- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- The Week Ahead – The Fed takes centre stage along with the RBA and BoE in a data heavy calendar

- Home

- News & analysis

- Economic Updates

- The Week Ahead – The Fed takes centre stage along with the RBA and BoE in a data heavy calendar

News & analysisNews & analysis

News & analysisNews & analysisThe Week Ahead – The Fed takes centre stage along with the RBA and BoE in a data heavy calendar

31 October 2022 By Lachlan MeakinWith the bulls fully in charge, global markets head into the first week of November with one of the most important economic calendars we’ve seen this year to look forward to.

Risk-on has certainly been the narrative in October so far, with the Dow Jones index surging 5.89% last week, up 14.4% for October and on track, coming into its last trading day of the month, to be its best performing month since 1976.

Other risk assets have performed almost as well with Bitcoin up around 5% on the week and most currencies handily outperforming the US dollar as traders wound back their “flight to safety” trades in the Greenback.

Looking ahead, an extremely important week in data will test this narrative, either confirming it, seeing risk-off back on the table or neither and seeing probable whipsawing in risk assets.

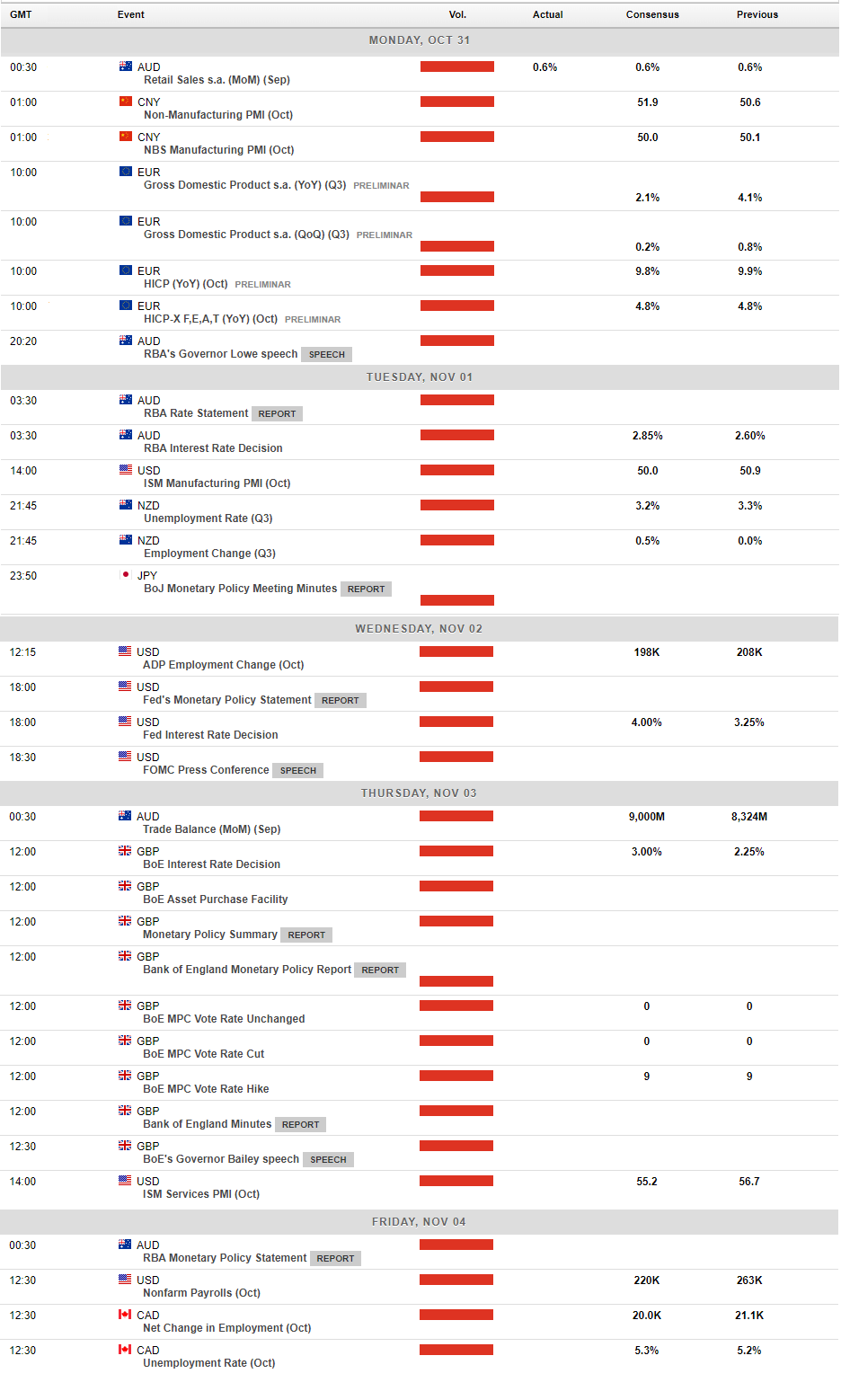

Amid worldwide employment and PMI data which will give an early indication of Q4 performance, we’ll have three Central Bank meetings where a surprise or two is possible.

FOMC meeting – 75bp incoming, but where to next?

Taking centre stage will be the Federal Reserve on Wednesday where they are expected to hike by another 75bp. Their path thereafter appears a little less certain and the accompanying statement and press conference will be closely watched for any hints on the magnitude of future rate hikes.

The next biggest data point from the US will be Octobers Non-Farm payroll figure released on Friday, with a strong labour market giving the Fed licence for aggressive hikes, this figure will take on extra importance for indications of how aggressive they can be in their December meeting and beyond.

BoE – 75bp expected, but could we get a surprise?

UK rate markets and most economist are predicting a 75bp hike from the Bank of England on Thursday as they continue to battle inflation rates not seen in decades. There is a growing argument that maybe, following the RBA and Bank of Canada’s lead, that they may opt for a softer 50bp hike and surprise the market. With the GBP recovering from the multi decade lows of a few weeks ago, the latest data not providing a clear justification for a faster hike and recent speeches by policymakers that have been signalling that markets are overestimating the amount of tightening left to come, we could see a surprise.

RBA – 25 or 50 after red hot CPI figure?

With the big upside miss to Q3 inflation still in recent memory there is a good chance that the Reserve bank of Australia will have to return to its heftier 50bp of tightening after it dropped to 25bp at the October meeting. While most economists are predicting the RBA will stick with 25, the rates market is split, with around a 50/50 chance of a 50bp hike priced in, whatever happens we are certain to see some volatility in AUD and the ASX200 at 2:30pm AEDST on Tuesday, prepare accordingly.

The weeks busy calendar below:

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

What Is the Consumer Price Index (CPI)?

CPI is a globally recognised economic indicator used by many countries to measure inflation and assess changes in the cost of living for their citizens. It evaluates the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services, such as food, clothing, rent, healthcare, entertainment, and tran...

November 1, 2022Read More >Previous Article

Buying entry forming on EUR/NZD?

The EUR has been rebounding strongly on the back of being sold off for much of the year. With inflation at record highs and a cost of living and energ...

October 28, 2022Read More >Please share your location to continue.

Check our help guide for more info.