- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- US stocks dump in choppy session after FOMC decision

- Home

- News & analysis

- Economic Updates

- US stocks dump in choppy session after FOMC decision

News & analysisNews & analysis

News & analysisNews & analysisUS equites had a wild ride over night, A strong ADP jobs report was indexes track lower at the start of the session (Good news is bad news!) only to have a euphoric lift after the FOMC statement which traders took as a dovish pivot from the Fed, only to have the party ruined by Jerome Powell’s press conference where he poured cold water on that idea. This saw the Dow Jones dump 1000 points from the high to finish down 505 points, or 1.55%.

FOMC

No surprise from the Federal Reserve as far as a fourth 75bp interest rate increase in a row, bringing the cumulative policy tightening to 375bp since March. However as expected it was the statement and press conference that traders were looking to for clues to the Feds next move and which drove market action.

Initially the FOMC statement was cheered, seeing a big rise in risk assets as it painted the picture of a slowing pace of hikes going forward. “The Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.” This statement suggested that they’ve done a lot of work already and it may be time to take things a little slower.

This, unfortunately for the bulls, didn’t last long as Jerome Powell took centre stage at the scheduled press conference and pulled the rug on any hopes of a full Fed pivot anytime soon. The Fed chair indicated that while the pace of hikes may slow, that the length of restrictive rates will take as long as it takes to get inflation down, this saw bond yields spike, the USD bid and equities crater as markets repriced their prediction for the Feds terminal rate.

UK rate decision

Another interesting Central Bank decision awaits the markets later today with the Bank of England releasing their interest rate decision and monetary police report.

A 75bp hike is expected by the market and is the consensus view among economists, however recent comments from Board members where they have indicated uncomfortable with the amount of tightening priced into financial markets, makes it very possible we may get a downside surprise with a 50bp hike, either way it is likely the voting members will be split and some volatility in Gilt and currency markets would be expected.

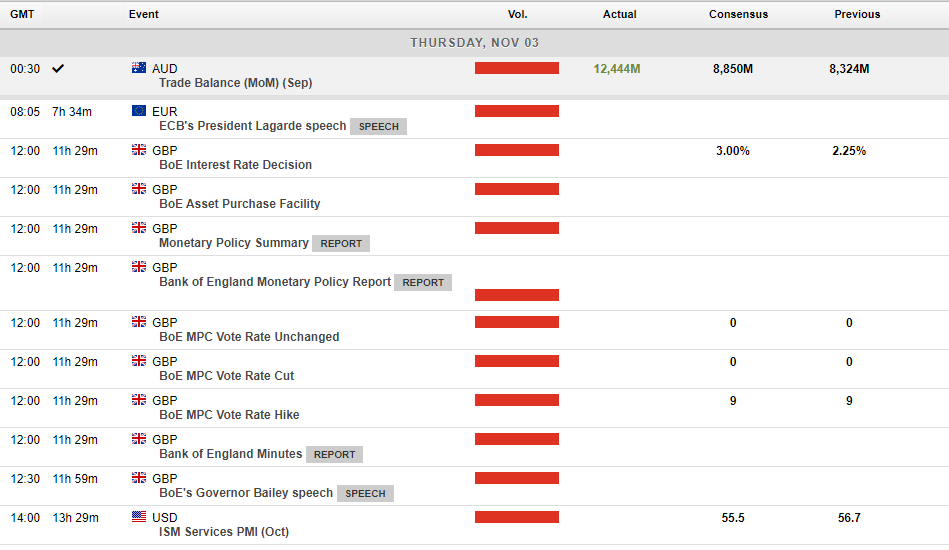

Todays scheduled economic announcements below:

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Bank of England announces biggest single rate hike in 33 years

Another day, another hike. On Wednesday, the US Federal Reserve announced its latest policy decision to raise its interest rates from 3.25% to 4%, to its highest level since January 2008. On Thursday, it was the Bank of England's turn to announce its decision. As expected, the central bank raised its interest rates by 0.75% to 4%. It was the hig...

November 4, 2022Read More >Previous Article

Airbnb sets a new quarterly record – disappoints on guidance

Airbnb Inc. (NAS:ABNB) reported its latest financial results after the closing bell in the US on Tuesday. World’s second largest online travel co...

November 3, 2022Read More >Please share your location to continue.

Check our help guide for more info.