- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Client support

- Contact us

- FAQs

- Quick support

- Trading hours

- Fraud and scam awareness

- Legal documents

Open Account

- CFD trading

- CFD trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- ETFs

- Accounts

- Accounts

- Compare our accounts

- Our spreads

- Funding & withdrawals

- Open CFD account

- Try free demo

- Company, Trust or SMSF account

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- cTrader

- cTrader copy trading

- Mobile trading platforms

- GO WebTrader

- Premium trading tools

- Premium trading tools

- Tools overview

- Trading central

- VPS

- Genesis

- Autochartist

- Share trading

- Share trading

- Invest in shares

- Invest in shares

- Trade ASX shares and ETFs

- Share trading platform

- Log into share trading

- Open share trading account

- Help centre

- Downloads

- Downloads

- Android app

- iOS app

- Education

- Education

- Resources

- Resources

- News & analysis

- Education hub

- Economic calendar

- Courses

- Courses

- Introduction to forex

- First steps in forex

- Next steps in forex

- Help & support

- Help & support

- About

- About

- About GO Markets

- Our awards

- Sponsorships

- Client support

- Home

- News & analysis

- Economic Updates

- Wall St rally sees S&P 500 enters technical bull market – VIX dumps, Gold pumps

- Home

- News & analysis

- Economic Updates

- Wall St rally sees S&P 500 enters technical bull market – VIX dumps, Gold pumps

News & analysisNews & analysis

News & analysisNews & analysisWall St rally sees S&P 500 enters technical bull market – VIX dumps, Gold pumps

9 June 2023 By Lachlan MeakinA tech led rally saw the S&P 500 index enter a technical bull market after rallying 20% from the October 2022 lows, a big miss on unemployment claims which saw it hit 19-month highs added to the “bad news is good news” narrative, sending yields lower, chances of a Fed rate hike next week tumbling and risk assets soaring.

Big mover in the US stock market was Tesla (TSLA) rallying almost 5% for its 10th consecutive day up day, it’s longest winning streak since Jan 2021.

