- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- The Week ahead – BoE and SNB set to hike, RBA minutes and Jerome’s jawboning.

- Home

- News & analysis

- Economic Updates

- The Week ahead – BoE and SNB set to hike, RBA minutes and Jerome’s jawboning.

News & analysisNews & analysis

News & analysisNews & analysisThe Week ahead – BoE and SNB set to hike, RBA minutes and Jerome’s jawboning.

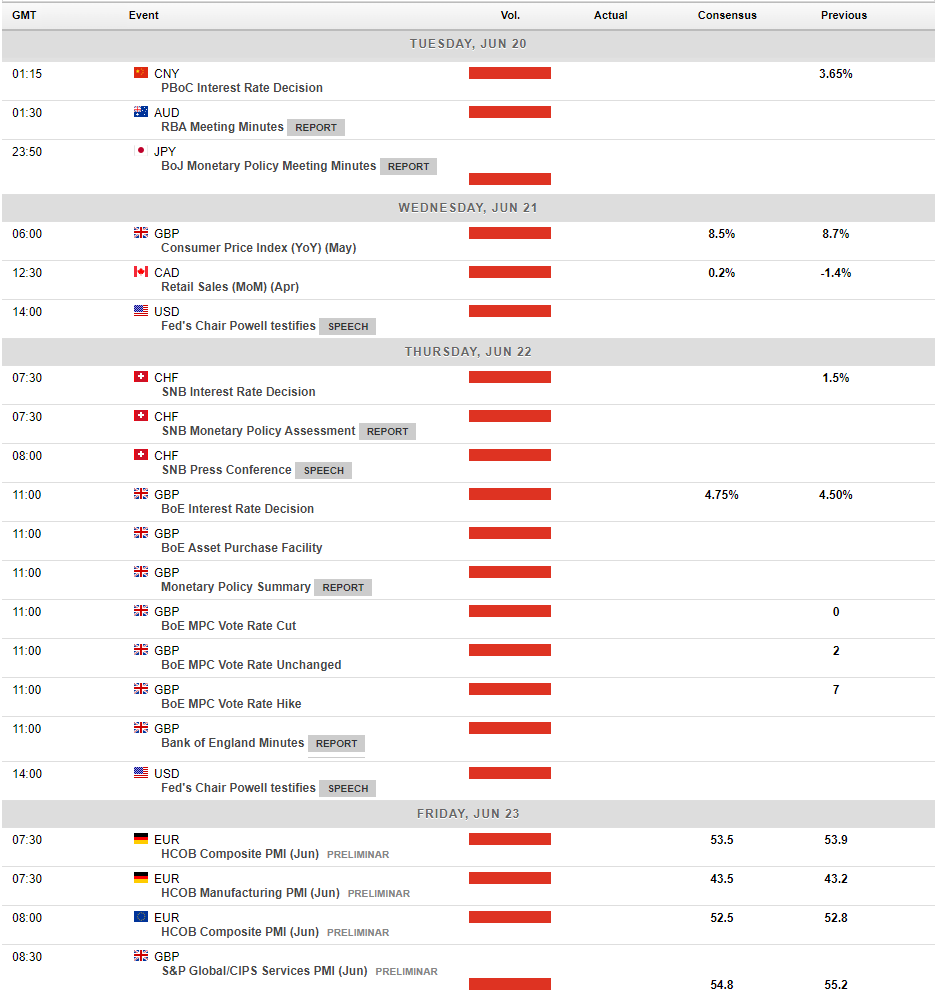

19 June 2023 By Lachlan MeakinMore Central bank action is set to dominate the news flow this week with the FOMC and ECB decisions done, coming up we have the Bank of England and the Swiss National bank with monetary policy meetings, sprinkled with a slew of Fed speakers which should keep markets interesting.

