- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- The Week Ahead – US Mid-terms set stage for another volatile week

- Home

- News & analysis

- Economic Updates

- The Week Ahead – US Mid-terms set stage for another volatile week

News & analysisNews & analysis

News & analysisNews & analysisThe Week Ahead – US Mid-terms set stage for another volatile week

7 November 2022 By Lachlan MeakinAnother week done, another roller coaster for equity and risk markets as the bulls and the bears battled to take control of the narrative in a data rich week.

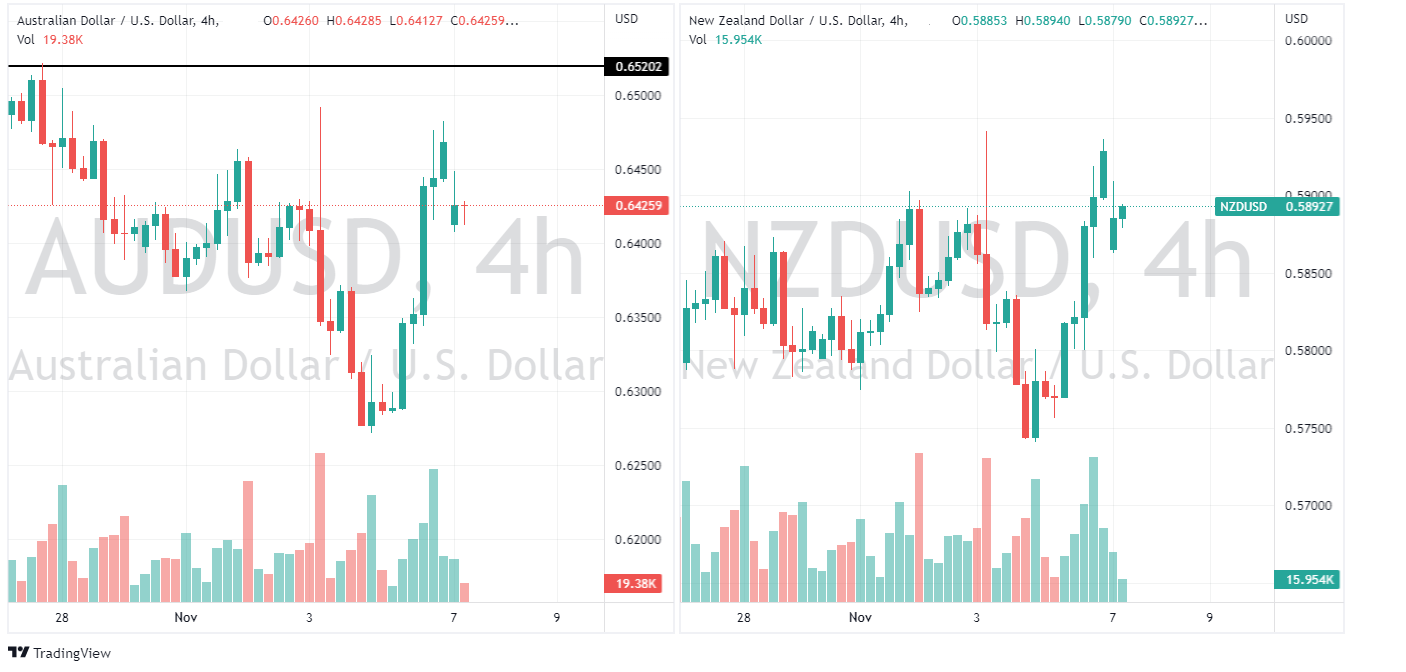

Markets pumped on what was taken initially as a dovish FOMC statement, only to dump as Fed chair Jerome Powell threw cold water on that idea during his presser, then pumped again on Friday as hopes of a China re-opening energised the markets and saw risk assets, especially Oil and Antipodean currencies, soar (Though they have given back some of it with a gap down at today’s open)

Looking ahead, the main risk event this week will be the US midterm elections held on Tuesday in the US.

