- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- Market Analysis – USD surges, AUD hit by RBA, Oil and Gold continue decline

- Home

- News & analysis

- Economic Updates

- Market Analysis – USD surges, AUD hit by RBA, Oil and Gold continue decline

News & analysisNews & analysis

News & analysisNews & analysisMarket Analysis – USD surges, AUD hit by RBA, Oil and Gold continue decline

6 December 2023 By Lachlan MeakinUSD was bid in Tuesdays session with DXY finding strong support at its 200 Day MA and pushing up to test the big 104 figure before losing steam. DXY did have a sharp dip on big miss in the JOLTS employment data though a strong ISM Services PMI figure offset that and saw DXY rally for the rest of the session. Interestingly yields didn’t recover the same way, with the US 10-Year yield falling to 3-month lows showing the USD strength was more of a technical pullback from oversold levels and haven flows on a choppy equity market.

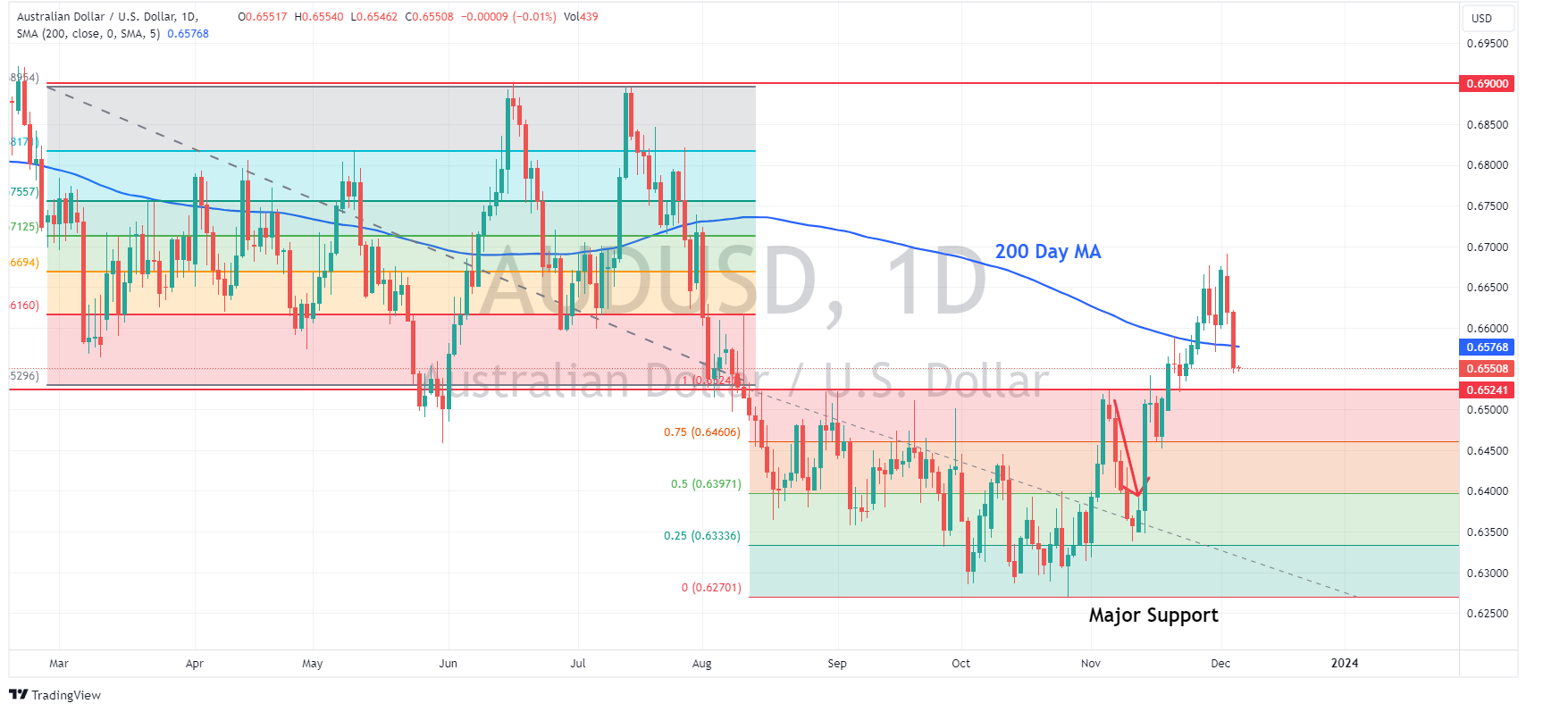

AUD was buffeted by a strong USD and fallout from the RBA rate decision. The central bank kept rates on hold as expected but the accompanying statement lacked the hawkish messaging that AUD bulls were looking for. AUDUSD pushing decisively below its 200-day MA support level and printing a low of 0.6545. The previous range top of 0.65 will be the key level to watch to the downside coming into today’s Aussie GDP report.