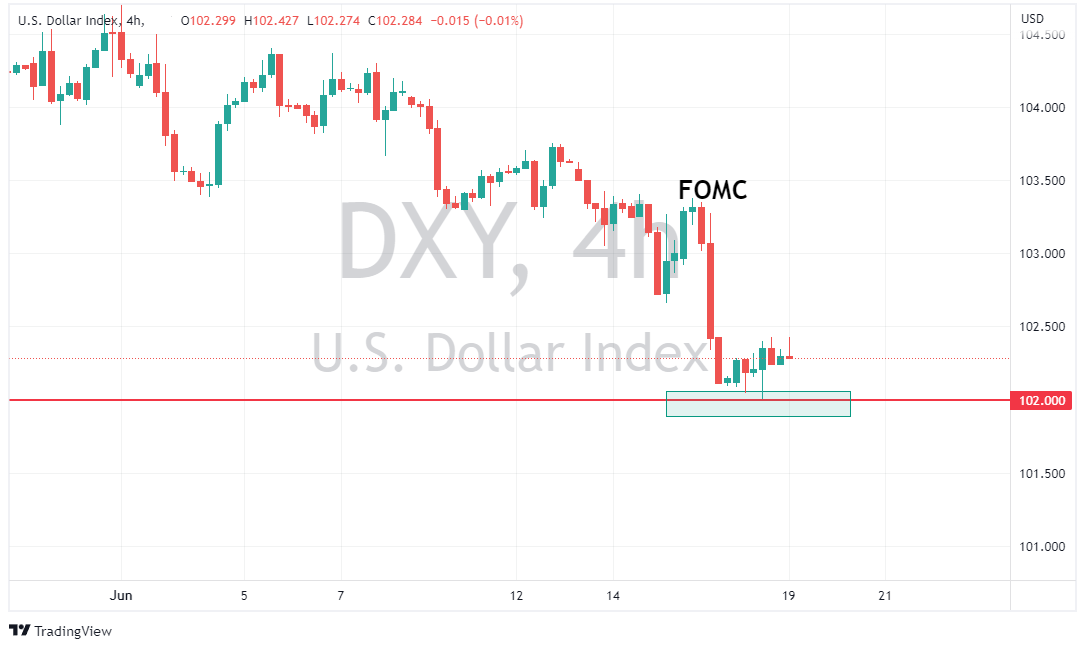

US – Dollar Index holding critical support.

US markets will get off to a quiet start, with the markets closed on Monday due to a public holiday. After last week’s fireworks with the FOMC deciding on a “hawkish” pause (Though Chair Powell did water that down with a “dovish” presser) this week will be all about the Fed speak for traders trying to gauge what’s next from the Fed. Fed members Bullard, Mester , Barkin and Goolsbee are all slated for appearance this week but it will be Thursdays appearance of Powell before the Senate Banking Panel which I suspect will draw the most interest. Currently markets seem to be convinced that last weeks FOMC decision was a skip, not an end to the Feds tightening cycle, so Powell’s comments will be closely watched by USD traders with the Dollar Index finding some minor support at 102 after its worst week since January, holding this level will hinge on the tone of the Fed speakers this week.

UK – Bank of England set to hike – will they push back against the market’s hawkishness?

After some hot inflation and wage data, markets are now expecting the Bank of England to take rates close to 6% over the coming months from the current 4.50% (Another six 25 bp hikes!) The question traders will be taking into Thursday’s BoE meeting (Where a 25bp hike is fully priced in and then some) is whether the Bank will push back against this extremely hawkish pricing or not which will have a material effect on the GBP in the short term. The GBP rallied strongly last week, blasting through all previous resistance to hit 14-month highs on the back of this hawkish pricing, so whether this rally has legs left or not will depend greatly on the BoE’s comments accompanying the rate decision.

Switzerland – SNB rate hike 25 or 50?

The SNB is also set to release their latest monetary policy on Thursday where a hike of 25bp is fully priced in with a 50-50 shot at a supersized 50bp hike. Inflation in Switzerland is fairly benign by international standards at 2.2%, but it is still above the SNB target band of 0 – 2.0%, that, combined with hawkish rhetoric seen recently out of SNB members and the Swiss coming from a low base (official rate is only 1.50% currently) has seen markets re-price to the hawkish side for this decision, a 50bp hike would likely see the CHF reverse some of it’s recent weakness, either way the usually boring CHF will be one to watch over this decision with some key technical levels in the EURCHF in play.

