- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- US Equities Eke out a Gain, Dollar Battered, Bonds Bid

- Home

- News & analysis

- Economic Updates

- US Equities Eke out a Gain, Dollar Battered, Bonds Bid

News & analysisNews & analysis

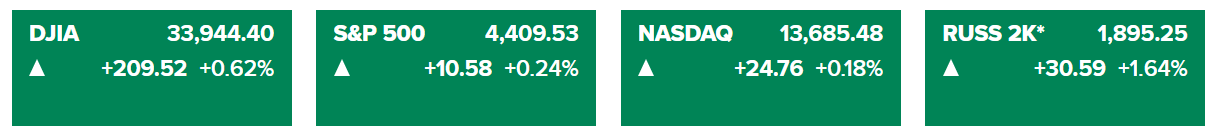

News & analysisNews & analysisMajor US indices finished in the green in Monday’s session as lowered inflation expectations saw treasury yields come off the recent highs, bolstering stocks but seeing the USD take a big hit.

The Russell 2000 was the clear outperformer (+1.64%) while the Nasdaq squeaked into the green after spending most of the session in negative territory, this saw the Nasdaq/Russell 200 ratio again find stiff resistance at 8.2 after another rejection from this level.

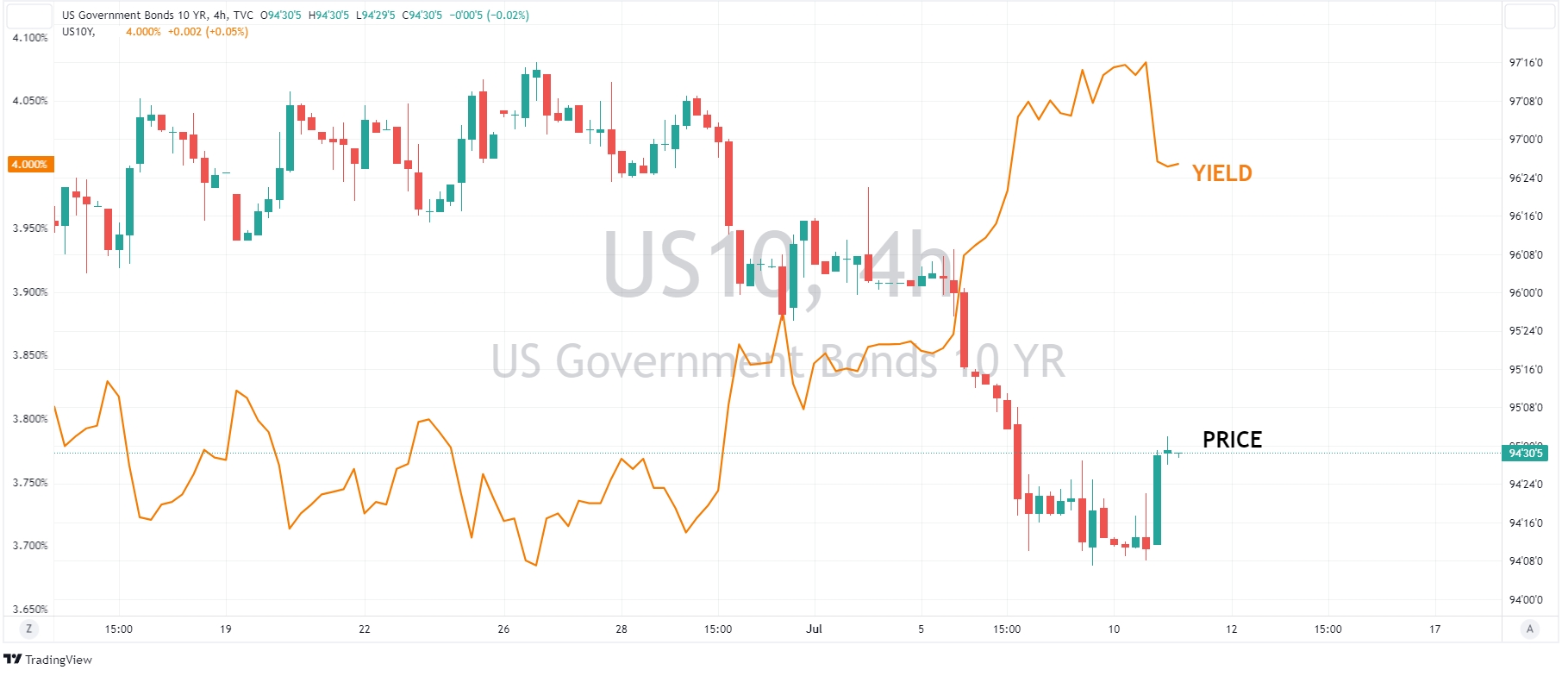

Bonds saw a big move to the upside as treasury yields tumbled after used car figures saw a rapid decline in price, which will spill into future inflation readings, the US 10 year yield pushing back below 4%.

FX Markets

USD sold off on Monday on the back of the sharp decline in US Treasury yields. The US Dollar Index breaking through the minor support and psychological level of 102.00.

EUR saw gains, mostly due to a weaker USD with EURUSD testing 1.10 to the upside, its highest level since June 22nd and pushing to the top of its recent range. ECB member Nagel also helped the EUR somewhat, reaffirming that inflation remains too high, adding that while GDP may slow, he is convinced a hard landing can be avoided.