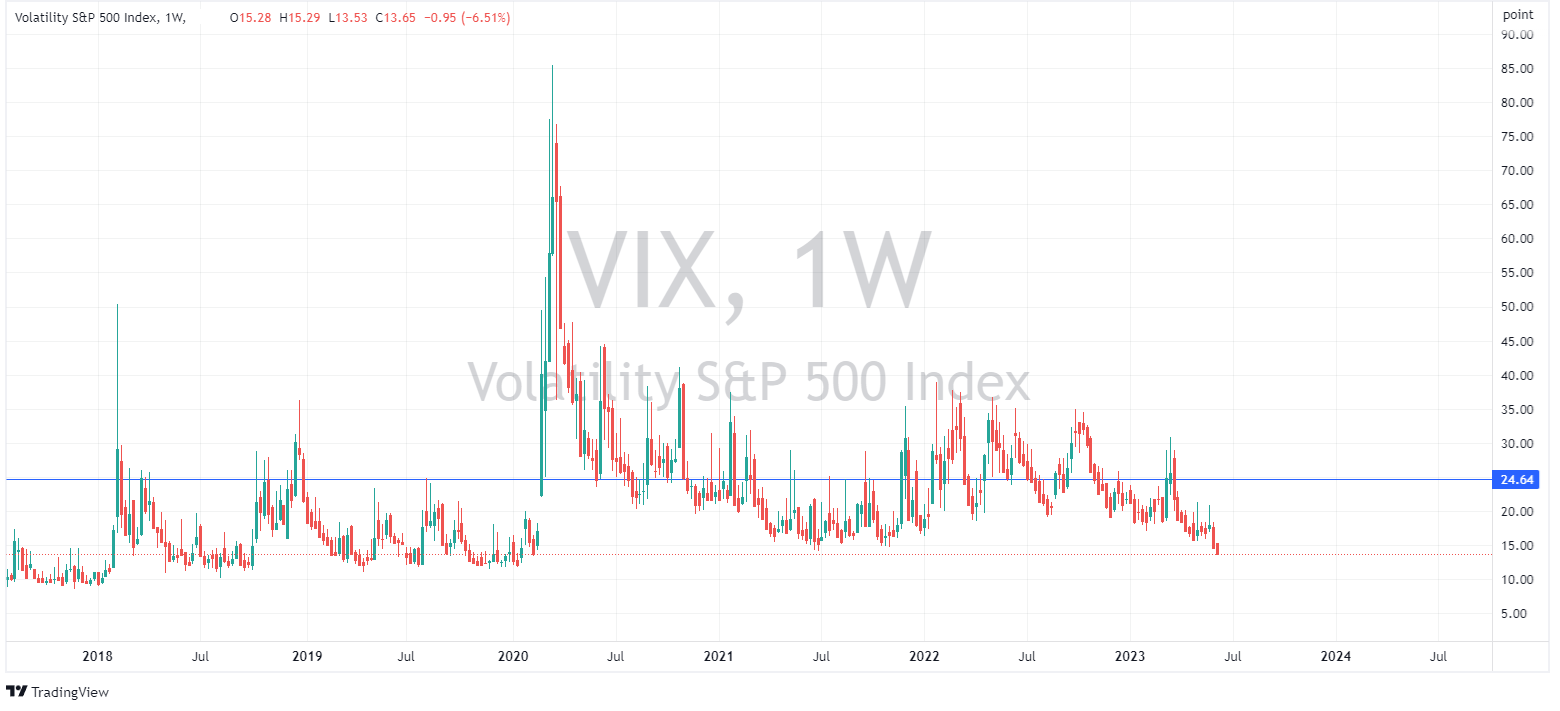

The VIX or “fear index” continued to sell off today, having now dropped 9 of the last 11 sessions and seeing the cash VIX index hit a 13 handle, its lowest point since the pandemic. Volatility sellers continuing to take advantage of a low volatility environment, though at these levels it’s a risky game in my opinion.

FX Markets

USD was lower on Thursday, with the DXY hitting June lows before troughing at 103.29. A positive risk sentiment and a sharp drop in yields seeing the Dollar Index suffering its biggest one day drop since March. The 103 level looks like the next minor support level, and well withing reach considering recent price action.

CHF was the G10 outperformer seeing strong gains against the USD in the wake of a hawkish set of remarks from SNB Chairman Jordan, USDCHF breaking decisively below its trend line. Jordan noted that inflation is more persistent than the bank had thought, and they are seeing second- and third-round effects. Markets are pricing in a 100% chance of a 25bp hike, and about 50-50 it could be a 50bp hike at the next SNB meeting on June 22nd.