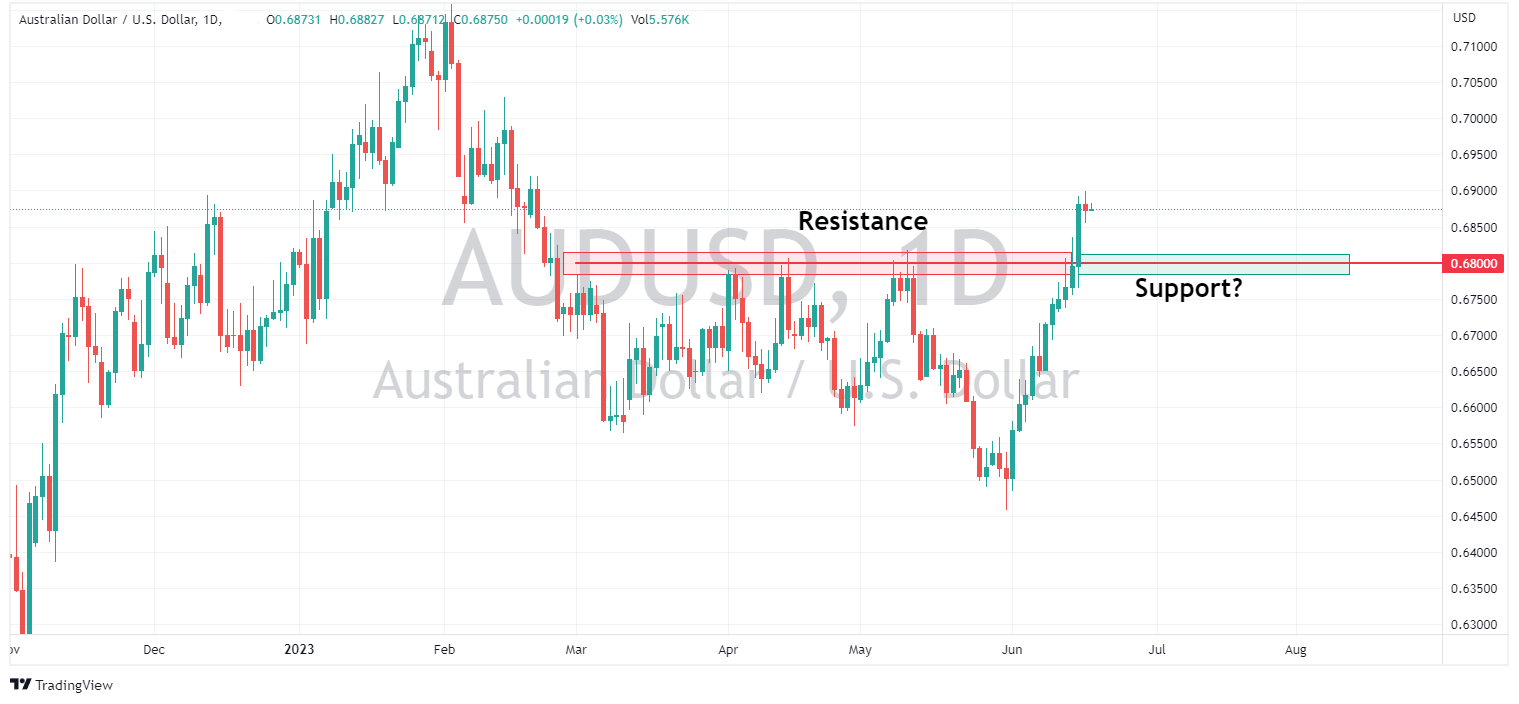

Australia – RBA minutes

After another “surprise” rate hike against market expectations, trading desks will be poring over the RBA minutes released on Tuesday for more colour regarding that decision. Rates markets are pricing in a 53% of a 25bp hike at the next RBA meeting, I would expect these odds to fluctuate significantly between then and now, Tuesdays minutes will certainly play a part in that and have repercussions for the AUD which has so far had a record start to June with AUDUSD rallying 6% so far this month, crashing through the major resistance at 0.6800, the question is will this level flip to support now?

The weeks calendar of major news below:

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

AUDUSD testing key support after RBA minutes

The RBA minutes of their June meeting where another surprise hike had most of the market off side were released today, and they were surprisingly dovish. The board made clear the decision between a hike and hold was finely balanced and seems to suggest further hikes may require a high bar for inflation readings to sway them. AUD reaction was swift ...

June 20, 2023Read More >Previous Article

Asia Morning FX – AUD and EUR surge, USD takes a hit post FOMC, BoJ ahead

USD tumbled in Thursday’s session in the wake of a dovish Powell presser (relative to statement/dot plots) saw the Dollar bears in charge. This, cou...

June 16, 2023Read More >Please share your location to continue.

Check our help guide for more info.