- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- State of Play for FAANG stocks

News & analysisThe FAANG stocks are perhaps the most well-known and well-advertised stocks in the market. The FAANG stocks are made up of META (Which used to be Facebook), Apple, Amazon, Netflix, and Google (now traded as Alphabet). They are often grouped as they are some of the biggest tech players in the market with a collective market cap of around 7 trillion dollars. The recent tech sell-off had a profound impact on these stocks. By looking at the FANG index, trading ideas for the individual stocks may be generated.

With the market sentiment changing the way forward for these stocks is unknown. Will they bounce up to new highs and continue their rise to all-time high prices or will the rally fail and will they fall back down.

Whilst looking at the valuations of these companies, they may seem to be overvalued. They run at very large multiples of their earnings. The group of stocks has been one of the best performers over the previous decade. In addition, the group performed exceptionally during the Covid pandemic. With the impending threat of interest rates rising, challenges to the performance of the FAANG stocks may be extended as increased borrowing costs has a much greater effect on growth stocks.

Meta and Netflix in particular have struggled the most in the group. Both companies have had to face challenges relating to increased competition within the market. Conversely, Google and Amazon both recorded outstanding results recently. Google’s parent company, Alphabet smashed analyst expectations with revenue up by 32% compared to the same time the prior year.

Amazon similarly beat analysts’ expectations after the release of its last earnings report, increasing net sales by 9% to 137.40 billion. They also grew their net income by 98.6% for the year-on-year result. Therefore, some of these top tech companies still have large room for growth.

Technicals

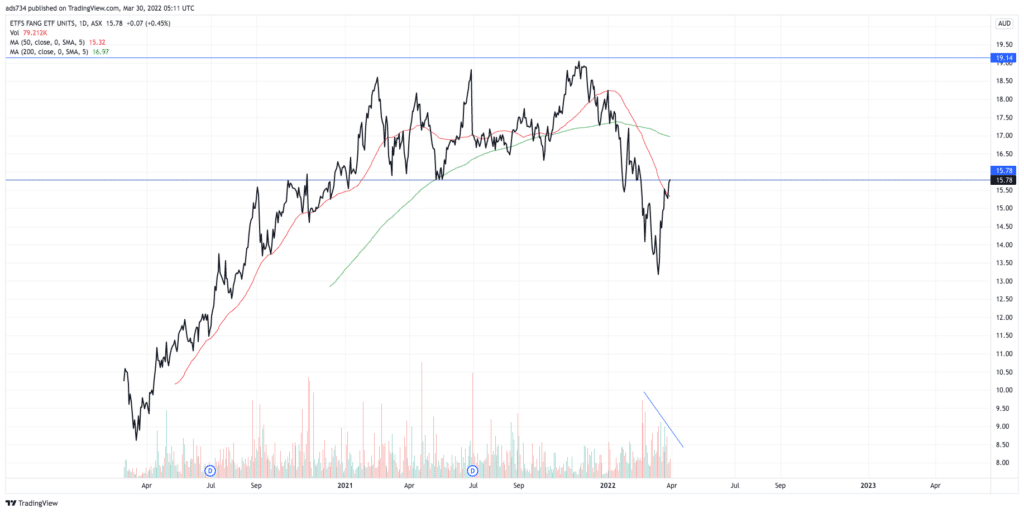

The price action for the FAANG stocks is somewhat encouraging indicating that a reversal may be near. Currently, the price of the FANG index is sitting just on the resistance level at 15.80. The FANG index had been trading between a range of 15.80 and 19.14 for almost 6 months before it broke downwards. The breakdown was largely on the back of inflationary pressures.

The concern is that looking at the 50 period MA and the 200 period MA a death cross has occurred. This is where the 50MA has crossed below the 200MA. It is indicative of sellers being in control. In addition, both averages are steadily on the decline.

On the other hand, there are some small signs that the 50 Period MA is starting to flatten. As the price of the ETF has risen the volume of sellers has dried up. This indicates that the selling has been absorbed. In addition, the price has been able to reclaim the 50MA. If the ETF can confirm the break back into the range it may be able to challenge the top-level support.

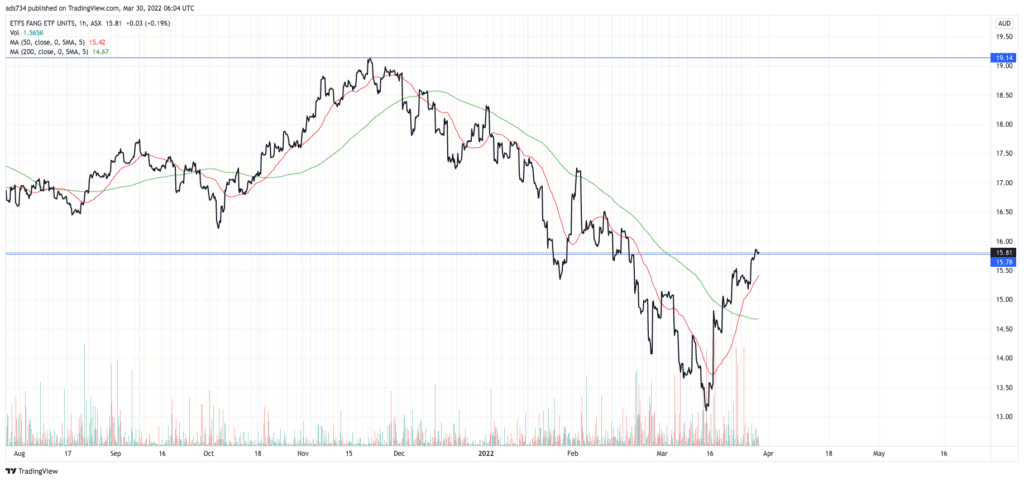

On the shorter hourly time frame, the 50 MA has been accelerating upward towards the longer-term support at 15.80. There has been a cross of the 50 MA above the 200 MA which indicates a positive shift. Lastly, the 200MA for the first time since Nov 2021 is beginning to plateau. A buying opportunity for these stocks may become apparent shortly.

All of the individual FAANG stocks can be traded on Go Markets MT5.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Walgreens Boots Alliance exceeds Wall Street expectations

Walgreens Boots Alliance Inc. reported its latest financial results for the second quarter of fiscal 2022 on Thursday. The pharmaceutical company reported revenue of $33.756 billion in the quarter, beating analyst forecast of $33.228 billion. Earnings per also topped analyst estimates at $1.59 per share vs. $1.39 per share expected. CEO Ro...

April 1, 2022Read More >Previous Article

Paychex beats estimates

Paychex Inc. reported its latest financial results before the opening bell on Wall Street on Wednesday. The US payroll services company reported to...

March 31, 2022Read More >Please share your location to continue.

Check our help guide for more info.