Commodities

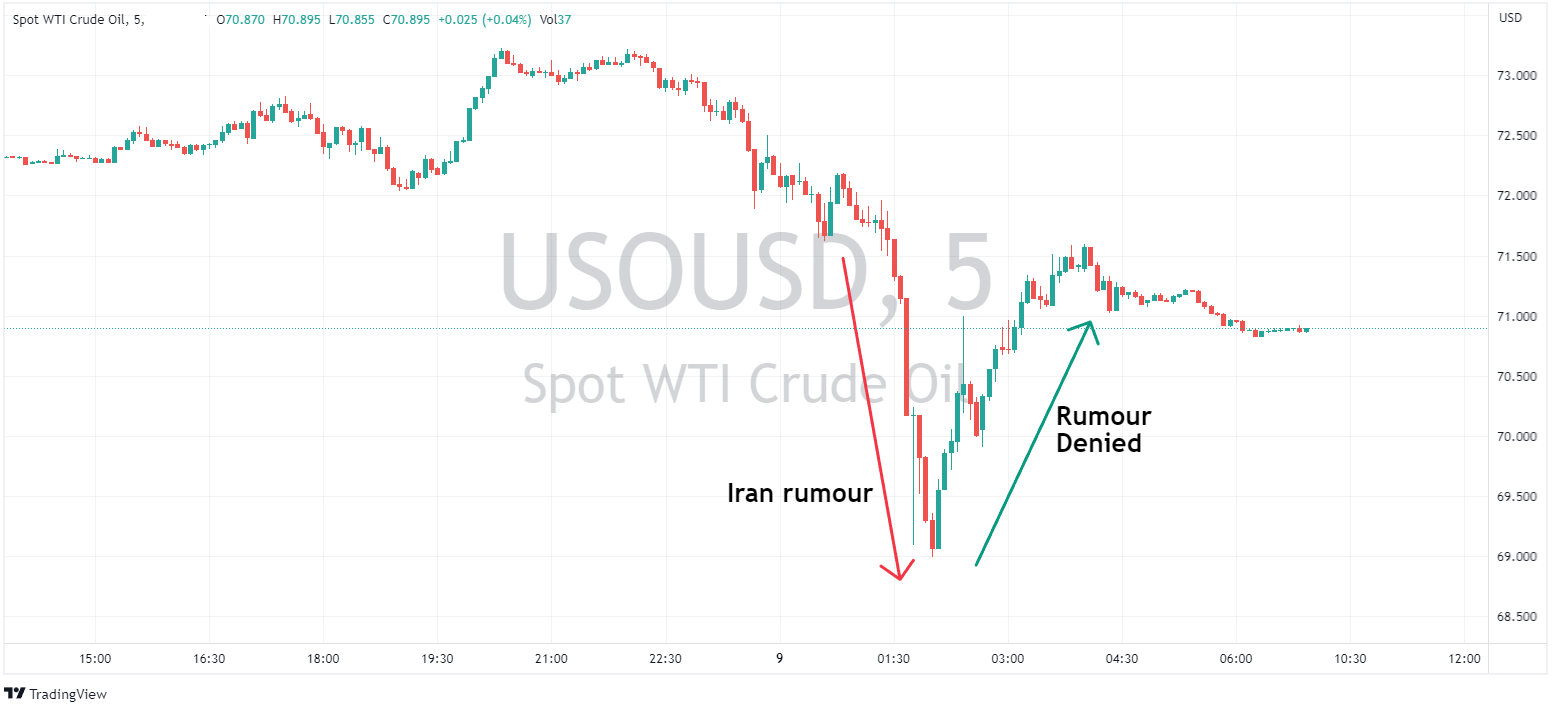

Oil prices plunged early in the US session with USOUSD back below $70 and well below pre-Saudi-cut levels after reports that Iran and US are near an interim deal on nuclear enrichment and oil exports. This was denied around an hour later, seeing a sharp rebound in the oil price in a volatile session.

