- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- Big-Tech leads US Stocks lower, Gold slides again, Bonds bid ahead of CPI

- Home

- News & analysis

- Economic Updates

- Big-Tech leads US Stocks lower, Gold slides again, Bonds bid ahead of CPI

News & analysisNews & analysis

News & analysisNews & analysisBig-Tech leads US Stocks lower, Gold slides again, Bonds bid ahead of CPI

10 August 2023 By Lachlan MeakinMajor US indexes were lower in in a choppy session on Wednesday as traders position themselves for today’s pivotal CPI reading out of the US. Tech led the declines with the Nasdaq being the worst performing index, dropping 162 points (-1.17%), the NDX100 closing below its 50 Day MA for the first time since early March. AI exuberance seeming to lose steam with industry bellwether SMCI tumbling after releasing earnings, dragging down heavyweight NVDA almost 5%.

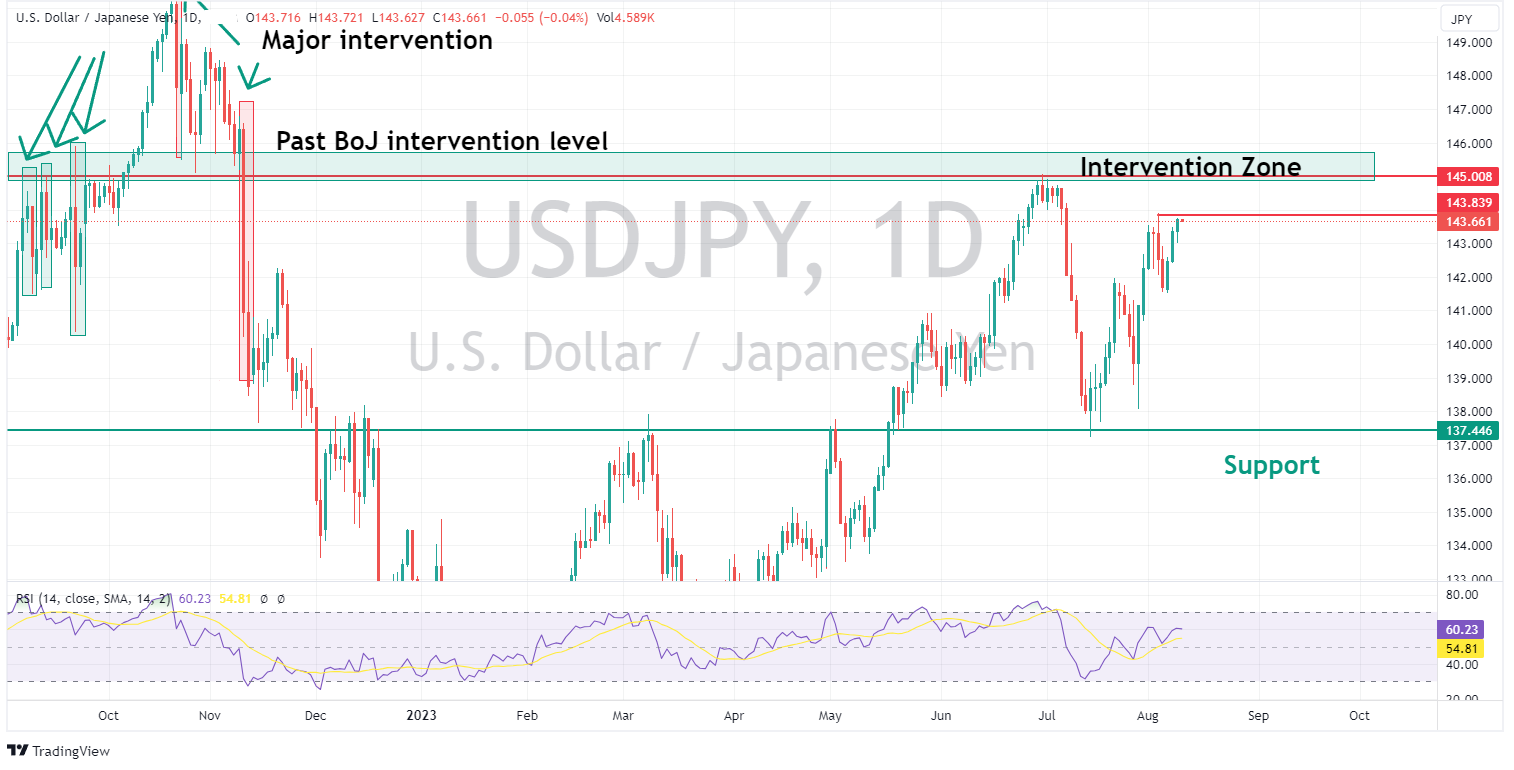

FX Markets

It was a quiet session in FX with most majors fairly flat on Wednesday ahead of today’s US CPI which is likely to see a more exciting session on Thursday. Highlights were JPY still grinding lower, USDJPY pushing to test the August highs and continuing its seemingly inevitable march to test the BoJ resolve at the 145 mark, though today’s CPI will play a big part in that in the near term.