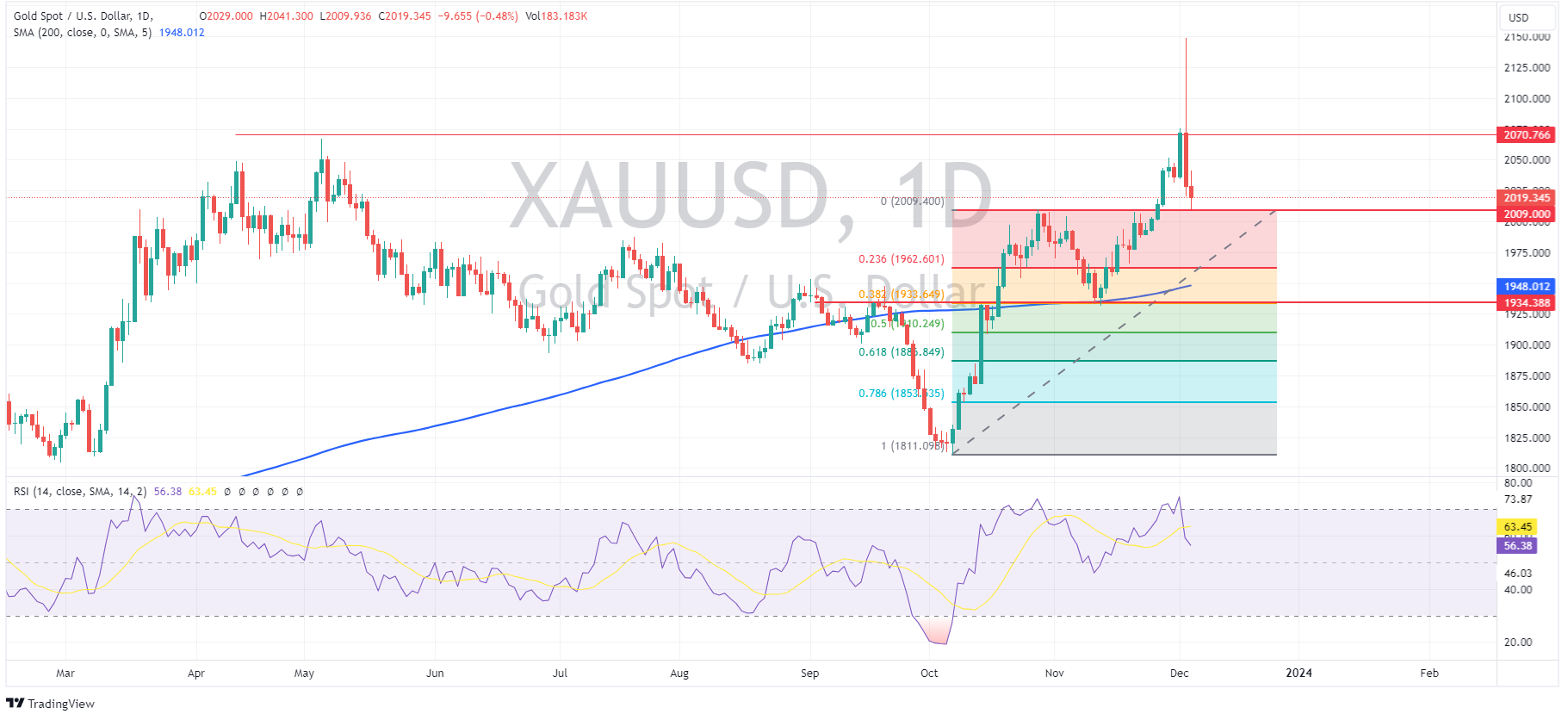

Gold continued its steep decline after setting all-time highs on Monday. XAUUSD attempted an Asian session rally but reversed course as the US came online breaking lower to test the 2009 resistance/support level. USD and a technical pullback from extreme overbought conditions seemingly the main driver of the precious metal. Gold traders will be watching if the previous established resistance level at 2009 now switches to support.

