- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- US stocks rally on light news day ahead of CPI figures

- Home

- News & analysis

- Economic Updates

- US stocks rally on light news day ahead of CPI figures

News & analysisNews & analysis

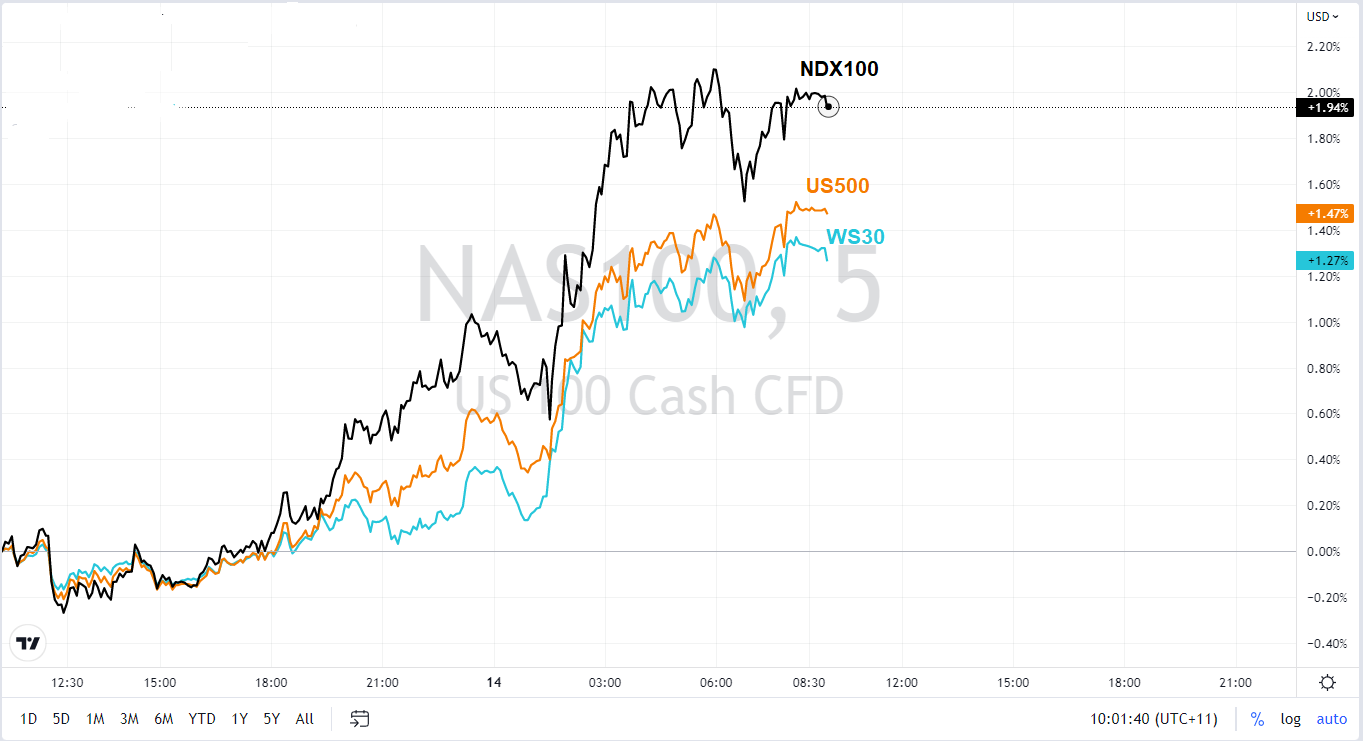

News & analysisNews & analysisUS stocks gained throughout the session as they turned risk on ahead of Tuesday’s CPI figure which is expected to show a moderating of inflation causing investors to hope of a less aggressive Federal Reserve going forward. Tech led gains as the sector most sensitive to market sentiment, the Nasdaq finishing up 1.48% with the Dow and S&P 500 not far behind.