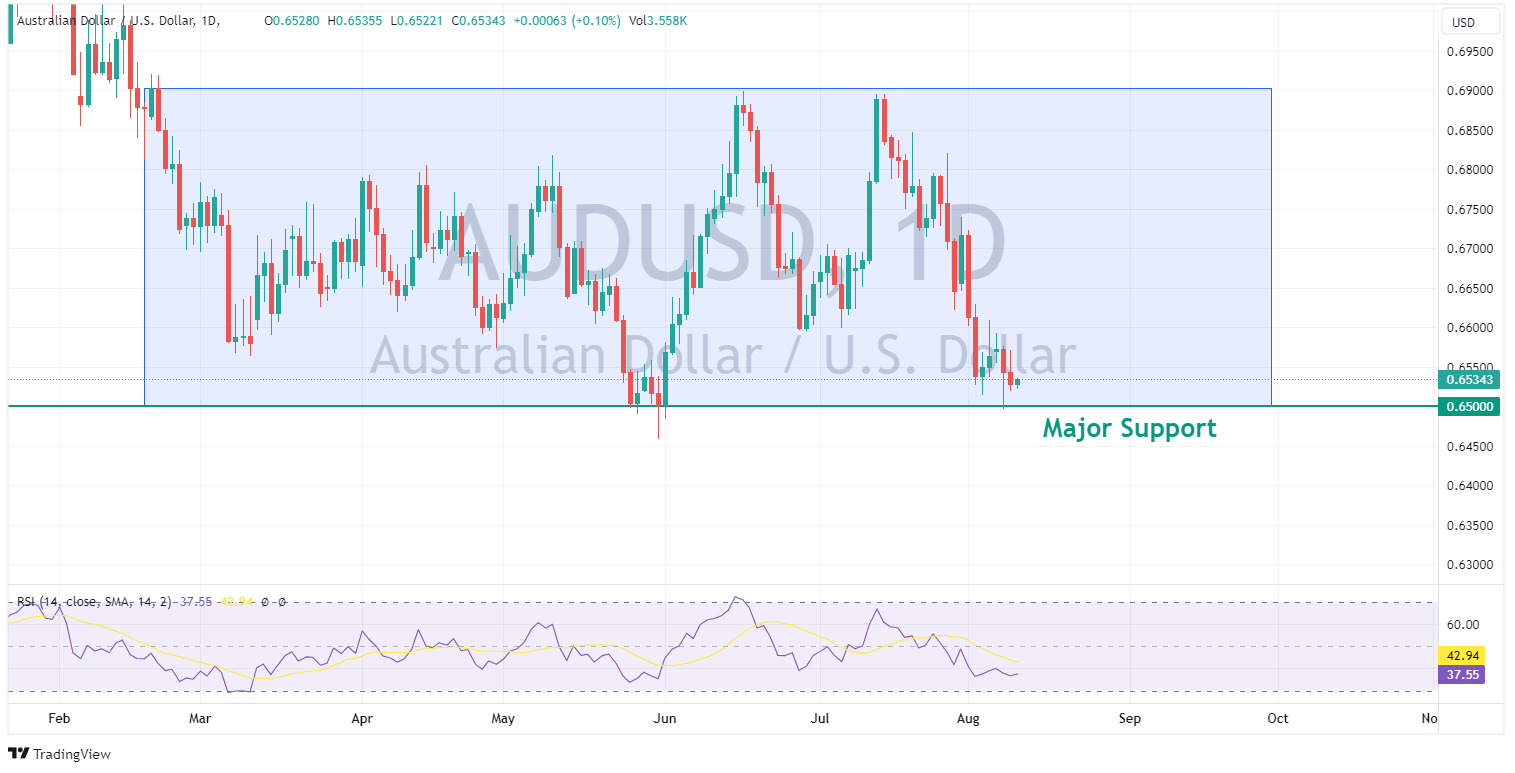

AUDUSD drifted lower on the sour risk sentiment, though still stubbornly holding on to the major support at the big figure at 0.6500, we could see a serious test of AUD bulls resolve at this level if US CPI comes in hot later today.