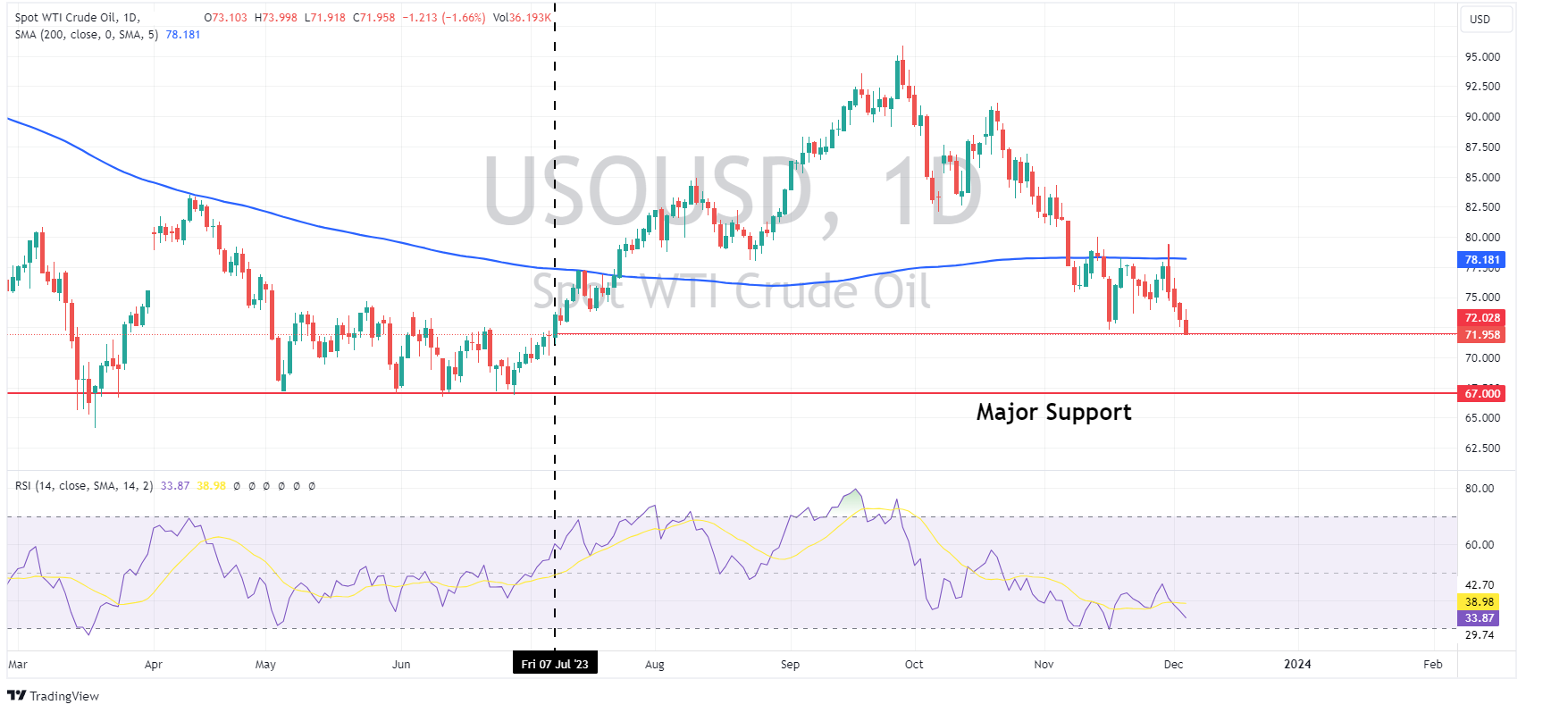

Crude oil declined for a 4th straight session on USD strength an inventory builds and concerns the “voluntary” nature of the recently announced OPEC+ production cuts may not happen. There was an initial move higher after a Russian press report of comments from Deputy PM Novak saying Russia intends to fully fulfil its obligations to voluntarily reduce oil output as early as January. The initial pop didn’t last though and crude trended lower for the rest of the session hitting 5-month lows.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

AutoZone latest financial results announced

The largest US retailer of aftermarket automotive parts, AutoZone (NYSE: AZO), released its latest earnings report for its fiscal first quarter that ended on November 18, 2023, before the US market opened on Tuesday. Company overview Founded: July 4, 1979 Headquarters: Memphis, Tennessee, United States Number of employees: 119,000 (20...

December 6, 2023Read More >Previous Article

NIO Q3 results have arrived – the stock is rising

Chinese electric vehicle company, NIO Inc. (NYSE: NIO), reported Q3 results before the opening bell in the US on Tuesday. Company overview Fou...

December 6, 2023Read More >Please share your location to continue.

Check our help guide for more info.