- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

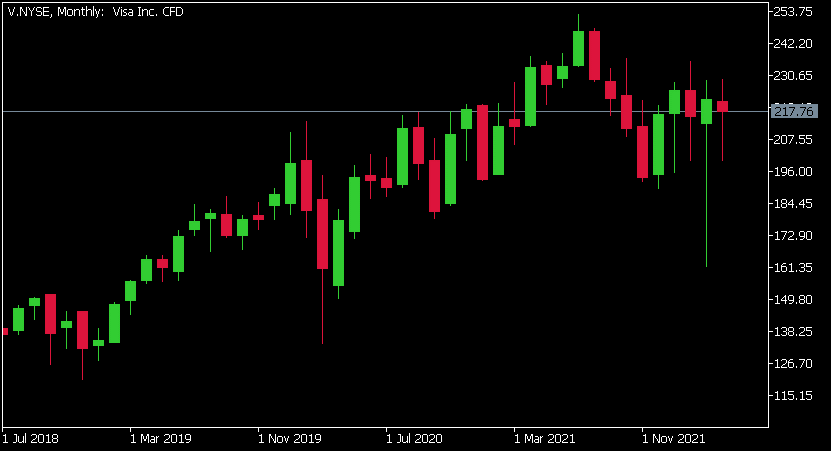

- Visa crushes Wall Street estimates

- 1 Month -2.86%

- 3 Month +5.67%

- Year-to-date +0.38%

- 1 Year -6.82%

News & analysisVisa Inc. announced its fiscal second quarter 2022 results after the closing bell on Wall Street on Tuesday.

The financial services giant topped both revenue and earnings per share estimates, sending the share price higher on Wednesday.

The company reported revenue of $7.189 billion in the quarter vs. $6.833 billion estimate.

Earnings per share reported at $1.79 per share vs. $1.65 per share expected.

Alfred F. Kelly Jr., Chairman and CEO of Visa commented on the latest results following the announcement: “We had a very strong quarter amidst the invasion of Ukraine and our decision to suspend operations in Russia, with GAAP EPS up 23% and non-GAAP EPS up 30%. The Omicron variant impacts were short lived and the global economic recovery that began in the middle of last year continued. We had solid growth in most countries around the globe and across all elements of our business, with revenue growth of over 20% in consumer payments, new flows and value added services. While the geopolitical environment remains uncertain, we expect continued growth driven by a robust travel recovery and through the enablement of traditional and newer ways to pay globally.”

Visa Inc. chart

Visa shares were up by over 8% during the trading day on Wednesday, trading at $217.76 per share.

Here is how the stock has performed in the past year:

Visa price predictions

Morgan Stanley: $284

Credit Suisse: $265

Barclays: $260

Wedbush: $270

Mizuho: $220

Visa Inc. is the 12th largest company in the world, with a total market cap of $471.64 billion.

You can trade Visa Inc. (V) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Visa Inc., TradingView, CompaniesMarketCap

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

RBA rate day well in play after record CPI print

Going into yesterday's Aussie Inflation figures bond markets were pricing in around a 40% chance of a hike to 0.25% at next Tuesdays RBA May meeting. Most pundits including analysts at the big 4 banks thought this unlikely, with a move in June their predictions. Yesterday's eye watering CPI figure, took the market by surprise coming in at 2.1% f...

April 28, 2022Read More >Previous Article

Musk’s future for Twitter

The future of the large-cap tech giant and social media platform, Twitter, will be one to watch closely after the Board approved tech billionaire and ...

April 27, 2022Read More >Please share your location to continue.

Check our help guide for more info.