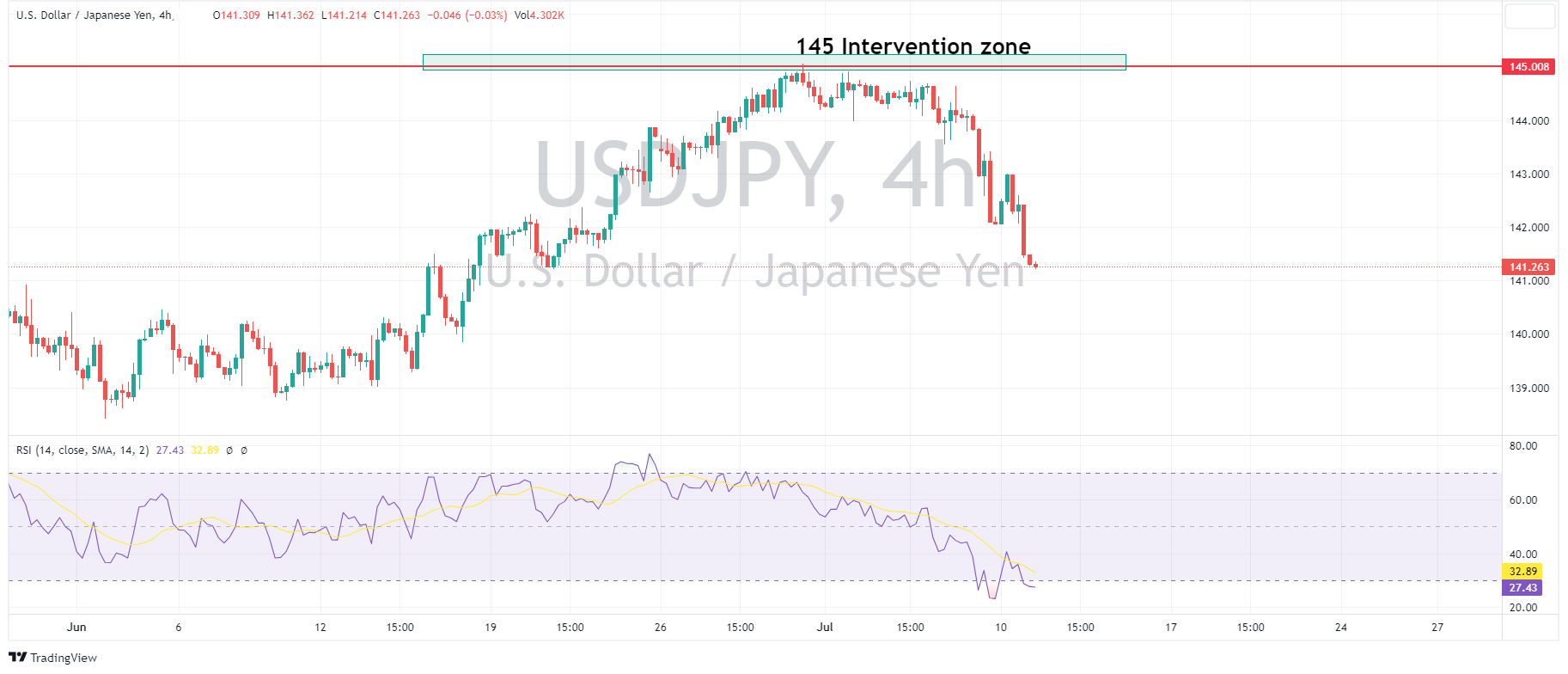

JPY saw solid gains, with USDJPY falling from peaks of 143 to lows of 141.30 the Yen supported by the move lower in US yields, and traders being wary about possible BoJ intervention if the cross rises above the 145 level.

Gold saw a wild ride in Monday’s session, finish mostly flat for the day after a sharp dip lower early in the session to test support at 1912 USD an ounce. This is despite a weaker USD and lower yields, XAUUSD looking bearish while it holds below the 1932 resistance level.

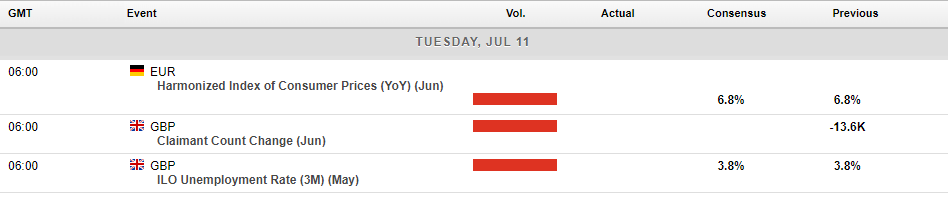

In today’s economic announcements, the main risk event will be jobs data from the UK at 06:00 GMT. The Rates market is split at the moment as to the size of the next hike from the Bank of England at their August meeting, this data point will be influential in how the market prices the odds, so expect some volatility in GBP at this time if the figure is off expectation.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Potential Reversal on the NZDUSD?

The current market consensus is that the Reserve Bank of New Zealand (RBNZ) would likely keep interest rates at 5.50% at the upcoming meeting on 12th July. This is supported by the RBNZ’s monetary statement indicating that “monetary policy is having a sufficiently moderating effect on demand and inflation, and that we are yet to see the full ef...

July 11, 2023Read More >Previous Article

Charts to Watch in the Week Ahead – BoC rate decision, US CPI, RBNZ, UK wage and jobs data

Central banks are back in action in the coming week with the Bank of Canada and RBNZ scheduled to release their latest monetary policy and official ra...

July 10, 2023Read More >Please share your location to continue.

Check our help guide for more info.