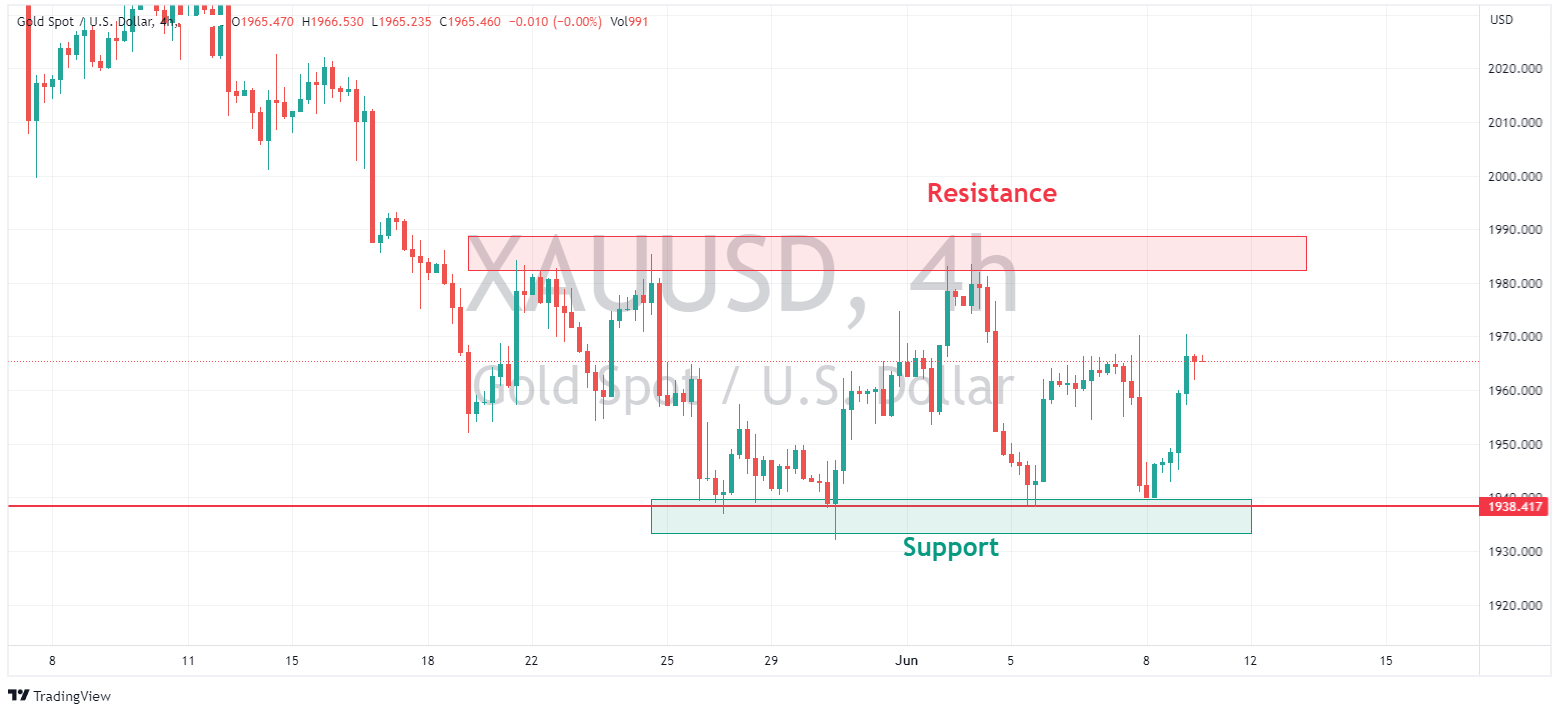

Gold surged in Thursday’s session bouncing strongly from its 1940-1935 support zone to push above 1970 USD an ounce and erasing all of Wednesdays steep losses. Lower yields and a weaker USD the main drivers of the precious metals price.

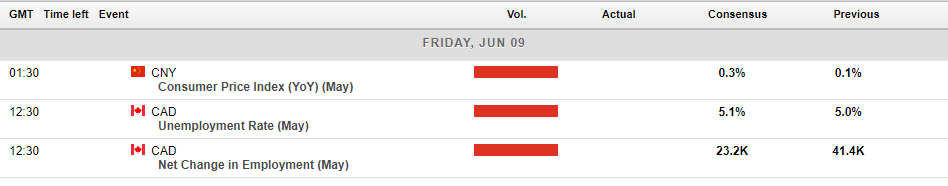

Today’s calendar:

Ready to start trading?

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Asian markets looking to open strongly as big tech pushes US markets higher ahead of CPI

US markets rallied strongly again to start the week with lower yields, on the back of hopes of a Fed pause this week, saw big tech surge and the Nasdaq (+1.53%) lead major indices to print fresh YTD highs. Another day, another up day for Tesla (TSLA) with its stock price rising for the 12th straight day - the longest winning streak in the co...

June 13, 2023Read More >Previous Article

AUDUSD Soars on RBA Hike, EURUSD underperforms, CAD, GBP, JPY wrap

USD was firmer on Tuesday amid a light news calendar sparse in any key risk events. The US Dollar index again having a choppy session in a tight range...

June 7, 2023Read More >Please share your location to continue.

Check our help guide for more info.