- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- Lynas Rare Earths releases impressive Quarterly growth figures

- Home

- News & analysis

- Economic Updates

- Lynas Rare Earths releases impressive Quarterly growth figures

News & analysisNews & analysis

News & analysisNews & analysisLynas Rare Earths (LYC) has continued its recent momentum by releasing impressive quarterly figures. LYC is a premier Rare Earth mining and production company and the largest outside of China. The companies’ main mining operation is in Kuantan, Malaysia whilst its processing facilities are based in Western Australia. The company also has plans to develop a mining site in Kalgoorlie in Western Australia to expand its operations.

The company reported strong growth in all key metrics. It saw a strong 25.93% rise in total volume sold since the last quarter. This helped support a 38.14% increase in sales revenue and a 42.37% increase in sales receipts. The revenue was boosted by an overall increase in the demand and price of Neodymium and Praseodymium which are the essential rare earths that are needed for electronics and EV batteries.

LYC CEO Amanda Lacaze had this to say about the company’s results. “I am very pleased to report a record quarter for the period ending 31 March 2022.” A key message from Lacaze was that the company is focused on “developing initiatives to increase supply to support continued market growth.”

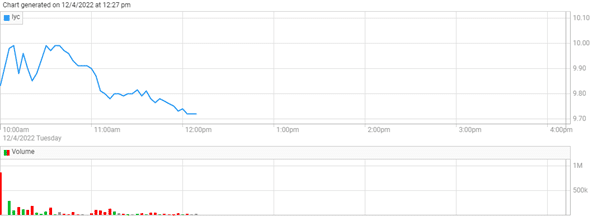

The LYC share price as of 12.30 pm on 12 April 2022 the price of LYC stands at $9.63. The price is down 1.7% from the previous day’s closing price.

As the price of Neodymium and Praseodymium continue to rise with the increase in demand for critical minerals. LYC is well-positioned to take advantage as one of the world’s largest producers of Rare Earths.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Better than expected – BlackRock tops Wall Street estimates for Q1

BlackRock Inc. reported its first quarter financial results before the opening bell in the US on Wednesday. World’s largest asset manager reported revenue of $4.699 billion, beating analyst forecast of $4.672 billion. Earnings per share also topped analyst forecast at $9.52 per share vs. $8.70 per share expected. ''BlackRock generated $1...

April 14, 2022Read More >Previous Article

Dividends with potential to keep an eye on

Choosing the right Dividend has always been a mixture or in-depth analysis, market opportunity and a bit of luck the company reaches their financial g...

April 12, 2022Read More >Please share your location to continue.

Check our help guide for more info.