Commodities

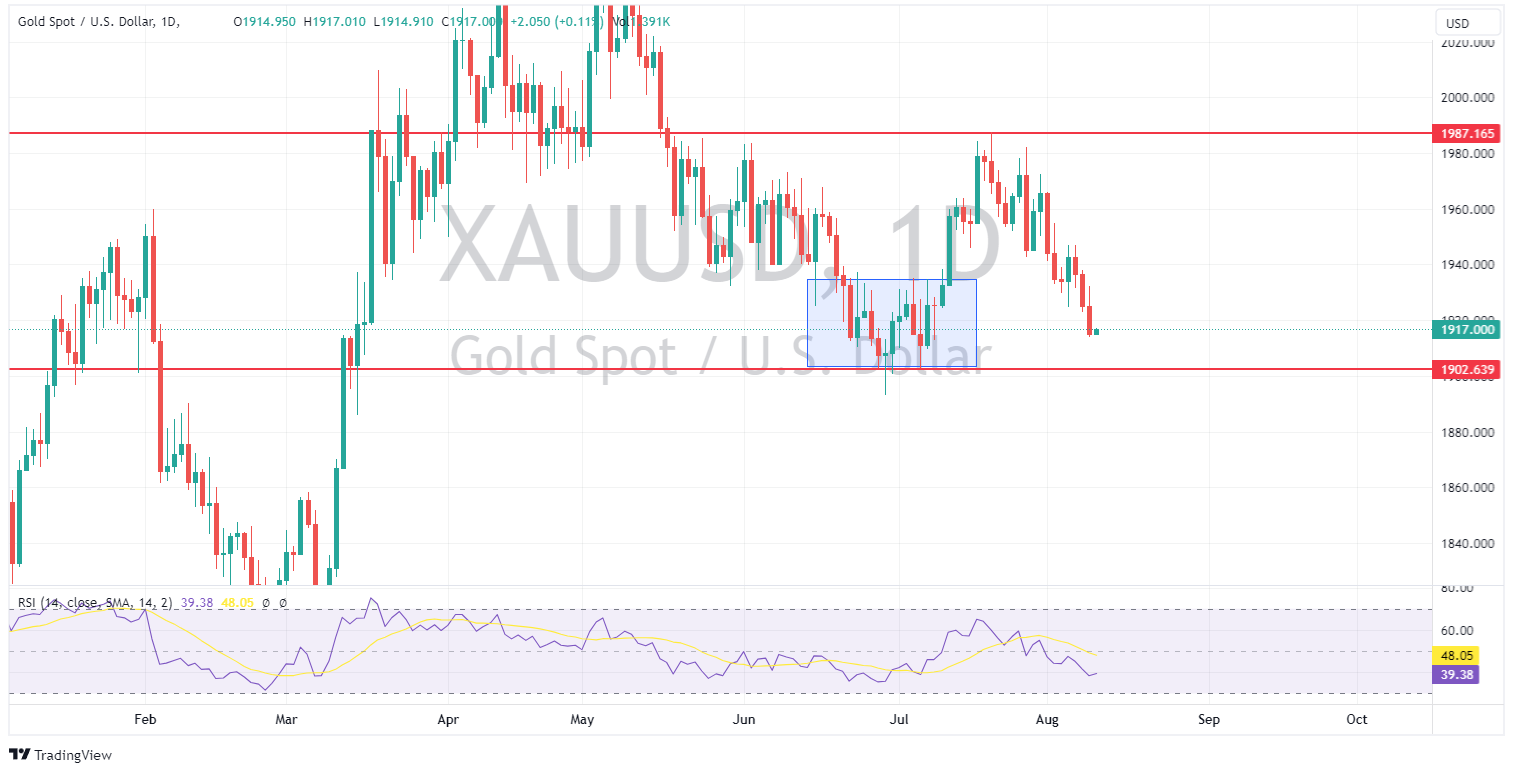

Continuing high yields and a USD grinding higher saw Gold continue its downtrend, XAUUSD pushing lower through the 1920 level, into the chop range we saw it trade in June/July. 1902 the next major support level, and from a technical point of view, fresh air below that, 1902 will be a critical level to watch.

Crude Oil surged again on Wednesday, breaking through the major resistance at 83.68 and hitting highs not seen since November ’22. The Daily RSI moving to an extreme overbought level.

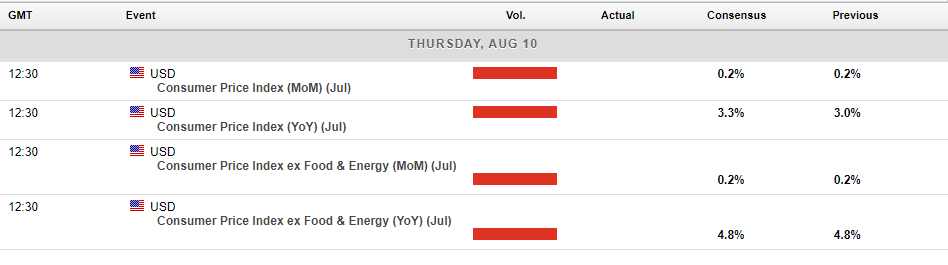

Today’s calendar is dominated by the much awaited US CPI, while there are a multiple tier one US releases between now and the next FOMC meeting, this will be one of the big ones to shape the markets expectations of the Feds move at that meeting, big volatility across all markets is very likely on its release.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

From Data to Dollars: An introduction to Quantitative Trading

Quantitative trading, often referred to as quant trading, is a trading strategy that relies on the use of mathematical models, statistical analysis, and data-driven approaches to make trading decisions. Often associated with the creation of specific automated trading systems, terms Expert advisors (EAs) on MetaTrader platforms, it a perceived as a ...

August 12, 2023Read More >Previous Article

FX analysis – markets turn risk-off on weak Chinese data, Moody’s downgrade – USD bid, AUD sinks

Global markets were buffeted by a risk-off catalysts in Tuesdays session. Weak Chinese trade data, hawkish Fed-speak and a Moody’s downgrade of US r...

August 9, 2023Read More >Please share your location to continue.

Check our help guide for more info.