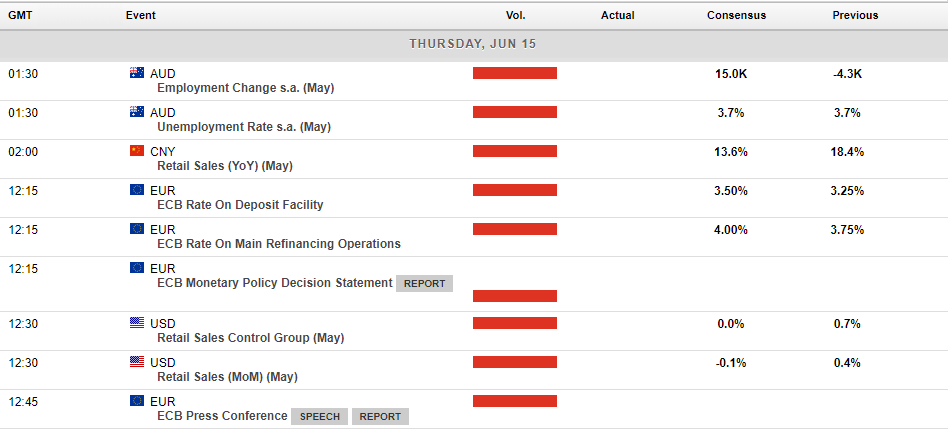

AUD and NZD were the G10 outperformers with the Kiwi seeing much stronger gains than the Aussie. Both the AUD and NZD were already outperforming pre-Fed, finding support from the positive risk environment and PBoC actions on Tuesday. NZDUSD and AUDUSD posted highs of 0.6236 and 0.6835, respectively. NZD has sold off early in the Asian session after a weak GDP reading, seeing NZ enter a technical recession after the economy shrank 0.1% in the first quarter., AUD traders will have employment figures released at 11:30 AEST to contend with.

GBP saw strong gains vs the USD. Cable tested 1.27 to the upside pre-Fed making a fresh YTD high and at the highest level since April 2022 as GBP continued to rally post the hot labour market data on Tuesday with the GBP gaining support as the markets price in a hawkish BoE going forward.

Gold bounced around in a similar path to the USD, XAUUSD tested it’s major support at 1939 with the USD surging post-FOMC, but sound solid buying at that level to again hold the lower band of it’s May/June range.

In the day ahead, the Asian session will see what could be an exciting AUD session, with Australian employment figures due, and Chinese Industrial production and retail sales not long after.

The ECB is also due to release their monetary policy later in the session, a hike of 25bp being fully priced in, but again as with the Fed it will be the accompanying statement and subsequent presser that have the most potential to cause volatility.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Asia Morning FX – AUD and EUR surge, USD takes a hit post FOMC, BoJ ahead

USD tumbled in Thursday’s session in the wake of a dovish Powell presser (relative to statement/dot plots) saw the Dollar bears in charge. This, coupled with a hawkish ECB and mixed US data saw DXY fall from highs of 103.38 in the European morning to a low of 102.08, with the psychological 102 level the next obvious support. A hawkish ECB, where ...

June 16, 2023Read More >Previous Article

Adding the RSI to your entry or exit decision-making

The Relative Strength Index (RSI) is an oscillator type of indicator, designed to illustrate the momentum related to a price movement of a currency pa...

June 14, 2023Read More >Please share your location to continue.

Check our help guide for more info.