- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- The Week Ahead – Volatility set to continue with key inflation readings from UK, Canada, NZ, EU and Japan.

- Home

- News & analysis

- Economic Updates

- The Week Ahead – Volatility set to continue with key inflation readings from UK, Canada, NZ, EU and Japan.

News & analysisNews & analysis

News & analysisNews & analysisThe Week Ahead – Volatility set to continue with key inflation readings from UK, Canada, NZ, EU and Japan.

17 October 2022 By Lachlan MeakinVolatility in markets is set to continue this week with a slew of inflation figures from Canada to New Zealand being released, along with Australian employment figure and the minutes from the last RBA meeting where they surprised markets with “dovish” rate hike.

Last week saw the markets react violently to the hot CPI figure out of the US, with a step drop in risk assets retracing to see US equity markets have a record up day, only to sell off on Friday sealing a real rollercoaster of a week.

Topping off the elevated CPI figures out of the US was disfunction in the UK Gilt (Bond) markets, which saw the normally boring 10-year Gilt Yield pump, dump and pump again. A wild ride that also dragged the GBP with it as the UK government and BoE scrambled to calm markets with emergency measures and assurances.

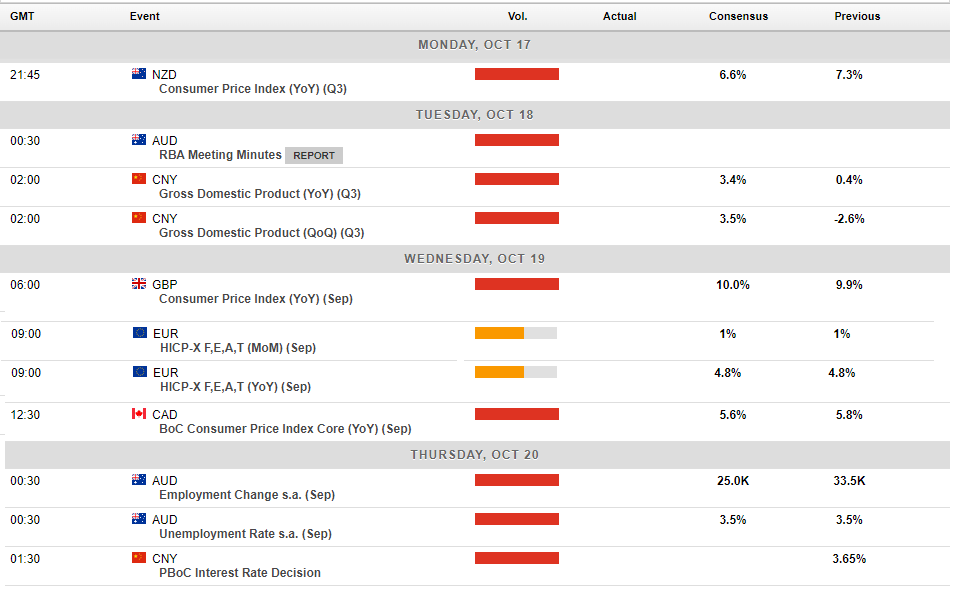

With Central banks almost universally being in “data dependent” mode as to their next moves, this week looks set to continue the volatility with a busy calendar ahead.

Closely watched inflation figures will be released by NZ, Canada, Japan, the UK and the Eurozone through out the week, with inflation data being the main data point most investors are using to predict Central Bank hike trajectories, all of these releases have the potential to see some volatility in the currency and equity markets.

The one with the most market moving potential I think will be the UK figure. With analysts being split on the BoE’s next move, either a 75bp or supersized 100bp hike this reading should go someway to settling that and will likely see Gilt Yields and the GBP re-pricing accordingly.

Another currency to watch is the AUD, with RBA minutes released from their last meeting where the Central Bank surprised markets with an undersized 25bp hike. To round this off, AU employment figures will be released on Thursday, a strong figure here will make things awkward for the RBA. With the AUD also acting as a proxy for Chinese growth, China GDP figures release on Tuesday could also see a move in AUD.

A Chart to watch

USDJPY will be one to watch this week, with traders really testing the resolve of the Bank of Japan having pushed the price up above 148.80, well above the point of their recent intervention at 147.50.

Whether the BoJ allows this to go unanswered will be interesting to see!

This week’s major economic announcements:

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

What is mean reversion?

Mean reversion strategies are some of the simplest trading strategy’s used by sophisticated traders. However, when most traders hear the term, they immediately get confused. So, what is mean reversion and why do traders use it as a strategy? Mean reversion is the tendency for the price of an asset to move back to its long-term averag...

October 18, 2022Read More >Previous Article

AUD bounces strongly in line with US equity’s jump

The US indices pumped higher as holders of shorts had to close their positions which resulted in one of the strongest sessions in recent months. The U...

October 14, 2022Read More >Please share your location to continue.

Check our help guide for more info.