- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- Stocks and Crypto down, Oil dumps and pumps as market goes risk off amid China COVID woes

- Home

- News & analysis

- Economic Updates

- Stocks and Crypto down, Oil dumps and pumps as market goes risk off amid China COVID woes

News & analysisNews & analysis

News & analysisNews & analysisStocks and Crypto down, Oil dumps and pumps as market goes risk off amid China COVID woes

22 November 2022 By Lachlan MeakinUS equities finished with modest losses in Mondays session of a holiday shortened week in a low volatility session. The Dow Jones dropping 45.42 points or -0.13%, the more risk sensitive NASDAQ underperforming finishing down 121.55 points or 1.09%.

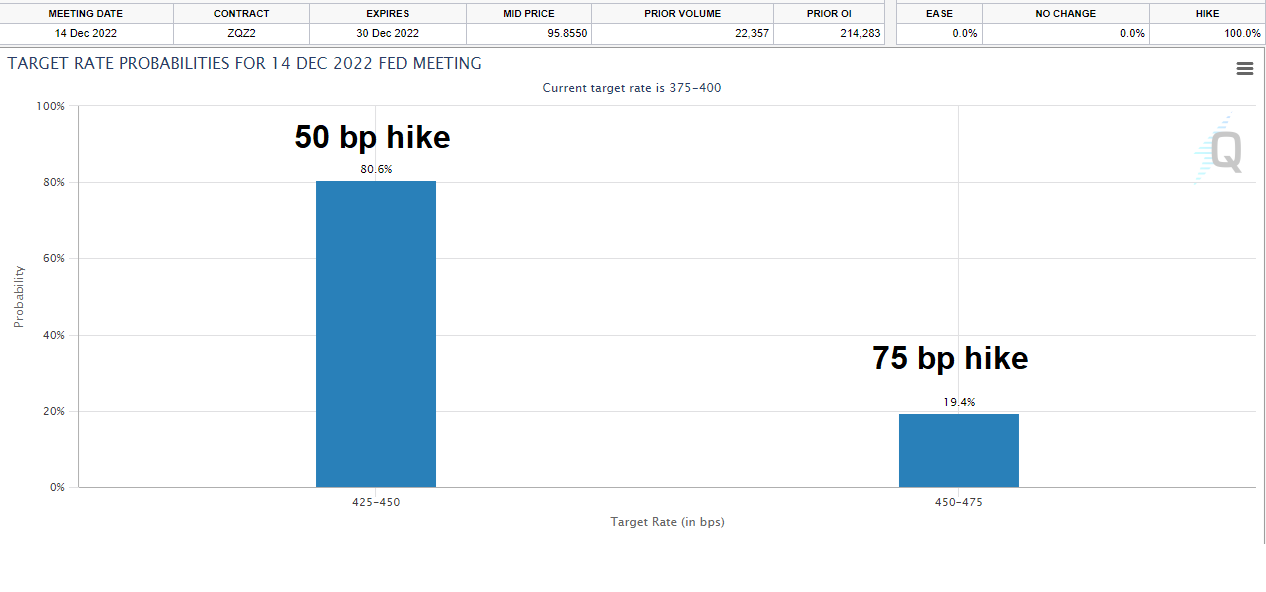

Scheduled news flow was light with only scheduled speeches from Fed voting members Daly and Mester having any weight, both re-iterated similar Fed themes of fighting inflation, but Daly’s comments were seen as dovish with comments like “Fed has more work to do when it comes to rate hikes but also must be mindful of the risk of tightening policy too much”. Though this failed to lift the markets or move any Fed expectations of the Feds next hike, with 50bp at their December meeting pretty much a lock according to rates markets.

Most the market action came out of the unscheduled releases, with soaring COVID cases, lockdowns and increased testing requirements being reported in China cast doubt on the global growth story and cast a bearish pall over the market and seeing the offshore Yuan take a tumble, another tailwind for the US dollar.

There was more pain in crypto land as the FTX hacker started dumping their Ethereum, seeing the ETHUSD tumble below 11k before finding some support, BTCUSD followed, breaking back below 16k and testing the lows set earlier in the month.