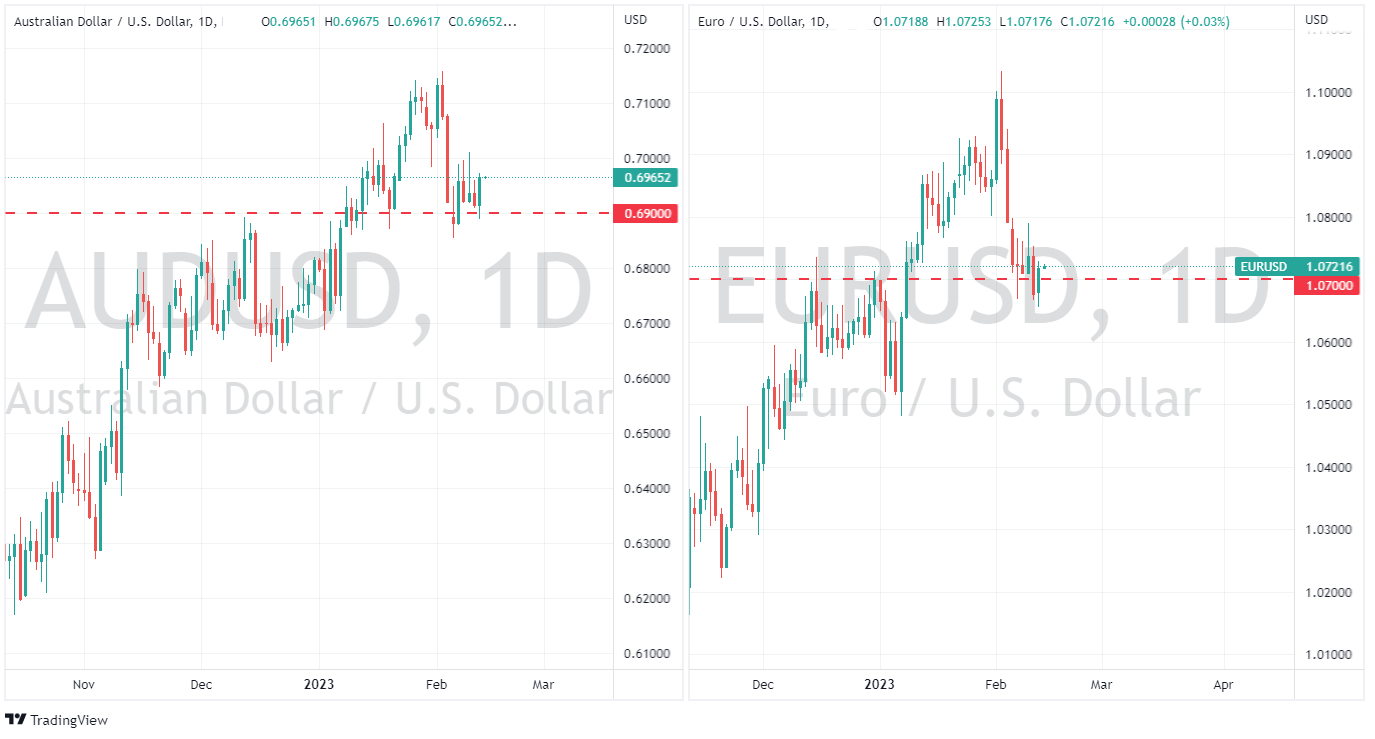

The US dollar was weaker on improved risk sentiment, coupled with an expectation of moderating inflation leading to a softer rate hike path from the Fed. AUDUSD reclaimed the 0.69 support level, the EURUSD retaking the 1.07 support level.

Despite Dollar weakness the Gold price slipped, breaking last weeks lows in an ominous sign for Gold bulls that the market is seeing Gold as a bit frothy after the recent run up.

Crude Oil had a rollercoaster of a session, rallying in the first half of the session on market optimism only to get hammered and give up all the gains on the news that the Biden administration was planning to release 26, barrels from the Strategic Petroleum Reserve (SPR) taking traders by surprise.

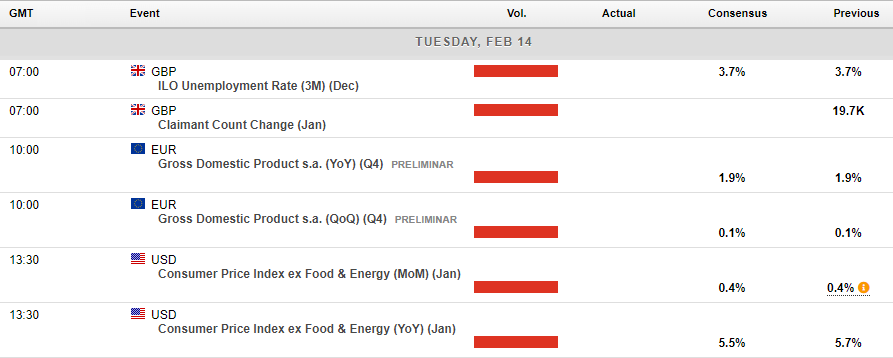

In economic releases ahead, the big one of the week will be released later today in the US CPI figures. Rates markets expectations of the Fed’s rate hiking/cutting trajectory have been the main driver of risk assets in recent times, this figure is sure to see some volatility in markets on it’s release, trade with caution.

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Airbnb sets a new Q4 record – the stock is up

Airbnb Inc. (NASDAQ:ABNB) announced Q4 2022 and 2022 full year financial results after the market close in the US on Tuesday. World’s second largest travel company reported revenue of $1.902 billion (up by 24% year-over-year), beating analyst estimate of $1.861 billion. The revenue reported was the highest for a Q4 in Airbnb’s history. ...

February 15, 2023Read More >Previous Article

Navigating the US CPI data release

The Federal Reserve's latest decision to hike rates by 25bps, taking the US Federal Funds Rate to 4.75%, saw the DXY trade lower from the 101.70 price...

February 14, 2023Read More >Please share your location to continue.

Check our help guide for more info.