- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Articles

- Economic Updates

- BNPL sector showing signs of a reversal after monstrous selloff

- Home

- News & analysis

- Articles

- Economic Updates

- BNPL sector showing signs of a reversal after monstrous selloff

News & analysisNews & analysis

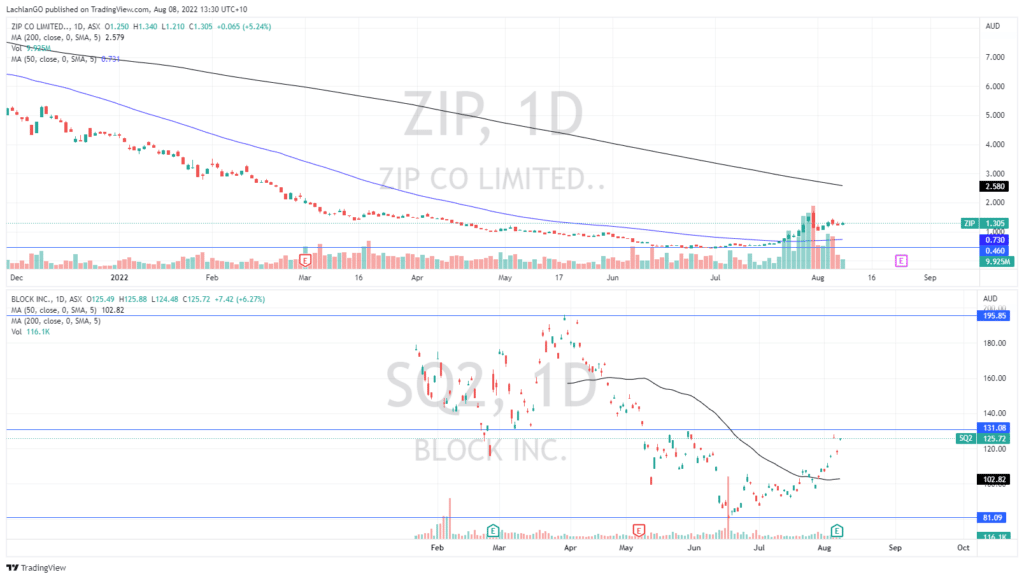

News & analysisNews & analysisThe Buy Now Pay Later, (BNPL) sector has seen a resurgence after a long and brutal sell-off. The reason for, much of the resurgence is not related to any specific catalyst but rather, changing sentiment within the broader market. The sector rose significantly before and during the Covid-19 pandemic. However, as the pandemic came to an end and consumers returned to traditional forms of purchasing, the BNPL sector began to lose some of its steam. In the last few weeks, the sector has seen a resurgence with many of the heavyweights including ZIP, (ZIP) and Square, (SQ2) seeing large surges in their share prices.

Impact of interest rates and recession fears

The big issue with the sector was always going to be how would interest rate changes would affect the sector and its model. The business model generally allows consumers to purchase goods/services in instalments with the requirement to pay interest if the repayments are not met. The interest payments have been a cause for concern from consumers, especially as interest rates have been raised by the Reserve Bank of Australia and other Central Banks. These rate increases created very bearish sentiment for the BNPL sector with ZIP and SQ2 seeing large dips in their share price.

The market also became saturated very quickly, meaning many large institutions and banks created their own BNPL service or bought their own such as Square in the case of their purchase of industry leader Afterpay. This has led to further potential transactions and failed mergers. Specifically, Latitude, (LFS) and its failed acquisition of Humm, (HUM) and ZIP and its failed acquisition of Sezzle, (SZL).

Why the surge?

The price of ZIP has seen a very sharp rise. This has been partially because of the short squeeze that has been able to accelerate the price rise. With so much selling occurring and such a high level of short interest, at some stage, a buying zone had to present itself. Once this zone was established the volume was able to follow through. The market was also buoyed by inflationary pressures easing because of the interest rate hikes.

On both Price Charts below, it can be seen that some kind of ‘bottom in the medium term at least has been found. For ZIP, this was seen at $0.45 and SQ2 at $81. Importantly, and more so for ZIP, the breakout from the bottom was supported by strong buying volume. This likely indicates that large institutions were behind the reversal.

Looking ahead, whilst a ‘bottom’ does seem to be in, the sector is still at the mercy of the overall market and if a recession hits or more bearish sentiment takes over, the BNPL sector may fall again. However, if all the worst outcomes have been priced in already, then long trading/investing opportunities may become apparent.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Barrick Gold beats Q2 estimates – sends the stock price higher

Barrick Gold Corporation (GOLD) reported its latest financial results before the market open in the US on Monday. One of the world’s largest gold producers reported revenue of $2.874 billion vs. $1.178 billion expected. The Canadian company reported earnings per share of $0.24 per share for Q2, also beating analyst estimate of $0.23 per sha...

August 9, 2022Read More >Previous Article

Four Australian Stocks to Watch

Today, we are going to be looking at some Australian stocks to watch, there has been positive activity in the Australian market over the last couple o...

August 8, 2022Read More >Please share your location to continue.

Check our help guide for more info.