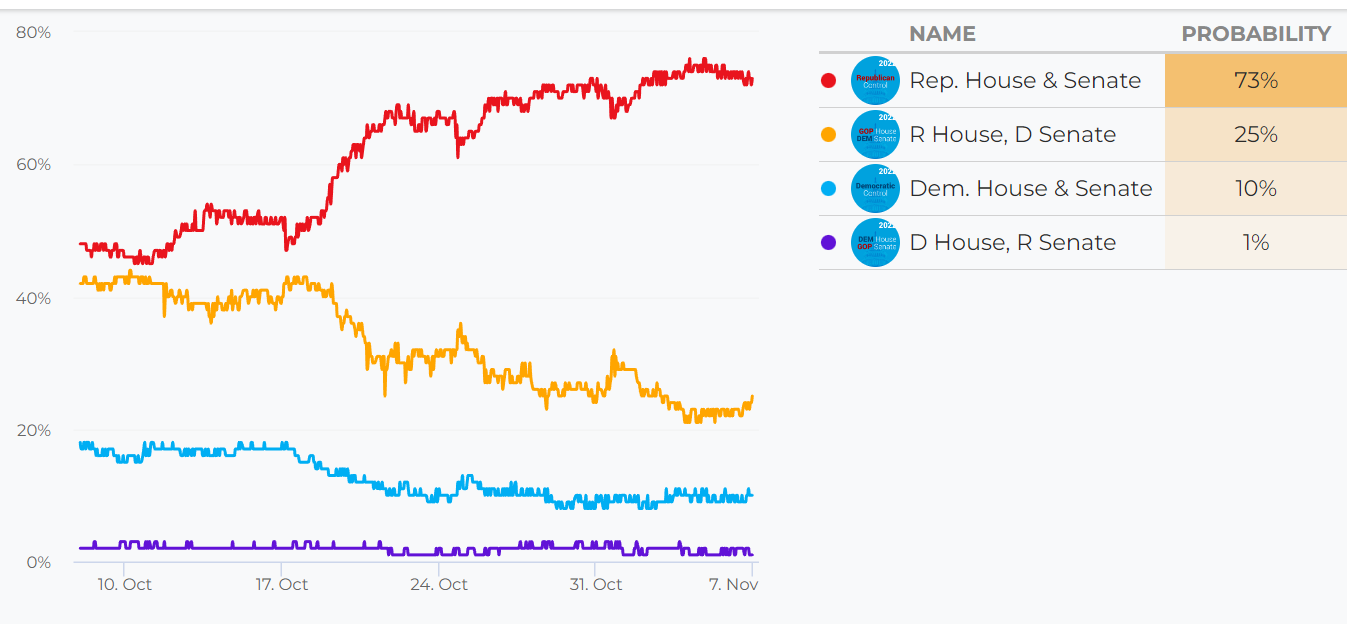

US elections, midterms included normally cause some market turbulence, but this one is set to shake things up more than usual with the backdrop of the US government and the Federal reserve currently battling decades high inflation. Currently the Predictit betting market has the Republicans red hot favourites to take both the House and the Senate, if this holds true it will effectively make Joe Biden a lame duck President with interesting ramifications for financial markets.

One big effect this will have on FX and equity markets is that if the current administration is unable to pass fiscal measures to support the market in a downturn, then the heavy lifting will have to be done by the Federal Reserve. In this scenario it is possible the Fed will have to pivot on their rate hike trajectory sooner than anticipated, as rate cuts may be needed to prop up a struggling economy, whereas before, fiscal policy could have filled that need. This would likely be negative for the USD and a positive for equity and risk markets, for the short term at least. Either way, as the results start coming in on Tuesday night EST volatility in markets is pretty much a given.

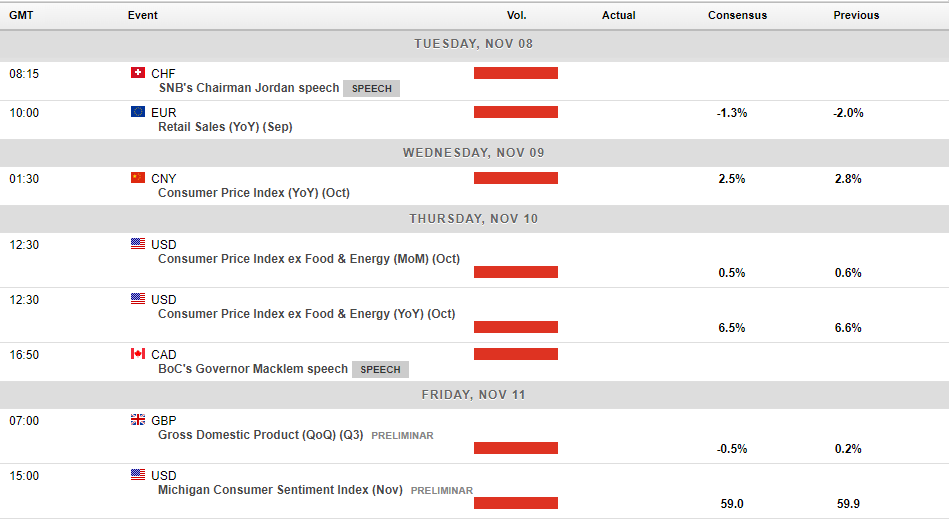

US October CPI figures will also be released this week, which may see some repricing in the markets prediction of the size of the next Fed rate hike on December 14. Though, with November CPI figures released the day before on December 13, this week’s CPI figures may have less an impact than normal.

This weeks scheduled economic announcements

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

BioNTech tops Q3 expectations – the stock is up

BioNTech SE (NASDAQ:BNTX) reported its third quarter financial results on Monday. The German pharmaceutical company beat both revenue and earnings per share (EPS) estimates for the quarter, sending the stock price higher. The company reported revenue of $3.392 billion vs. $2.024 billion expected. EPS reported at $6.841 per share vs. $3.352...

November 8, 2022Read More >Previous Article

AUDNZD falls from the top of its range

The AUDNZD pair has seen a large drop in the last few weeks and months as the Reserve Bank of Australia has brought about softer interest rate changes...

November 7, 2022Read More >Please share your location to continue.

Check our help guide for more info.