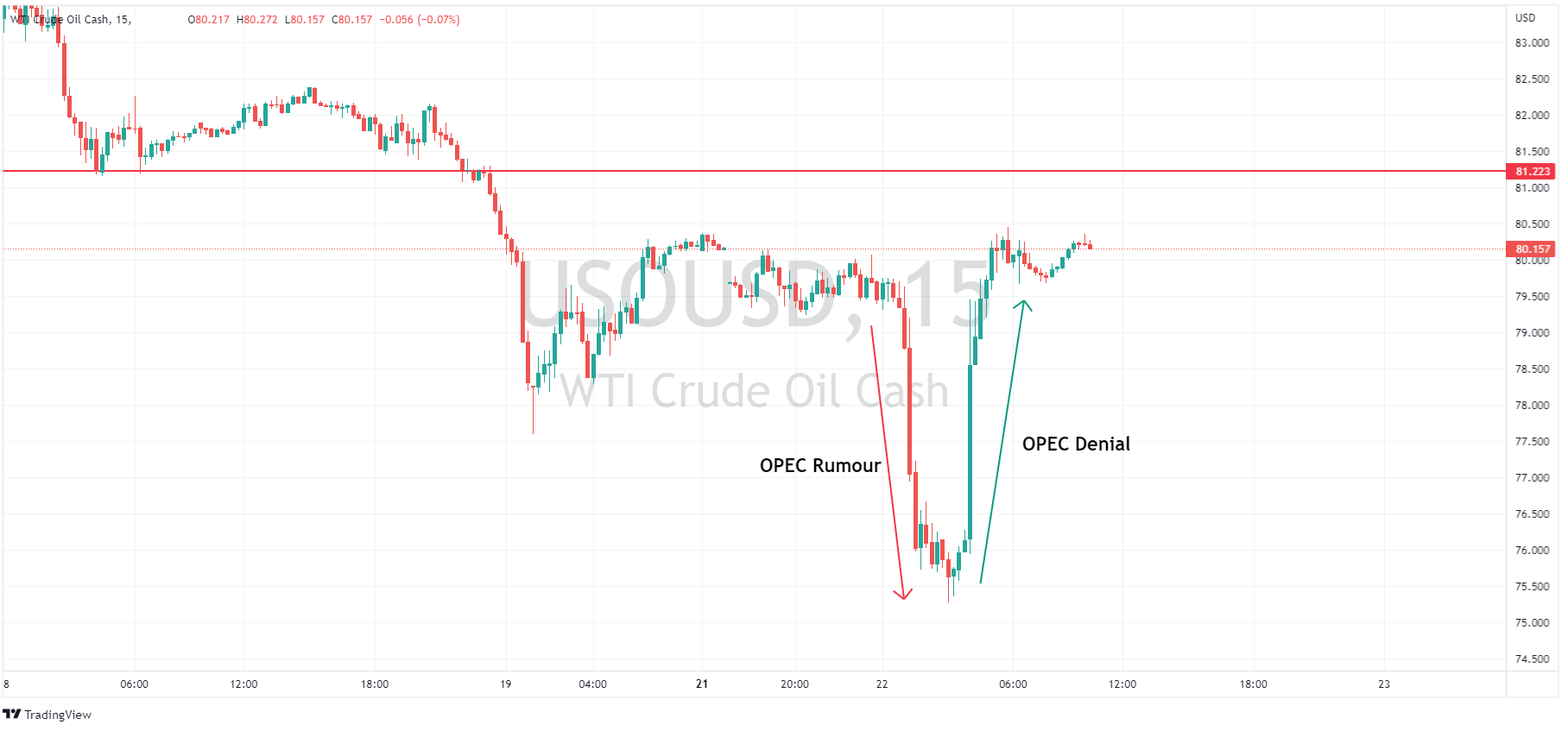

Oil had an exciting session, already under pressure from a strengthening US dollar and COVID news from China then rumours from the Wall St Journal that OPEC+ was considering production hikes saw US crude dumped down to a $75 handle. This however didn’t last long as the Saudis denying this rumour soon after seeing the price pump back up to unchanged, certainly a wild ride for Oil traders.

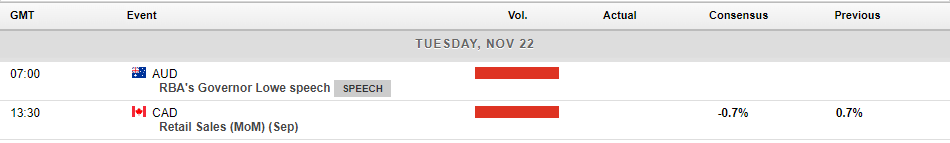

Todays economic releases are again light on the ground, with RBA governor Lowe scheduled to speak at a dinner in Melbourne (unlikely to have any real market impact) and Canadian retail sales.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Medtronic posts mixed results

Medtronic posts mixed results Medtronic Plc (NYSE: MDT) reported latest financial results for its second quarter of fiscal year 2023, which ended October 28, 2022 on Tuesday. The medical technology company posted mixed results for the quarter. Revenue reported at $7.585 billion (down 3% year-over-year) vs. $7.698 billion expected. Earni...

November 23, 2022Read More >Previous Article

Zoom tops Q3 estimates

Zoom Video Communications Inc. (NASDAQ: ZM) reported third quarter financial results after the market close in the US on Monday. The US communicati...

November 22, 2022Read More >Please share your location to continue.

Check our help guide for more info.