- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- FOMC incoming – DXY, Oil analysis

News & analysisIn one of the most anticipated FOMC meetings this year , the Federal Reserve is widely expected to leave the fed funds target range at 5.25-5.5% in today’s FOMC meeting with futures markets pricing in virtually no chance of the December hike the Fed had previously pencilled in via their last “Dot Plot” projections.

What will move markets will be the updated economic projections (with an updated Dot Plot), the accompanying statement and Powells presser, will the Fed push back against the markets dovish expectations at the rate of cuts next year?

A pushback of some kind is expected, especially after US CPI figures yesterday showed a modest though unexpected rise in the m/m figure, so what will move the market is a more or less hawkish than expected Powell.

Charts to Watch:

US Dollar Index (DXY)

DXY has been trading in a tight range for the last week, trapped between 104.25 to the upside which is the 7-day high and trendline resistance level, and 103.50 to the downside, the 50% fib and 200-day MA support area. A more hawkish Powell will see yields rally and should push the DXY higher along with them, the 104.25 level will be key to watch if this is the case, a break and hold will be needed to see another leg higher in USD. A “dovish” Powell and the support area at 103.50 could come into play, a fail to hold the support could see the resumption of the November Dollar downtrend.

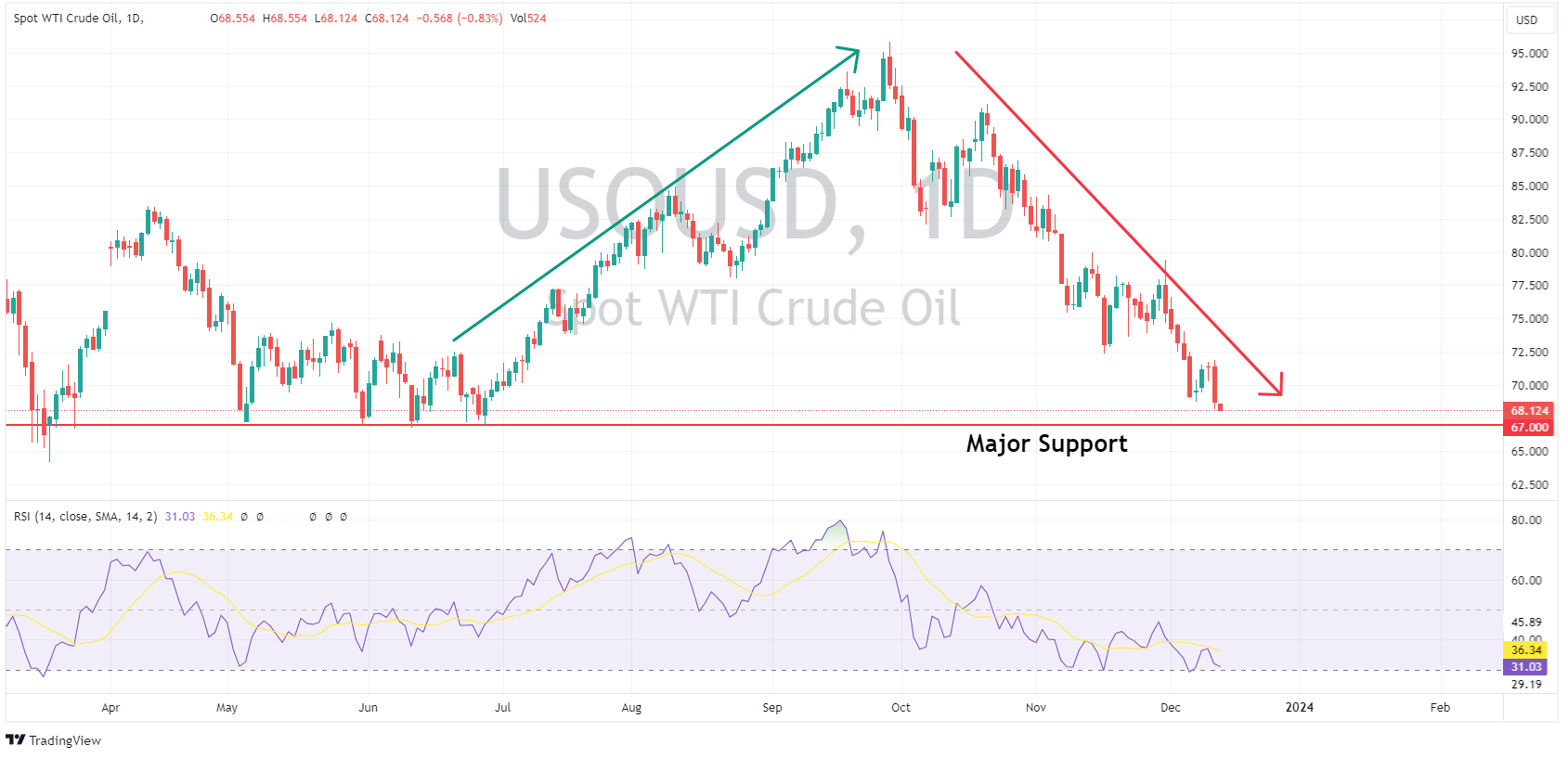

Crude Oil (USOUSD)

Crude Oil has been in a non-stop downtrend since September due to demand concerns as higher rates start to bite on the world economy. USOUSD is approaching a major support level at 67 USD a barrel, a level that held further declines in the earlier part of 2023. A hawkish Powell, where he hints rates will remain higher for longer than the market is pricing in wil add to those demand fears and could see this major support level tested. On the other hand a dovish Powell should give oil a much needed tailwind as demand fears wane, and could see a bounce in price from these oversold levels.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

FX Analysis – Dollar dumps, Gold surges on Fed pivot

Wednesdays FOMC meeting was always going to be about whether we’d see a hawkish pushback against market expectations of a dovish Fed in 2024, or a validation of those expectations, from the market reaction to the meeting, traders decided the latter is the conclusion. Rates were kept on hold at 5.35%-5.5% as expected but the updated dot plot an...

December 14, 2023Read More >Previous Article

Johnson Controls International results announced – the stock is down

On Monday, Citigroup raised its target price for the Irish multinational conglomerate, Johnson Controls International plc (NYSE: JCI), from $58 to $61...

December 13, 2023Read More >Please share your location to continue.

Check our help guide for more info.